Los Angeles isn’t just a city; it’s an economic beast with a real estate market that marches to the beat of its own drum. Forget the generic advice that flies in Omaha—it’ll get you eaten alive here. If you’re serious about stacking wealth in LA, you need a game plan as dynamic and diverse as the city itself. We’re cutting through the fluff to bring you the nine best real estate investment strategies that are crushing it in the City of Angels.

This playbook is your secret weapon, whether you’re a seasoned investor, a first-time homebuyer, a seller cashing out, or an aspiring flipper. We’ll demystify the unique opportunities and brutal challenges of this hyper-competitive landscape. Moving beyond the tired basics, we’re serving up actionable insights, local intel, and the raw pros and cons of each approach—from the classic “Buy and Hold” to the sophisticated world of real estate syndications. You’ll discover which strategies vibe with your capital, risk tolerance, and long-term ambitions. For a broader, national perspective to complement this local deep dive, check out the further real estate investment insights on the Fundpilot blog.

At ACME Real Estate, we live and breathe this market. We’ll unpack everything from high-octane flips in up-and-coming neighborhoods to the surprising power of house hacking. This isn’t theory; it’s your roadmap to success, packed with street-smart tips to turn your LA property dreams into a profitable reality. Let’s get into it.

1. Buy and Hold: The Foundation of LA Wealth

The buy and hold strategy is the undisputed bedrock of building generational wealth in a pressure-cooker market like Los Angeles. It’s a brutally simple yet powerful long-term play: you buy an investment property, you hang on for dear life, and you generate passive income through monthly rent while the property (hopefully) appreciates in value. This strategy isn’t about fast cash; it’s about playing the long game, letting market appreciation and equity buildup work their slow, undeniable magic.

In a city legendary for its gravity-defying property values, this is one of the most fundamental and proven real estate investment strategies. Think of it as planting a money tree; it demands patience, but the eventual harvest can be life-changing. You’re aiming for two streams of return: consistent cash flow from tenants and a fat capital gains payday when you eventually decide to sell.

How to Implement This Strategy in LA

Winning the buy and hold game in Los Angeles boils down to a killer acquisition and iron-fisted management. You’re not just buying a property; you’re launching a long-term business.

- Hunt in Growth Zones: Target neighborhoods buzzing with job diversity, new infrastructure, and killer amenities. We’re talking about areas with real, tangible momentum—not just hype. Think places with new transit lines going in or communities benefiting from major redevelopment projects.

- Run the Damn Numbers: A common rule of thumb is the “1% Rule,” suggesting monthly rent should be at least 1% of the purchase price. Let’s be real: hitting that in LA is like finding a unicorn. But it’s still a critical benchmark for stress-testing a deal’s cash flow potential.

- Screen Tenants Like the FBI: Your tenants are the engine of your business. A bulletproof screening process—credit checks, background checks, income verification—is non-negotiable. It’s your first line of defense against vacancies and soul-crushing headaches.

- Build a War Chest: Never go into battle without reserves. Keep at least six months of operating expenses (mortgage, taxes, insurance, maintenance) liquid. This buffer protects you from a sudden vacancy or a busted water heater without torpedoing your entire investment.

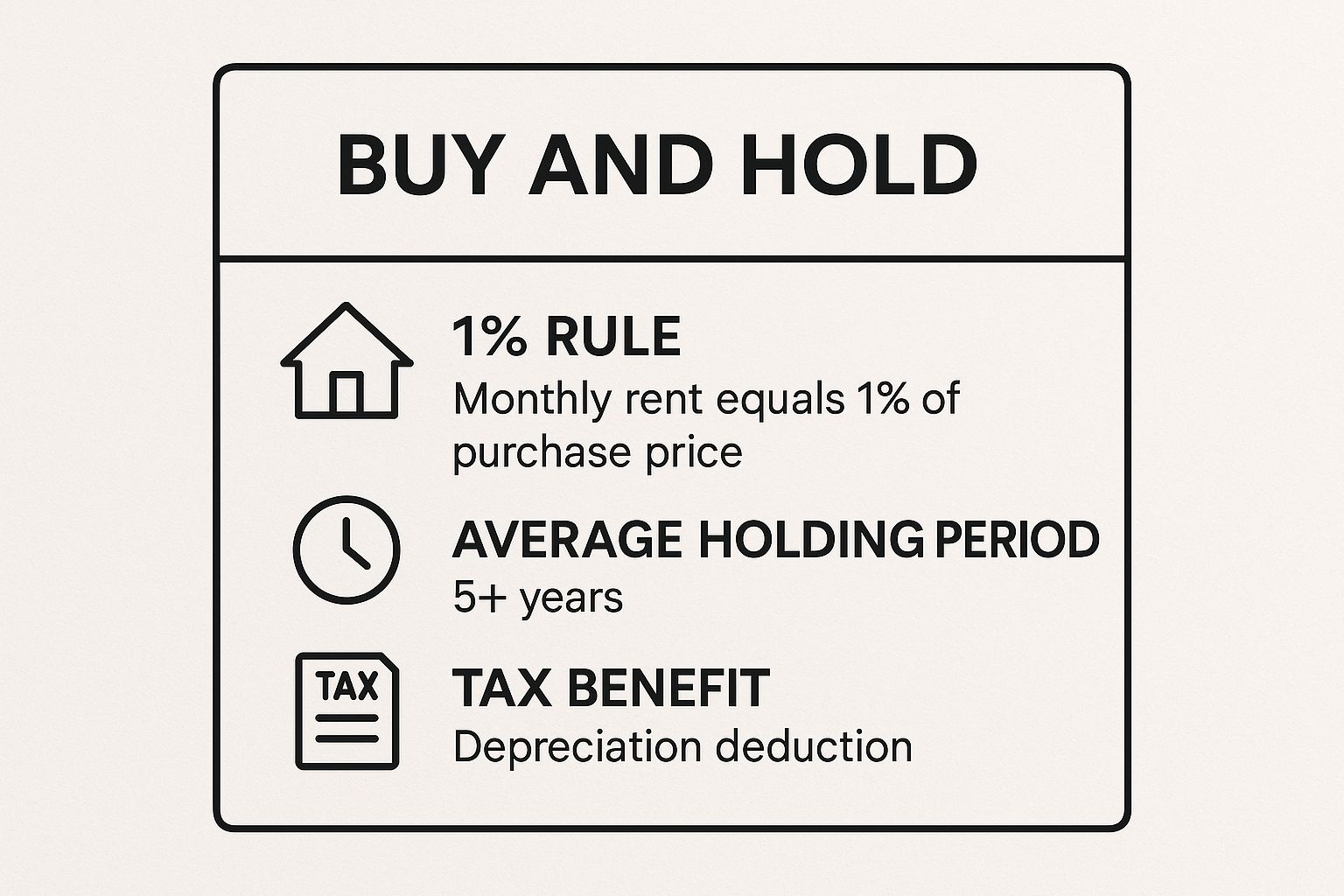

To help you remember the core principles of this strategy, here’s a quick reference summarizing the key data points.

These metrics highlight the long-term commitment and financial discipline required for a successful buy and hold investment, emphasizing cash flow, holding period, and tax advantages. One of the juiciest perks is depreciation, which lets you deduct a portion of the property’s cost from your taxable income annually. Dive deeper into the powerful real estate investment tax benefits on acme-re.com to make sure you’re squeezing every last drop of value from this advantage.

2. Fix and Flip: High-Speed Value Creation

The fix and flip is the adrenaline-junkie cousin to the patient buy and hold. Made famous by a thousand TV shows, this method is simple in theory: buy a distressed property, renovate it with surgical precision, and sell it fast for a profit. It’s an active, short-term blitz that thrives on market intel, speed, and execution, making it one of the most exhilarating real estate investment strategies out there.

This game isn’t about waiting for the market; it’s about “forced equity”—creating value with your own two hands (or, more accurately, your contractor’s). In a tight market like LA, where buyer demand is ferocious, a flawlessly renovated home commands a massive premium. The mission: get in, add value, and get out before the market knows what hit it, capitalizing on the spread between your all-in cost and the final sale price.

How to Implement This Strategy in LA

To win in the LA flipping scene, you need a hawk’s eye for deals and a process as tight as a drum. You’re not just an investor; you’re a project manager, a designer, and a marketing ninja rolled into one.

- Live by the 70% Rule: This is the flipper’s gospel. You should pay no more than 70% of the property’s After Repair Value (ARV) minus the estimated repair costs. This formula bakes in a profit margin beefy enough to absorb surprises and market shifts.

- Focus on High-ROI Bling: Not all renovations are created equal. For flipping, you must master which updates deliver the most bang for your buck. Focus on renovations that boost home value—think stunning kitchens, spa-like bathrooms, and curb appeal that stops traffic.

- Build Your A-Team: Your network is your net worth. Forge ironclad relationships with reliable contractors, agents who unearth off-market gems, and hard money lenders who can wire funds yesterday.

- Know Your Escape Hatch: Plan A is to sell. But always have a Plan B and C. If the market suddenly turns, could you pivot and rent it out (the BRRRR method)? Could you offer seller financing? Multiple exit strategies are your shield against disaster.

To master your numbers and ensure profitability on every project, it is crucial to use the right tools. You can calculate potential returns with our fix and flip investment calculator to analyze deals quickly and accurately.

3. Real Estate Investment Trusts (REITs): The Stock Market Shortcut

Want a piece of the LA real estate action without the midnight calls about a clogged toilet? Real Estate Investment Trusts (REITs) are your ticket. This strategy lets you invest in massive, income-producing real estate portfolios by buying shares in a company, just like you’d buy stock in Apple. It’s one of the most accessible real estate investment strategies, offering liquidity and diversification that owning a physical property just can’t touch.

REITs are companies that own, operate, or finance huge portfolios of properties—apartment complexes, office towers, shopping malls, you name it. When you buy a share, you become a fractional owner of these assets, collecting your cut of the income, often through juicy dividends. It’s the closest you can get to being a real estate mogul from your laptop.

How to Implement This Strategy in LA

Winning with REITs means applying stock market discipline to the real estate world. You’re not buying a building; you’re betting on a pro management team and their portfolio.

- Diversify Like a Pro: Don’t bet the farm on one horse. Spread your cash across different REIT sectors—residential, industrial (like Prologis – PLD), retail (like Realty Income – O), or even funky niche sectors like cell towers (American Tower – AMT).

- Bet on the Jockey, Not Just the Horse: A REIT is only as good as its management. Dig deep into their track record, their investment philosophy, and how they handled past recessions. A great team is the secret sauce.

- Compound Your Winnings: Turn on dividend reinvestment (DRIP). This simple move automatically uses your dividend payouts to buy more shares, letting the power of compounding work its magic and dramatically accelerate your wealth-building.

- Watch the Fed: REITs can be sensitive to interest rate hikes. Keep an eye on the Federal Reserve’s moves and the broader economy. Rising rates can sometimes be a headwind for REIT valuations, creating potential buying opportunities.

4. Wholesale Real Estate

Wholesaling is the art of the deal—a fast-paced strategy perfect for investors with more hustle than cash. The game is this: you find an undervalued or distressed property, get it under contract with the seller, and then sell (or “assign”) that contract to another buyer—usually a flipper—for a fee. You never actually own the property; you’re selling the paper.

This is one of the most electric real estate investment strategies because it minimizes your risk and requires very little of your own money. Your primary investment is time, marketing savvy, and your network. Wholesalers are the ultimate matchmakers, connecting motivated sellers with hungry cash buyers and pocketing the difference.

How to Implement This Strategy in LA

To succeed as a wholesaler in Los Angeles, you have to be fast, connected, and a master of local market values. You need to sniff out deals before the competition and have a pre-vetted list of buyers ready to pounce.

- Build a Black Book of Cash Buyers: Your buyer list is your lifeblood. Hit up local real estate meetups, network with flippers on platforms like BiggerPockets, and build relationships with contractors and agents who know who’s buying with cash. Your ability to close a deal is 100% dependent on this list.

- Master the Art of Finding Motivation: Focus your energy on finding sellers who need to sell, not just those who want to. This includes owners facing foreclosure, navigating probate, or stuck with a derelict property. Think direct mail, “driving for dollars” (spotting distressed homes), and hyper-targeted online ads.

- Analyze Deals in 60 Seconds: In LA, good deals have the shelf life of a Snapchat. You must be able to calculate the After Repair Value (ARV), estimate repair costs, and determine your Maximum Allowable Offer (MAO) instantly. Hesitate, and the deal is gone.

- Lawyer Up: Don’t screw around with the legalities. A real estate attorney is non-negotiable to ensure your assignment contracts are ironclad and compliant with California law. A single misstep here can be catastrophic. Operate ethically and legally, always.

5. Short-Term Rentals (Airbnb): The Hospitality Game

The short-term rental (STR) strategy means buying a property to lease out on a nightly or weekly basis on platforms like Airbnb or VRBO. This transforms a real estate asset into a full-blown hospitality business, often raking in way more revenue than a traditional long-term rental. It’s a direct play on LA’s colossal tourism industry, business travel, and endless stream of visitors hungry for a unique place to stay.

This strategy is about maxing out income through high turnover and dynamic pricing. You’re basically running a boutique hotel. In a city that hosts everything from the Oscars to the Olympics, the demand for cool, flexible lodging is relentless. The goal is to create an unforgettable guest experience that fuels five-star reviews, sky-high occupancy, and premium nightly rates.

How to Implement This Strategy in LA

Crushing it with STRs in Los Angeles requires mastering local laws and having a flair for hospitality. You’re not just a landlord; you’re a host, a marketer, and an operations wizard.

- Become a Regulation Guru: LA has notoriously strict rules, like the Home-Sharing Ordinance, which often limits STRs to your primary residence and requires registration. Research the specific laws for your target area—the rules in Santa Monica are completely different from those in West Hollywood or unincorporated LA County. Ignorance is not an excuse.

- Create an “Instagrammable” Experience: High-quality furnishings, professional photos, and killer amenities are table stakes. Things like lightning-fast Wi-Fi, a chef’s kitchen, and a curated list of local hotspots can turn a good stay into a viral sensation.

- Price Like an Airline: Use dynamic pricing tools or religiously track local event calendars, holidays, and seasonal demand. A property near the Hollywood Bowl or Crypto.com Arena can command insane rates during a big concert or game.

- Automate Everything: Implement smart locks for keyless entry, automated messaging for guest communication, and lock down a reliable cleaning crew. Building systems frees you from the daily grind and ensures a flawless guest experience every time.

This hands-on approach demands more work than buy and hold, but the potential for explosive cash flow is a massive draw. To learn more, see how you can treat your short-term rental as a hospitality business on acme-re.com and fully capitalize on this lucrative strategy.

6. Real Estate Syndications

Real estate syndications are your ticket to the big leagues. This strategy lets you pool your money with other investors to buy massive commercial assets—like an apartment complex or office building—that you could never afford alone. It’s team-based investing on steroids, where you leverage the expertise of a professional sponsor who finds the deal, manages the property, and executes the business plan.

This model rips down the velvet rope, giving you access to institutional-grade real estate. You can own a piece of a 200-unit apartment building just as easily as buying a single-family rental. You act as a silent, limited partner (LP) providing the cash, while the sponsor, the general partner (GP), does all the heavy lifting. This makes it one of the most powerfully passive real estate investment strategies available.

How to Implement This Strategy in LA

When you invest in a syndication, you’re betting on the sponsor as much as the property. Your mission, should you choose to accept it, is to perform deep-cover due diligence on the team running the show.

- Vet the Sponsor Relentlessly: This is everything. Scrutinize their track record, their experience in the specific asset class (multifamily, industrial, etc.), and their past performance. Ask for references from past investors and actually call them.

- Follow the Money (The Fees): Syndications have fees—acquisition fees, asset management fees, and a “promote” (profit split). Understand exactly how the sponsor gets paid and ensure their incentives are aligned with yours. You want them to win only when you win.

- Don’t Go All In: Never put all your capital into one deal. Spread your investments across different sponsors, markets, and property types. This diversification builds a more resilient portfolio that can withstand market turbulence.

- Interrogate the Business Plan: A legit sponsor will provide a detailed investment summary laying out their plan to boost the property’s value. Rip their projections apart. Are they realistic? Are they backed by solid data? Or are they just wishful thinking?

Syndications are perfect for investors chasing passive income and equity growth without the landlord headaches. It’s your pass to play in the lucrative commercial real estate sandbox, leveraging professional muscle to build serious wealth.

7. House Hacking: Live for Free While Investing

House hacking is, without a doubt, the most badass entry point into real estate investing, especially in a wallet-crushing market like Los Angeles. The concept is pure genius: buy a property, live in one part, and rent out the rest. The rent from your tenants covers most, or even all, of your mortgage. You live for free while building equity in an appreciating asset.

This strategy smashes the barrier to entry by merging your living expenses with your first investment. Instead of saving for a separate rental down payment, you leverage your primary home loan. Popularized by communities like BiggerPockets, house hacking is the ultimate cheat code to get in the game, learn how to be a landlord, and launch your portfolio with minimal financial pain.

How to Implement This Strategy in LA

A successful house hack in LA demands creativity and a willingness to share your turf. It’s an active, hands-on strategy that turns your home into a cash machine.

- Hunt for Multi-Family or ADU Gold: The holy grail is a duplex, triplex, or fourplex. You can also find single-family homes with a permitted Accessory Dwelling Unit (ADU) or a layout that’s begging for one. Neighborhoods with a good mix of this housing stock are your prime hunting grounds.

- Weaponize Low Down Payment Loans: Because you’re living there, you can snag owner-occupant financing like an FHA loan, which requires as little as 3.5% down. This is a game-changer compared to the 20-25% down needed for a typical investment property.

- Screen “Roommates” Like Tenants: Whether you’re renting a separate unit or a spare bedroom, your screening process must be airtight. Treat every applicant like a formal tenant—run credit and background checks. This isn’t about finding a new best friend; it’s about protecting your investment.

- Know the Landlord Laws: Get intimate with LA’s rent control and tenant protection laws. Understanding your rights and responsibilities before you have tenants living next door is non-negotiable. Ignorance can be incredibly expensive.

House hacking is a phenomenal launchpad for ambitious investors. It forces you to learn property management firsthand while killing your biggest personal expense. After living there for the required time (usually one year), you can move out, rent your old unit, and do it all over again, scaling your portfolio at a blistering pace.

8. Commercial Real Estate Investment: Playing in the Big Leagues

Graduating to commercial real estate is like going from playing in a garage band to headlining a stadium tour. This strategy involves buying income-producing properties like office buildings, retail centers, industrial warehouses, or large apartment complexes (five units or more). The buy-in is steep, but the potential for massive cash flow and professional tenants makes it one of the most powerful real estate investment strategies for serious players.

This game changes the rules. You’re no longer dealing with individual renters; you’re negotiating long-term, triple-net (NNN) leases with businesses and corporations. The scale is bigger, the stakes are higher, and the rewards can be epic. Success here isn’t about curb appeal; it’s about cold, hard numbers: revenue, expenses, and long-term economic viability.

How to Implement This Strategy in LA

Cracking LA’s competitive commercial market requires sharp business instincts and a team of assassins. You’re not just buying a property; you’re buying a business.

- Master the Metrics: Forget the 1% rule. In the commercial world, the Capitalization (Cap) Rate is king. This metric (Net Operating Income / Property Value) is the universal language for valuing and comparing deals. Understanding how to calculate and interpret cap rates in different LA submarkets is mission-critical.

- Focus on Tenant Quality and Location: A retail center on a high-traffic street with a major grocery store as an anchor tenant is infinitely more valuable than one in the middle of nowhere with sketchy tenants. Your obsession should be securing strong, credit-worthy tenants locked into long-term leases.

- Assemble Your Power Team: You can’t do this alone. Your squad must include a commercial broker who’s a shark in your chosen asset class, a real estate attorney who speaks fluent “commercial lease,” and a top-tier property management company.

- Analyze Macro Trends: Is e-commerce gutting retail space in the Valley? Are tech companies flocking to Silicon Beach? Answering these questions helps you skate to where the puck is going and invest in asset classes with a future.

9. Real Estate Crowdfunding: The Digital Landlord

Real estate crowdfunding is the new-school, tech-fueled way to get in the game. It allows you to own a piece of the LA real estate pie without the landlord drama by pooling your money with other investors through an online platform. It’s one of the best real estate investment strategies for anyone seeking diversification and a completely passive experience with a low buy-in.

Think of it as a digital real estate syndicate. Instead of buying an entire duplex, you can invest a smaller amount into a portfolio that owns a piece of that duplex, plus a retail spot in Santa Monica and a warehouse near the port. Platforms like Fundrise and RealtyMogul, supercharged by the JOBS Act, give you access to deals that were once the exclusive playground of the ultra-wealthy.

How to Implement This Strategy in LA

Winning at crowdfunding is all about due diligence on the platform itself. You’re not just investing in a property; you’re trusting the platform’s expertise to manage your money.

- Vet the Platform, Not Just the Property: Look past the glossy marketing photos. Dig into the platform’s track record, its leadership team, and its historical returns. How did their projects fare during the last market downturn?

- Deconstruct the Fee Structure: Crowdfunding isn’t a charity. Platforms charge fees for management, acquisitions, and other services. These fees eat directly into your returns, so read the fine print and know exactly what you’re paying for.

- Diversify Your Digital Empire: Don’t put all your chips on one project or even one platform. Spread smaller bets across different property types (multifamily, commercial, industrial) and geographic locations to build a resilient, diversified portfolio.

- Start Small, Scale Smart: Dip your toe in with an amount you’re comfortable losing. As you get more familiar with the process and see how the platform performs, you can gradually increase your investment. This is a marathon, not a sprint.

Top 9 Real Estate Investment Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Buy and Hold | Medium 🔄 | High ⚡ | Medium to High 📊 | Long-term wealth building, passive income | Stable cash flow, tax benefits, inflation hedge ⭐ |

| Fix and Flip | High 🔄 | High ⚡ | High (if successful) 📊 | Short-term profit, renovation expertise | Quick ROI, control over improvements ⭐ |

| REITs | Low 🔄 | Low ⚡ | Medium 📊 | Hands-off investment, liquidity | Professional management, diversification ⭐ |

| Wholesale Real Estate | Medium 🔄 | Low ⚡ | Low to Medium per deal 📊 | Capital-light quick deals, networking | Low capital, fast profits, no management ⭐ |

| Short-Term Rentals (Airbnb) | High 🔄 | Medium to High ⚡ | High (in good markets) 📊 | Active rental management, premium pricing | Higher income potential, personal use flexibility ⭐ |

| Real Estate Syndications | Medium to High 🔄 | High ⚡ | Medium to High 📊 | Access to large commercial deals | Passive investment, professional management ⭐ |

| House Hacking | Low to Medium 🔄 | Low ⚡ | Low to Medium 📊 | Owner-occupied rentals, beginner investors | Reduced living costs, easier financing ⭐ |

| Commercial Real Estate | High 🔄 | High ⚡ | High 📊 | Large income properties, stable tenants | Higher income, long leases, appreciation ⭐ |

| Real Estate Crowdfunding | Low 🔄 | Low ⚡ | Medium 📊 | Small investors seeking diversification | Low barrier, passive, geographic spread ⭐ |

Your Next Move: Making LA Real Estate Work for You

We’ve ripped through the dynamic landscape of Los Angeles real estate, dissecting nine powerful investment strategies. From the slow-burn wealth creation of Buy and Hold in rapidly changing neighborhoods to the high-stakes, high-reward chaos of a Fix and Flip in an area with older housing stock, the path to success is yours to choose. The key takeaway? There is no single “best” real estate investment strategy—only the best strategy for you.

Your journey is defined by your financial firepower, your appetite for risk, and your ultimate goals. Craving passive income? A REIT or a heavily vetted syndication could be your jam. Got an itch for a hands-on project with a quick payday? The flipping or wholesaling game is calling your name. Or maybe you want to turn your primary residence into a cash-flow machine through House Hacking in a duplex-heavy neighborhood. Each strategy demands a different level of your time, money, and sanity.

From Knowledge to Action: Your LA Blueprint

The real value here isn’t just knowing this stuff; it’s doing it. The Los Angeles market is a notoriously complex beast where local knowledge isn’t just an advantage—it’s everything. Knowing the difference between a REIT and an Airbnb is child’s play.

Success here means understanding the labyrinth of zoning laws in one city versus another, predicting the next hot neighborhood by tracking where the city is investing in infrastructure, and having a network of contractors who actually show up. It’s about seeing that a property’s value isn’t just in its square footage, but in its proximity to a new Metro line or its potential for an ADU (Accessory Dwelling Unit). This is where theory gets cashed in for real-world wealth.

Mastering Your Investment Mindset

Ultimately, your greatest asset isn’t your capital; it’s your strategic mindset. This means being proactive, not reactive.

- Be a Perpetual Student: The LA market is a living entity. Stay obsessed with local regulations, economic trends, and neighborhood shifts.

- Build Your A-Team: No one wins in real estate alone. You need a killer agent, a bulletproof lender, a savvy accountant, and contractors you’d trust with your life.

- Analyze, Don’t Romanticize: Run the numbers on every single deal. Factor in vacancy, maintenance, management fees, and realistic appreciation. Emotion is the sworn enemy of a good investment.

The strategies we’ve detailed are your weapons. Your mission is to pick the right ones, sharpen them with local expertise, and execute with brutal precision. Whether your goal is a nine-figure commercial portfolio or just enough passive income to tell your boss to take a hike, the opportunities in Los Angeles are massive. They belong to those bold enough to take them. Your LA story starts now.

Ready to turn this knowledge into a concrete action plan? Navigating the complexities of the LA market requires a partner who understands the nuances of the best real estate investment strategies. At ACME Real Estate, we are more than just agents; we are your strategic advisors, dedicated to helping you build a powerful portfolio. Let’s connect today and start building your Los Angeles real estate empire together.