Calculating your home equity is surprisingly simple. You just take your home’s current market value and subtract your outstanding mortgage balance. That’s it.

The number you’re left with is the portion of your home you actually own, free and clear of what the bank is owed. Getting a handle on this figure isn’t just a math exercise—it’s the first step to unlocking the massive financial potential you’ve been building.

Your Home’s Hidden Financial Superpower

Think of your home equity as a quiet financial engine humming in the background. It’s not just a number on a page; it’s a powerful asset that grows in two primary ways.

First, every single mortgage payment you make chips away at your loan principal, which directly increases your ownership stake. At the same time, your property’s value is (hopefully) appreciating, whether from local market heat or those slick home improvements you made. This gives your equity a second, powerful boost.

This one-two punch is what makes home equity a cornerstone of your net worth. It’s a tangible asset you are actively building, month after month, turning a housing payment into a wealth-building machine.

Unpacking the ‘Why’ Behind the Formula

Figuring out your home equity is about understanding your financial leverage. This number can influence major life decisions, from funding a killer renovation to crushing high-interest debt or even mapping out a comfortable retirement. It represents your financial footprint in the real estate market, and it’s a big deal.

The potential held within this asset is massive. As of mid-2025, U.S. homeowners are sitting on a staggering $17.6 trillion in collective home equity.

Of that, an estimated $11.5 trillion is “tappable,” meaning it can be borrowed against. That breaks down to roughly 48 million homeowners holding an average of $212,000 each in accessible equity. You can find more insights on homeowner equity at AdvisorsMortgage.com.

Your home isn’t just a place to live; it’s an investment vehicle. The equity you build is the fuel that can power your future financial goals, turning a monthly payment into a long-term wealth-building strategy.

Before you can put this superpower to work, you need an accurate number. Let’s walk through how to find the right figures and put them together so you have a crystal-clear picture of what you’ve built.

Finding Your Home’s Current Market Value

Before we can even talk about equity, we need to nail down the most important number in the whole equation: your home’s current market value.

Forget what you paid for it. Forget the Zestimate you glanced at last year. What matters is what a real, live buyer would be willing to pay for it right now. This isn’t just a number to plug into a formula; it’s the foundation of your entire calculation. Getting it wrong throws everything else off.

A quick online search will spit out a value from an Automated Valuation Model (AVM). These tools are fine for a ballpark figure, a casual “what if.” But an algorithm can’t see the killer custom kitchen you just installed, the leaky roof in the guest room, or the fact that your neighbor’s house just sold for $50,000 over asking in a bidding war.

For a number you can actually rely on, you have to think like an appraiser. That means digging into the “comps”—comparable, recently sold homes right in your neighborhood that are similar in size, age, and condition. This is ground-level, real-world data, not a wild guess from cyberspace.

Getting a Realistic Number

Looking at comps gives you a snapshot of what the market is actually doing, not just what a computer thinks it should do. Of course, the bigger picture matters, too.

The U.S. housing market in early 2025 is a mixed bag. We’re seeing modest price growth, around 3% or less annually. While housing inventory is up by roughly 20% compared to last year, it’s still tight by historical standards. That scarcity directly props up home values in many desirable neighborhoods.

So, how do you get a value you can take to the bank?

- Become a Neighborhood Expert: Start tracking recent sales (within the last 3-6 months) of homes similar to yours. Pay attention to what they actually sold for, not the wishful thinking list price. Every property owner has equal housing opportunity and access to this public information.

- Talk to a Pro: A local real estate agent can pull a Comparative Market Analysis (CMA) for you. This isn’t just a data dump; it’s a professional opinion based on market trends and firsthand knowledge of what buyers are looking for today.

- Hire a Professional Appraiser: If you’re planning a major financial move like a refinance or taking out a HELOC, this is non-negotiable. An official appraisal is the gold standard and provides the most definitive, legally defensible value.

And don’t forget that certain upgrades can move the needle on your home’s value. Simple things like high-quality, custom driveway gates can seriously enhance curb appeal and property value.

Your home’s value is a moving target influenced by sales down the street and broader economic trends. Combining online tools with real-world data from your specific area gives you the most powerful and accurate starting point for your calculation.

Once you have a confident estimate, you’re halfway there.

Now, let’s nail down the other side of the equation.

Tracking Down Every Dollar You Owe

Once you have your home’s market value, it’s time to face the other side of the coin: every single dollar you owe against the property. This sounds simple, but a common blunder I see constantly is homeowners only counting their primary mortgage. It’s an oversight that gives you a dangerously inflated sense of your actual equity.

To get the real number, grab your most recent mortgage statement or log into your lender’s online portal. Do not use your original loan amount. You need the current principal balance—the figure that shows what you actually owe today after all your payments.

Accounting for All Liens

Your main mortgage is often just the beginning. For a truly accurate equity calculation, you have to track down and add up every single debt secured by your home. Think of it as a financial scavenger hunt where finding everything is the only way to win.

You need to include the outstanding balances from any of these:

- Home Equity Lines of Credit (HELOCs): It doesn’t matter if you aren’t actively using it. The outstanding balance still counts against your equity.

- Second Mortgages: If you took out another loan for a renovation or to consolidate debt, that’s part of your total liability.

- Other Liens: This is the catch-all category for things like contractor liens or other financial judgments tied to your property.

Forgetting even one of these completely blows up your calculation. Add all of these balances together, and you’ll have the total “amount owed” for your equity formula.

Think of your home as a piggy bank. Your mortgage and other liens are just IOUs taped to the side. You can’t really know what’s inside until you account for every single one of them.

This process does more than just help you find your equity; it gives you a much clearer picture of your overall financial health.

Putting It All Together With Real-World Scenarios

Once you’ve nailed down your home’s market value and what you still owe, it’s time to let the numbers do the talking. The formula itself is dead simple, but the story it tells about your financial standing is incredibly powerful.

Let’s walk through a couple of real-life examples to see how this plays out.

From New Homeowner to Equity Powerhouse

First, meet Alex. He bought his condo in a competitive metro area two years ago.

- Market Value: $550,000

- Remaining Mortgage: $515,000

- Calculation: $550,000 – $515,000 = $35,000 in equity.

Alex has started to build a solid foundation, but his equity is still pretty modest. This is totally normal for new homeowners. In the early years of a mortgage, your payments are almost entirely devoured by interest. It’s a slow grind at first.

Now, let’s check in on Maria, who’s been in her home in a well-established neighborhood for 15 years.

- Market Value: $950,000

- Remaining Mortgage: $275,000

- Calculation: $950,000 – $275,000 = $675,000 in equity.

The difference is night and day. Maria’s equity has absolutely skyrocketed, thanks to a decade and a half of chipping away at her mortgage combined with some serious market appreciation. Her home isn’t just a place to live; it’s a major financial asset.

Home equity isn’t built overnight. It’s a marathon of disciplined payments mixed with the unpredictable sprint of market forces. Your neighborhood’s performance plays a huge role in how quickly you build wealth.

This is especially true when you zoom out and look at regional market shifts. The numbers from early 2025 show just how wild the variations can be across the U.S. Homeowners in states like Rhode Island and New Jersey saw their equity jump by over $35,000 in a single year. At the same time, those in Hawaii watched their equity drop by an average of $66,000. You can explore the full report on home equity gains at TheMortgageReports.com.

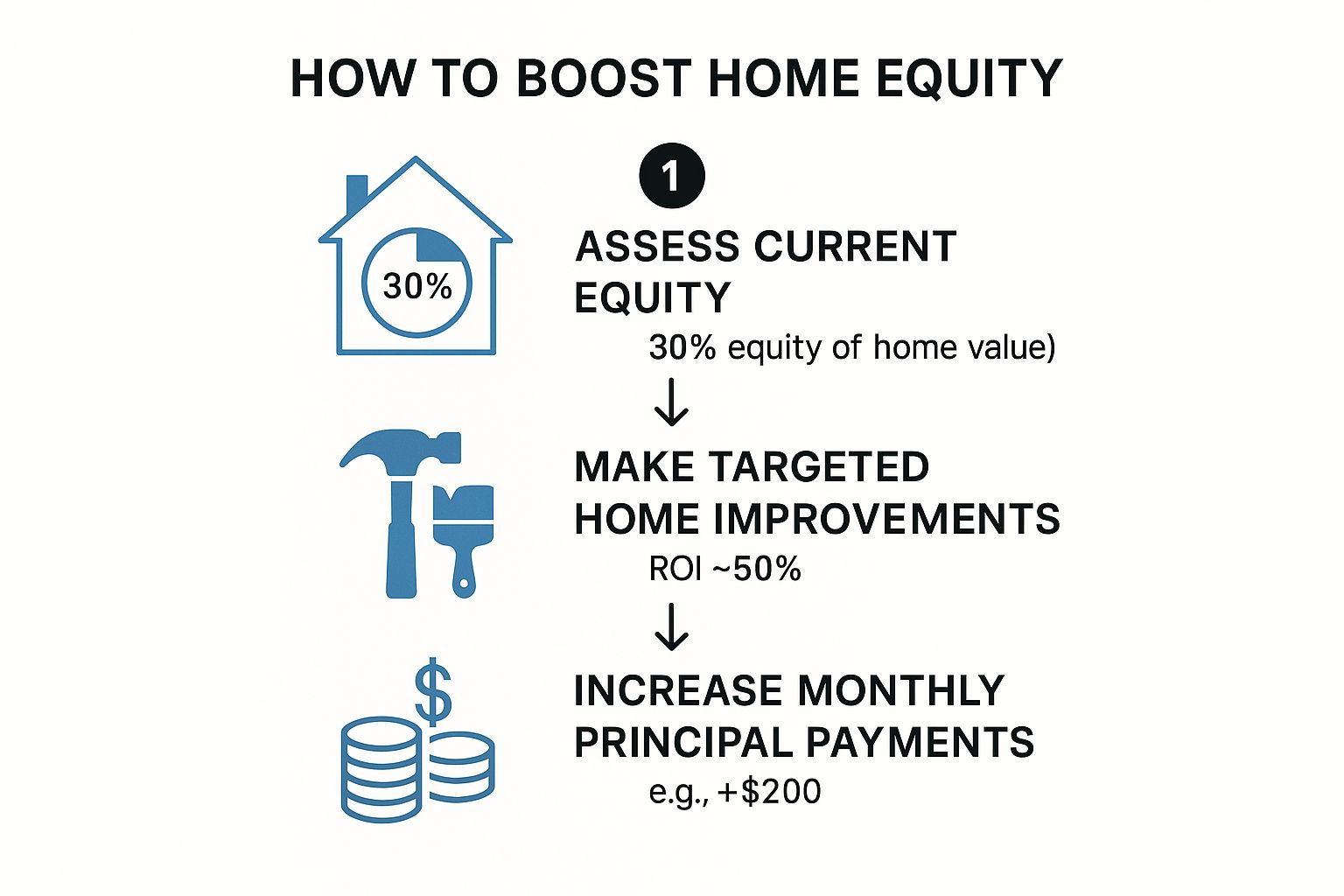

This visual breaks down a simple process for actively growing the equity you’ve built.

At the end of the day, you can put your foot on the gas. Strategic home improvements and extra payments toward your principal are two of the best ways to accelerate equity growth and take more control of your financial future.

Making Your Home Equity Work for You

Knowing your home equity is one thing. Knowing what to do with it is where the real strategy comes in. That number isn’t just a figure on a spreadsheet; it’s a powerful financial asset waiting for a job. The smartest homeowners put this value to work.

I’ve seen clients use their equity to consolidate high-interest credit card debt into a single, much more manageable payment. Others finally fund that kitchen remodel they’ve been dreaming about for years. Done right, those kinds of renovations can actually boost your home’s value, creating a positive feedback loop of even more equity down the line.

Understanding Tappable Equity

Before you start drawing up plans, you need to get familiar with a term lenders live by: tappable equity.

Most lenders want you to keep a skin-in-the-game cushion of at least 20% equity. This means they’ll typically let you borrow against 80% of your home’s total value. The amount you can actually access—your loan amount on top of your existing mortgage—is your tappable equity.

This isn’t just a rule for the bank’s benefit; it’s a critical buffer that protects you from market swings. Borrowing every last cent is incredibly risky. Keeping that 20% cushion is a savvy financial move that gives you a safety net if property values take a temporary dip.

Think of your equity as a financial resource, not free money. The goal is to use it strategically to improve your financial position, not just to spend it. Using it to pay off high-interest debt saves you money, while smart renovations can build future wealth.

For a broader perspective on integrating this asset into your long-term goals, exploring resources on understanding home equity’s role in comprehensive retirement planning can provide valuable context. The right strategy transforms your home from a place you live into a cornerstone of your financial well-being. To make the most of your investment, keeping up with local market dynamics using the latest real estate market analysis tools is always a smart play.

Still Have Questions About Home Equity?

Even after you nail down the formula, a few questions always seem to pop up. You’re not the first person to wonder about the finer points, so let’s clear up some of the most common head-scratchers we hear from homeowners.

Think of this as the last gut-check before you start putting your equity to work, armed with a real understanding of where you stand financially.

How Often Should I Calculate My Equity?

As a general rule, checking your home equity once a year is a smart move. It’s like an annual financial check-up that keeps you dialed in on your biggest asset’s performance.

But here’s the key: you should always run the numbers before making a major financial decision. If you’re even thinking about refinancing, applying for a Home Equity Line of Credit (HELOC), or putting your home on the market, you need a current, accurate calculation.

And if you’re in a hot market where values are shifting fast? Checking in every six months is a good way to stay ahead of the curve.

Can Home Equity Actually Be Negative?

Unfortunately, yes. When this happens, it’s called being “underwater” or having “negative equity.” It’s a brutal spot where your mortgage balance and any other loans against the property add up to more than your home’s current market value.

This scenario usually plays out when property values in your area take a nosedive after you’ve bought. Being underwater makes it incredibly difficult to sell or refinance without having to bring a pile of cash to the closing table to cover the difference.

Home equity is the slice of your home you actually own (Market Value – Loan Balance). A HELOC is a tool—a line of credit that lets you borrow against that ownership stake. Think of equity as the money in your bank account and a HELOC as the debit card that accesses it.

Getting these distinctions right is everything. Each piece of the puzzle builds on the last, giving you a complete picture of your financial position.

Ready to see what your home equity can unlock in the Los Angeles market? The team at ACME Real Estate has the local expertise to guide you through your next move, whether you’re selling, buying, or looking to invest. Visit us at https://www.acme-re.com to get the conversation started.