Let’s cut to the chase. Your debt-to-income ratio is just your total monthly debt payments divided by your gross monthly income. That’s it. But this one number is the gatekeeper to your financial future, telling lenders everything they need to know about how you handle your money. Nailing this calculation is your first power move toward any major financial goal.

Why Your DTI Ratio Is the Key to Your Next Big Move

Forget the dry financial jargon. Your Debt-to-Income (DTI) ratio is the secret handshake that gets you into the club of homeownership, a new car, or that business loan you’ve been dreaming of.

This isn’t just about getting a loan approved; it’s about getting a brutally honest look at your financial health so you can make moves with confidence. Whether you’re a first-time buyer or deep-diving into a real estate investor financing guide, it all kicks off with DTI.

The Foundation of Financial Approval

Lenders worship DTI because it cuts through the BS. It’s a raw, unfiltered snapshot of your financial obligations versus what you earn, making it their go-to tool for sizing you up. A low DTI screams financial discipline, telling them you have plenty of cash left over after paying your bills. That makes you a prime candidate for their money.

Real Talk: If your monthly debts are $2,000 and your gross monthly income is $6,000, your DTI is 33.3%. That’s the sweet spot. Most lenders want to see a DTI below 36%. They might stretch to 43% if you’re a rockstar borrower, but lower is always better.

A killer DTI isn’t just a vanity metric; it unlocks real perks:

- Better Loan Terms: A lower DTI means less risk for them and a lower interest rate for you.

- Higher Borrowing Power: It’s proof you can handle a bigger loan without breaking a sweat.

- A Smoother Approval Process: A good DTI greases the wheels and helps you sail through underwriting.

At the end of the day, your DTI ratio is how lenders decide if you can handle another payment. It’s the number that truly matters.

Tallying Your Income the Right Way

Before we dive into the debt, let’s get real about your income. Lenders aren’t just looking at your paycheck. To build the strongest case, you need to count every single dollar you earn. Don’t leave money on the table.

This is your moment to show off your entire financial hustle. Lenders calculate DTI using your gross monthly income—that’s your total haul before taxes and deductions crush your soul.

What to Include in Your Income Total

To max out your documented income, you need proof for every revenue stream. Think bigger than your 9-to-5 and start collecting the evidence.

Here’s the playbook for what lenders want to see:

- Primary Job Income: Your salary or hourly wages. Grab your latest pay stubs and W-2s.

- Side Hustle & Freelance Earnings: Slaying it on the side? Use tax returns (like a Schedule C) and bank statements to prove that income is legit and consistent.

- Investment & Rental Income: For the investors out there, this is mission-critical. Meticulously track every dollar from your properties. Using the best rental property accounting software isn’t just smart; it’s essential.

- Other Sources: Don’t sleep on alimony, child support, or Social Security. If you get it, count it.

Pro Tip: Lenders crave consistency. For variable income like freelance gigs, they’ll want to see a solid two-year track record. Get your tax returns and bank statements organized now to avoid a headache later.

This level of detail matters more than ever. Household debt is on a wild ride. Data reveals that for high-income countries, the average household debt ratio skyrocketed from 51% of GDP in 1990 to around 74% by 2023.

This is exactly why lenders grip DTI like a lifeline. It’s their shield against risk, making your income documentation your sword. If you’re a data nerd, you can dive into the global debt trends on Statista.

Figuring Out Which Debts Actually Count

Now for the fun part: your debts. Deciding what to include in your debt-to-income calculation can feel like a pop quiz you didn’t study for. Get it wrong, and your DTI will be worthless.

Lenders don’t care about your Spotify subscription or your weekly takeout habit. They’re laser-focused on the contractual, recurring debts that haunt your credit report. It’s a roll call of your biggest financial promises.

The Debts Lenders Are Watching

To calculate DTI, you need to sum up all your minimum required monthly payments for every debt you owe. Don’t worry about the total balance right now; that monthly hit is what counts.

Here’s your hit list:

- Housing Payments: Your mortgage or rent. If you own, loop in property taxes and homeowners insurance if they aren’t already part of your mortgage payment.

- Auto Loans: That monthly car payment is front and center.

- Student Loans: Even if your loans are on pause, lenders don’t turn a blind eye. They’ll use an estimated monthly payment, typically 0.5% to 1% of your total balance, and add it to your debt pile.

- Credit Card Minimums: Add up the minimum monthly payment for every single card, even that dusty one you only use for emergencies.

- Personal Loans: Any installment loans from a bank or credit union make the cut.

What Counts and What Doesn’t for Your DTI

It’s easy to get this wrong, so here’s a cheat sheet to keep you on the straight and narrow.

| Expense Type | Include in DTI Calculation? | Why or Why Not |

|---|---|---|

| Mortgage/Rent | Yes | It’s your biggest housing cost and a major contractual debt. |

| Car Loan | Yes | A fixed loan that lives on your credit report. |

| Credit Card Minimums | Yes | Lenders care about the required minimum, not your full balance. |

| Student Loans | Yes | It’s a long-term debt, even if payments are currently paused. |

| Groceries | No | This is a variable life expense, not a fixed debt. |

| Utilities | No | It’s a recurring bill, but not a loan. It doesn’t count. |

| Phone/Internet Bill | No | Same as utilities. It’s a service, not debt repayment. |

| Insurance Premiums | No | Health, life, and auto insurance are out. Only PITI is included. |

Getting this list right is non-negotiable. It’s the raw data that paints the picture lenders will judge you on.

Your mortgage is usually the 800-pound gorilla of your debt load. To really master that number, check out our guide on how to calculate mortgage payments for a deep dive.

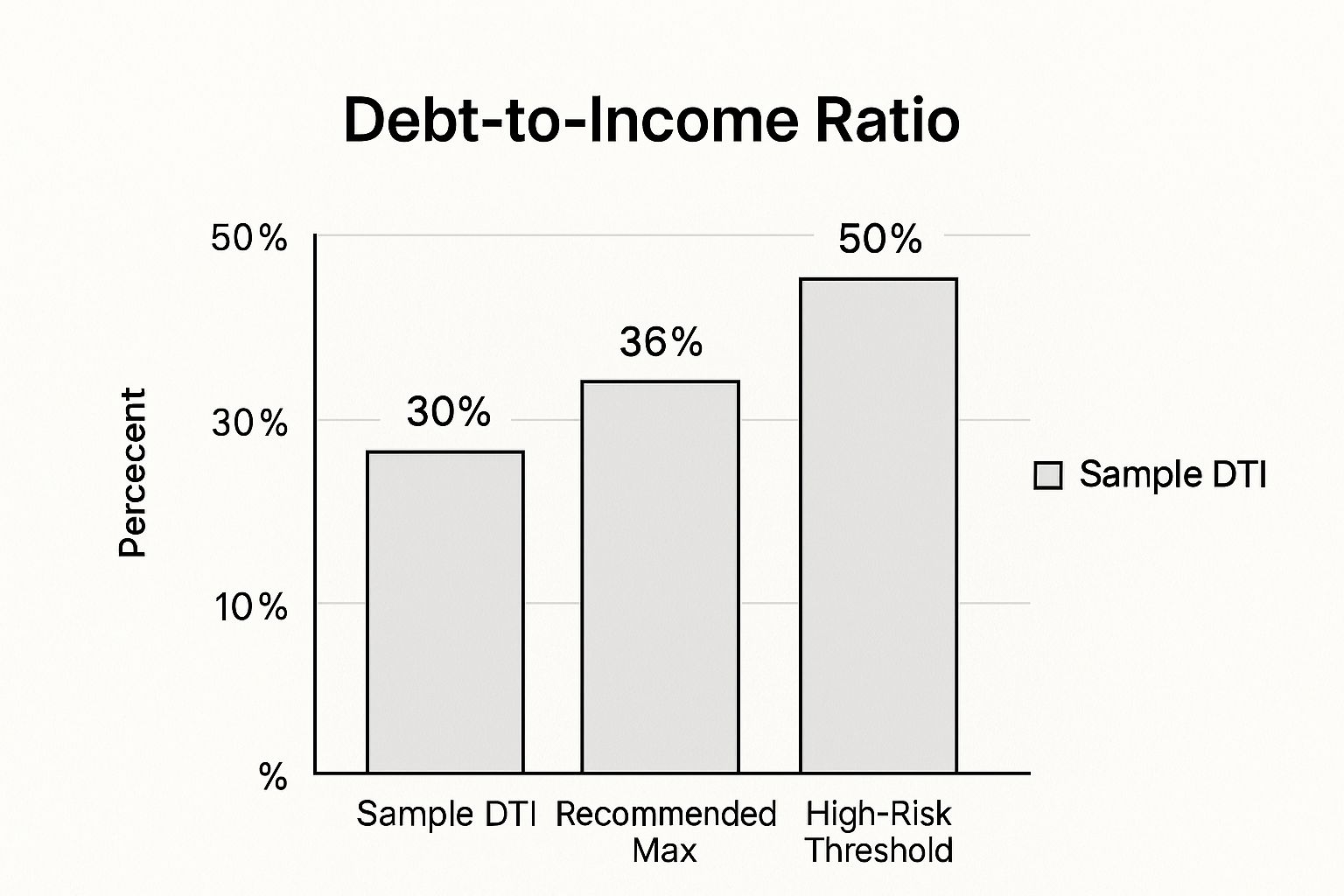

This visual gives you a quick reality check on DTI percentages and where you might land.

As you can see, lenders drool over a DTI under 36%. But don’t spiral if you’re higher. Many will play ball if other parts of your financial life—like a fat savings account and a killer credit score—are on point. Knowing exactly which debts to count is your first step to owning that number.

Calculating Your DTI with Real-World Scenarios

Alright, enough theory. Let’s get our hands dirty and crunch some numbers. The only way to truly understand how to calculate your debt to income ratio is to see it in action with people you can actually relate to.

It’s just simple division, but the result is a powerful truth bomb about your financial life. We’ll look at a couple of different scenarios to see how the DTI formula—Total Monthly Debts ÷ Gross Monthly Income—plays out in the real world. You’ll see fast how small changes can totally flip the script.

The Freelancer with a Fluctuating Income

Meet Alex, a freelance graphic designer. His gross monthly income averages $7,000, but any gig worker knows that number can be a rollercoaster. Lenders will typically average it over the last one or two years to find a number they can trust.

Here’s Alex’s monthly debt rundown:

- Student Loans: $400

- Car Loan: $500

- Credit Card Minimums: $250

- Rent: $2,200

Alex’s DTI Breakdown:

Total Debts: $3,350

Gross Income: $7,000

($3,350 / $7,000) = 0.478, which is a 48% DTI

A 48% DTI is a red flag for most lenders. It’s not a deal-breaker, but it makes getting a new loan tough. Alex’s game plan is crystal clear: he needs to either boost his documented income or go on a debt-killing rampage before he even thinks about applying for a mortgage.

The Dual-Income Couple Eyeing Their First Home

Now let’s look at Maria and Ben. They’re a power couple bringing in a combined gross monthly income of $12,000. They’re trying to crack into a competitive market like Los Angeles, where the income needed for a starter home is often double what the average household makes. We’re in the same boat, and we are committed to providing equal housing opportunities for everyone.

Here are their current shared debts:

- Car Loans (for two cars): $850

- Credit Card Minimums: $300

- Personal Loan: $200

- Future Mortgage Estimate (including taxes and insurance): $4,000

Maria and Ben’s DTI Breakdown (with the future mortgage):

Total Debts: $5,350

Gross Income: $12,000

($5,350 / $12,000) = 0.445, or a 45% DTI

This puts them on the knife’s edge of what many lenders consider acceptable. For them, understanding their DTI isn’t just a box to check; it’s the entire playbook. Once you nail this, you can level up and learn how to calculate other essential financial metrics like Return on Investment to get a 360-degree view of your money moves.

What Your DTI Number Actually Means (And How to Fix It)

So you’ve done the math and have your DTI ratio. Now what? To a lender, that number is a risk score. It’s their crystal ball for predicting how likely you are to handle your payments.

Lenders start getting sweaty palms when DTI creeps above 43%. The magic number—the one that gets you the VIP treatment—is anything under 36%. A ratio that low tells a lender you’re financially solid, making you a much safer investment for them.

With conventional mortgages, they often slice it two ways: a “front-end” DTI (just housing costs) under 28% and a “back-end” DTI (all your debts) below 36%.

Here’s a no-nonsense guide to how lenders see these numbers.

DTI Ratio Benchmarks for Lenders

This is how lenders size you up based on your DTI. No sugarcoating.

| DTI Ratio Percentage | Risk Level | Likely Loan Outcome |

|---|---|---|

| 36% or less | Low Risk | You’re golden. Expect the best rates and a smooth process. |

| 37% to 43% | Moderate Risk | You’re in the game. You’ll likely qualify, but the terms might not be as sweet. |

| 44% to 50% | High Risk | This is tough territory. You may need a co-signer, a bigger down payment, or to look at government-backed loans (FHA, VA). |

| Over 50% | Very High Risk | Don’t even bother applying yet. It’s time to go on a debt diet. |

Seeing your DTI in black and white can be a punch to the gut, but remember: it’s just a snapshot. It’s not your destiny.

If your DTI is north of 43%, don’t panic. It’s not an automatic rejection, but it’s a huge flashing sign telling you to get your financial house in order before you apply for a major loan. Ignore it, and you’ll pay the price in higher interest rates and fewer options.

Real-World Ways to Lower Your DTI

Fixing your DTI isn’t brain surgery. It comes down to two moves: decrease your debt or increase your income. Here are some battle-tested strategies that actually work.

One of the most effective psychological hacks is the debt snowball method. List your debts from smallest to largest balance. Attack the smallest one with every extra cent you have while making minimum payments on the rest. Once it’s dead, you roll that payment into the next smallest debt. Those quick wins build momentum and make you feel like a financial warrior.

Your DTI is a snapshot, not a life sentence. A few months of focused effort on reducing debt or boosting income can radically change your financial profile and borrowing power.

Another sharp move is smart debt consolidation. Juggling a few high-interest credit cards? A personal loan with a lower interest rate can bundle them into one single, manageable payment. This one move can slash your total monthly debt payments.

Finally, let’s talk income. Can you document more of it? Maybe it’s time to launch that side hustle, demand the raise you deserve, or just get better at tracking your freelance income.

For anyone trying to buy a home, especially a first-time home buyer in Los Angeles, a strong DTI can be the difference between winning a bidding war and staying on the sidelines. It’s worth the grind.

Your Top DTI Questions, Answered

Still confused? I get it. The DTI world is full of weird rules and “what ifs.” Let’s clear up the most common questions that trip people up.

Do I Have to Include My Spouse’s Debt If I Apply Alone?

This is a big one. If you’re applying for the loan by yourself, lenders typically only look at your individual income and debts. Sounds simple, right?

But here’s the curveball: if you live in a community property state (looking at you, California), the rules can get funky. Your best bet is to have a brutally honest conversation with your lender about their specific rules before you apply. No one likes surprises during a loan application.

What About My Student Loans in Deferment?

So your student loans are paused, and you’re not making payments. Cute. Lenders could not care less. They will absolutely count that debt and bake a hypothetical payment into your DTI.

Heads Up: Most lenders will assign a “phantom” monthly payment of 0.5% to 1% of your total loan balance. This can blow up your DTI if you’re not ready for it.

Can a Great Credit Score Make Up for a High DTI?

It’s a fair question. If your credit score is amazing, doesn’t that prove you’re a safe bet? Yes and no. A great credit score is crucial, but it can’t magically fix a DTI that’s through the roof.

Think of them as two different tests. Your credit score proves you pay your bills on time. Your DTI proves you can actually afford to take on new debt. You need to ace both to get the best deals.

Ready to put your DTI knowledge to the test in the Los Angeles market? The team at ACME Real Estate lives and breathes this stuff. We’ve got the street-smart expertise to guide you from number-crunching to closing day. Let’s find out where your story belongs by visiting us at https://www.acme-re.com.