Buying a home in Los Angeles is a marathon, not a sprint. The real starting line isn’t the first open house you visit—it’s getting your finances dialed in. Before you even think about neighborhoods, you need to get your credit score in shape, lock down a realistic budget, and secure a mortgage pre-approval. This groundwork is the single most important thing you can do to compete in LA’s high-stakes market.

Laying the Financial Groundwork for Your LA Home

Before you fall in love with a Spanish-style bungalow in Pasadena or a sleek condo in DTLA, you have to get real about the numbers. Winning in the LA market isn’t about luck; it’s about solid preparation. Think of this as your financial bootcamp—the training you do now gives you the power to act decisively when you find the perfect place.

Your Credit Score: The VIP Pass to Better Loans

Your credit score is the first thing any lender will scrutinize, and it directly controls your interest rate and how much you can borrow. A high score tells lenders you’re a safe bet, which can literally save you tens of thousands of dollars over the life of your loan.

You’ll want to aim for a score of 700 or higher to get access to more favorable loan products. If you’re not there yet, don’t sweat it. You can boost it pretty quickly with a few smart moves.

- Pay every single bill on time. This is the biggest factor, period. Consistency is everything.

- Knock down your credit card balances. Lenders get nervous when you’re using too much available credit. Try to keep your balances below 30% of your total limit.

- Check your credit reports for mistakes. Pull your reports from Experian, Equifax, and TransUnion and dispute any errors you find. It happens more often than you think.

To help you stay on track, here’s a quick checklist of the financial goals you should be aiming for in the LA market.

LA Home Buyer Financial Checklist

| Financial Milestone | Target Goal | Pro Tip for LA Buyers |

|---|---|---|

| Credit Score | 700+ | A higher score means a lower interest rate, which can free up hundreds in your monthly payment. |

| Debt-to-Income (DTI) | Under 43% | Lenders get strict on this. Pay down small loans or credit cards to improve your ratio before applying. |

| Down Payment Savings | 3.5% – 20% | While 20% is ideal, many programs exist. A stronger down payment makes your offer more competitive. |

| Closing Cost Savings | 2% – 5% of Sale Price | Don’t forget this! It’s a separate cash expense from your down payment for fees, taxes, and insurance. |

Keep this table handy as a reference. Hitting these numbers puts you in a powerful position to make a winning offer.

The Pre-Approval Power Move

Walking into an open house with a mortgage pre-approval letter is like showing up to a negotiation with all the leverage. It’s a formal document from a lender stating exactly how much they’re willing to lend you. This isn’t some vague online “pre-qualification”—it’s a serious commitment based on a deep dive into your finances.

A pre-approval letter signals to sellers that you are a serious, capable buyer. In a hot market where sellers might get a dozen offers, this piece of paper can be the difference between your offer being taken seriously or getting tossed in the “maybe” pile.

Pro Tip: Get pre-approved before you start your active home search. It sets a crystal-clear budget and prevents the heartbreak of falling for a home you can’t actually afford. You should also check out our guide to fully understand what you can afford: https://acme-re.com/2026/02/how-to-calculate-home-affordability/.

Cracking the Down Payment Code in LA

The down payment is often the biggest hurdle for buyers. While the old “20% down” rule is still a great goal to avoid private mortgage insurance (PMI), it’s not the only way to get the keys. Programs like FHA loans allow for down payments as low as 3.5%.

But here’s the reality in Los Angeles: a larger down payment makes your offer significantly stronger. Recent data shows the median down payment hit 19% in 2025. For a typical LA home price, that 19% can translate to a hefty $190,000, which is why many buyers get creative with savings strategies and family gifts.

As you get your finances in order, it’s also smart to start understanding your homeowners insurance policy. It’s a key piece of the financial puzzle that protects your new asset from the moment you close.

Finding Your Perfect LA Neighborhood

Los Angeles isn’t one city. It’s a sprawling, stitched-together collection of unique vibes, cultures, and communities. Finding a neighborhood that fits you isn’t about picking a dot on a map; it’s about matching a lifestyle to your own. This is where the real fun begins—you get to define what your ideal LA life actually looks like.

Forget the Hollywood stereotypes. The real Los Angeles is in the details—the walkability of a street in Larchmont, the creative pulse of the Arts District, or the quiet, tree-lined avenues of Pasadena. Your mission is to find the pocket of LA that feels like it was made just for you.

Define Your Non-Negotiables

Before you even think about scrolling through listings, grab a notebook and get brutally honest about your needs versus your wants. This isn’t a wishlist. It’s your personal search filter, and it will save you countless hours of frustration.

- Commute Reality Check: What is your absolute maximum commute time, and how are you getting there? An extra 15 minutes each way adds up to 10 hours a month stuck in traffic.

- Lifestyle & Amenities: Are you a “walk to a coffee shop every morning” person, or do you need a big yard for your dog? Are you looking for hiking trails or nightlife?

- Future Proofing: Where do you see yourself in five years? Will you need more space for a home office, or a quieter street? Will your housing needs change?

Your answers create a blueprint. For instance, if a sub-30-minute commute to Burbank and easy access to hiking are top priorities, you might focus on areas like Glendale or La Cañada Flintridge, not getting distracted by a cool loft in Santa Monica.

A great neighborhood doesn’t just hold your house; it enhances your life. The goal is to find a location where your daily routine feels easier, more enjoyable, and authentically you.

Doing Your Homework The Right Way

Once you have a shortlist, it’s time to do some real-world investigation. Online research is a great starting point, but nothing beats putting boots on the ground. Think of yourself as a detective trying to uncover the true character of a place.

Go beyond a quick drive-through. We suggest our clients spend a full weekend in their top-contender neighborhoods. This isn’t about looking at houses for sale; it’s about test-driving the lifestyle.

Your Neighborhood Test-Drive Checklist

- Visit at Different Times: See what the area feels like on a Tuesday morning versus a Saturday night. Is it vibrant or a ghost town? Does parking become impossible after 6 PM?

- Talk to the Locals: This is a fantastic trick. Strike up a conversation with someone walking their dog or the barista at the local coffee shop. Ask them what they love about living there—and, more importantly, what the frustrations are.

- Map Your Essentials: Don’t just Google it. Physically drive from a potential house to your job, the nearest grocery store, the gym, and anywhere else you go regularly. This turns an abstract commute into a tangible reality.

- Explore the Amenities: Don’t just note that there’s a park nearby—go walk through it. Check out the local restaurants and farmers’ markets to see if they fit your vibe.

This hands-on approach is critical. It’s what prevents that awful feeling of buyer’s remorse and ensures you’re not just investing in property, but in a community that will support your lifestyle for years to come.

Assembling Your Home Buying Dream Team

Trying to buy a home in Los Angeles on your own is a special kind of nightmare. Think driving the 405 during rush hour… blindfolded. You just wouldn’t do it. To navigate this market, you need a team of pros in your corner, each one a master of their craft.

This isn’t just about hiring a few people. It’s about building an alliance with a single mission: getting you the keys to the right home, on the best possible terms.

Your Quarterback: The Real Estate Agent

Your first and most important pick is your real estate agent. This person is your guide, your strategist, and your chief negotiator, all rolled into one. A great agent doesn’t just unlock doors to houses; they unlock opportunities you would never find scrolling through Zillow.

At ACME Real Estate, we believe an agent’s real value comes from their deep local knowledge and powerful network. Our agents live and breathe LA’s micro-markets, giving you an insane advantage. They know which listings are overpriced, which neighborhoods have hidden potential, and often hear about off-market deals before anyone else.

A top-tier agent does more than just find listings. They provide strategic advice, master the art of negotiation, and connect you with a network of vetted professionals who will make your journey seamless.

Think of your ACME agent as the quarterback of your homebuying team. They’re calling the plays, from the first search to the final closing, making sure every single person on your team is in sync. It’s a critical role, and you can learn more about what to look for when you choose a real estate agent in our detailed guide.

The Key Players on Your Roster

While your agent leads the charge, a few other experts are absolutely essential. Your agent will have a list of trusted pros they work with day-in and day-out, but it helps to know exactly who does what.

The Mortgage Lender

This is the person with the money. They dig into your financial life to approve and fund your loan. Your relationship with your lender is everything—a proactive, communicative lender can be the difference between a smooth closing and a deal-killing delay. They’ll be your main contact for all things financing, from pre-approval to the finish line.

The Home Inspector

Think of this person as your property detective. Before you commit, they’ll uncover any skeletons hiding in the walls, the attic, or under the foundation. They conduct a thorough visual investigation of the home’s structure and major systems—plumbing, electrical, HVAC, the works. Their detailed report gives you the leverage to negotiate repairs or, if needed, the confidence to walk away from a money pit.

The Escrow Officer

The escrow officer is the neutral third party who holds all the money and paperwork. They make sure every single condition in the purchase contract is met before any funds or keys change hands. They manage the earnest money deposit, wrangle all the documents, and facilitate the closing. Essentially, they protect both you and the seller by ensuring the entire transaction is handled fairly and by the book.

Together, these professionals form a protective circle around your transaction, each one bringing their expertise to the table to get you across the finish line.

Crafting an Offer That Wins in a Bidding War

This is where the game is won or lost. You’ve done the financial homework, scouted the perfect LA neighborhood, and have your team in place. Now, you’ve found the one. In a market like Los Angeles, you can bet you’re not the only person who thinks so. This moment is all about strategy, speed, and a bit of finesse.

Crafting a compelling offer isn’t just about throwing the highest number at the seller. It’s about creating a strategic proposal that solves their problems while getting you the house. In a bidding war, the biggest number doesn’t automatically win. Sellers are often hunting for the cleanest, most reliable offer that guarantees a smooth and predictable close.

Beyond the Price Tag: What Really Matters

While the offer price gets all the attention, the other terms are where you can really outmaneuver the competition. A sharp agent from ACME Real Estate plays detective, figuring out what the seller truly values. Do they need a lightning-fast close because they’re relocating for a job? Or do they need more time to find their next home?

Understanding the seller’s motivation is your secret weapon. For instance, offering a flexible closing date or a rent-back agreement (where you let them stay in the home for a bit after closing) can make your offer far more appealing than a slightly higher one from a less accommodating buyer.

The winning offer is a puzzle piece that fits perfectly into the seller’s specific needs. It’s not just about money; it’s about giving them the path of least resistance to the closing table.

Understanding the Anatomy of an Offer

Your offer is a total package, and every component matters. Getting each piece right is crucial to making your proposal stand out from the stack. Think of it as a presentation—every detail counts.

- Offer Price: This needs to be competitive but grounded in reality. We use deep market analysis to see what similar homes just sold for, helping you land on a number that’s aggressive yet justified by solid data.

- Earnest Money Deposit (EMD): This is your “skin in the game” money. A larger deposit, typically 1-3% of the purchase price, screams that you are a serious, financially secure buyer who won’t flake.

- Contingencies: These are your safety nets. They are clauses that let you walk away from the deal—with your deposit—if certain conditions aren’t met.

The Art of Wielding Contingencies

Contingencies are there to protect you, but in a dogfight for a property, they can also make your offer look weaker. The big three are the inspection, appraisal, and loan contingencies. Each one is an exit ramp if something goes sideways.

The inspection contingency lets you check the home’s condition. The appraisal contingency ensures the home is worth what you’re paying (a must for your lender). The loan contingency protects you if your financing unexpectedly falls through.

In a fierce bidding war, some buyers might shorten or even waive certain contingencies to look more attractive. This is a high-risk, high-reward strategy and one you should only consider after a serious talk with your agent about the potential fallout. Waiving an inspection, for example, could mean you inherit thousands in surprise repairs.

But there’s a middle ground. Instead of waiving the inspection entirely, you could shorten the contingency period from the standard 17 days down to 7-10 days. This signals to the seller that you’re decisive and ready to move. This is just one of many tactics that can give you an edge. For a deeper playbook, check out our guide on how to win a bidding war for a house.

A thoughtfully written offer letter can also be a game-changer. It’s not right for every situation, but a personal letter explaining why you fell in love with the home can forge an emotional connection, making you more than just a number on a contract. Your ACME agent can help you figure out when and how to use this powerful tool.

Navigating Escrow: From Accepted Offer to Keys in Hand

Congratulations! You made it through the offer trenches, your offer was accepted, and you can finally take a breath. Soak up that feeling—it’s a big deal. Now, welcome to escrow, the final leg of your homebuying marathon. This is the 30-to-45-day period where the real work happens behind the scenes to get you from an accepted offer to a closed deal.

Think of escrow as a neutral third party. An escrow company holds your earnest money deposit, the seller’s deed, and all the critical documents, making sure nothing changes hands until every single condition in the purchase agreement has been met. It’s the ultimate trust exercise in a high-stakes transaction, ensuring everyone plays by the rules.

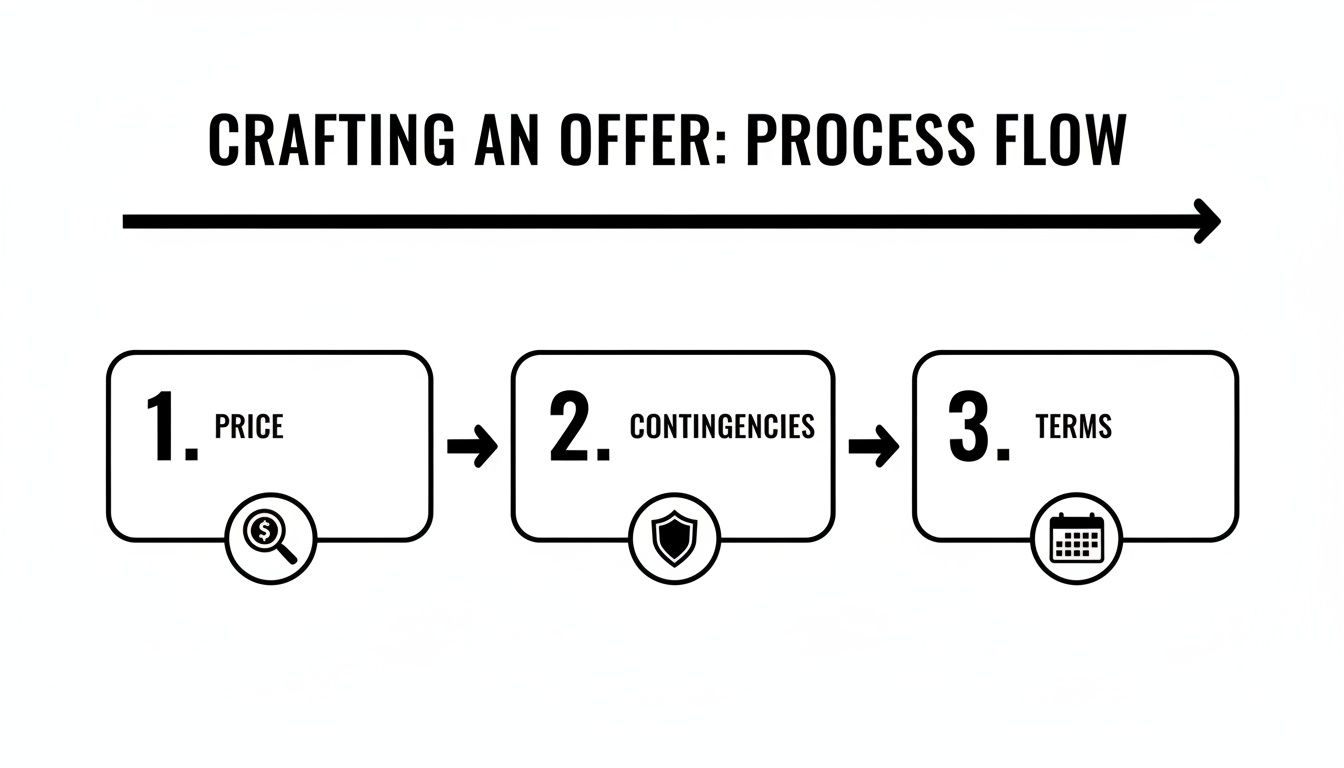

This flowchart breaks down the core pieces you just negotiated—the very things that will now be executed during the escrow period.

The price, contingencies, and terms you agreed on now set the timeline for your escrow officer to manage. It’s time to get to work.

The Due Diligence Deep Dive

For you as the buyer, the most hands-on part of escrow is the due diligence phase. This is your chance to really kick the tires and look under the hood with a team of professionals before you’re fully committed. Your agent will be quarterbacking a series of inspections, with the general home inspection being the main event.

A professional home inspector will spend several hours crawling through the property, checking the big-ticket items:

- Foundation and Structure: Looking for any cracks or signs of settling.

- Roofing: Assessing its age, condition, and any potential leaks.

- Plumbing and Electrical Systems: Testing for safety, functionality, and code compliance.

- HVAC: Making sure the heating and cooling systems are in good working order.

Your home inspection report isn’t a pass/fail test; it’s an educational tool. It gives you a detailed snapshot of the home’s condition and the leverage to negotiate for repairs or credits if significant, previously unknown issues pop up.

Depending on what that initial inspection uncovers, you might bring in specialists for a closer look—think a termite inspector, a roofer, or a sewer scope technician. This is your single best opportunity to uncover potential problems and make sure the home you’re buying is a sound investment.

Clearing Hurdles and Protecting Your Investment

While you’re busy with inspections, your lender is working on their own checklist to get your loan finalized. This involves a crucial step: the appraisal. The bank hires an independent appraiser to confirm the home’s market value, making sure they aren’t lending you more money than the property is actually worth.

At the same time, the escrow officer works with a title company to conduct a title search. They’re digging into the property’s history to ensure there are no outstanding liens, claims, or legal skeletons in the closet that could cloud your ownership. Once the title is confirmed “clean,” the company issues title insurance—a policy that protects both you and your lender from any future claims against the property.

This whole process is about risk management. Globally, real house prices fell 0.8% year-over-year in Q2 2025, but long-term, prices are up 20.6% since the 2010 Global Financial Crisis and have risen by over 50% in the US alone. That kind of volatility makes this due diligence phase absolutely essential. You can dig into more data on global property trends in this insightful report on residential property prices.

The Final Lap: Closing Day

Once all contingencies are removed, the loan is fully approved, and every condition is met, you’ll schedule your signing appointment. You’ll sit down with a notary to sign a mountain of paperwork—your final loan documents and closing statements. It can feel a bit overwhelming, but your agent or escrow officer will be right there to walk you through each document.

After you sign, you’ll wire your remaining down payment and closing costs to escrow. The day after the loan funds and the new deed is officially recorded with the county, the home is legally yours. Then comes the call from your agent with the three best words in real estate: “You have keys!”

Common Questions About Buying a Home in LA

Let’s be real: buying a home in Los Angeles can feel like navigating a maze blindfolded. A million questions pop up, and it’s easy to get bogged down in unfamiliar terms and high-stakes decisions. We get it. Here are some of the most common questions we hear from our clients at ACME Real Estate, answered straight up.

How Long Does It Really Take to Buy a Home in Los Angeles?

Every buyer’s journey is different, but a good rule of thumb is to expect the whole process—from actively hunting for a place to getting the keys—to take about two to four months.

The search itself is the real wild card. Some clients find their dream home in a month, while others take two or three, especially if their wish list is very specific or inventory is tight. Once you get an offer accepted, the escrow period typically clocks in at around 30 to 45 days. But don’t forget the prep work. Saving for your down payment and getting your credit in shape can take a lot longer, so starting early is the best way to keep your stress levels in check.

What Are the Biggest Hidden Costs I Should Budget For?

The down payment is just the opening act. The biggest surprise for most first-time buyers is closing costs. In California, you can expect these to run anywhere from 2% to 5% of the home’s purchase price. This is a separate cash expense you’ll pay at the end of the transaction.

Think of it as a bundle of fees for all the pros who make the deal happen:

- Loan Origination Fees: What the lender charges for creating your mortgage.

- Appraisal and Inspection Fees: Paying the experts who confirm the home’s value and structural health.

- Title Insurance and Escrow Fees: Costs to ensure the property title is clean and to have a neutral third party manage the money.

On top of that, you’ll have pre-paid items like property taxes and your first year of homeowner’s insurance. We always advise our clients to have an extra 1-3% of the home’s value stashed away for these costs, plus any immediate repairs or furniture you’ll need the day you move in.

Plan for your total cash-to-close to be your down payment plus an additional 3-5% of the purchase price. Knowing this number upfront prevents last-minute financial scrambling.

How Can I Compete Against All-Cash Offers in the LA Market?

It feels daunting, but you absolutely can win against cash offers. You just have to be smarter. While cash is simple and fast, a bulletproof financed offer can be just as attractive to a seller. The trick is to remove every ounce of uncertainty you can.

Instead of a basic pre-qualification, get a full underwritten approval from your lender before you make an offer. This is a game-changer. It means a human underwriter has already gone through your finances with a fine-tooth comb, making your offer nearly as certain as cash.

Flexibility is your other secret weapon. Offering a shorter contingency period (after a serious talk with your agent about the risks) or a closing date that lines up perfectly with the seller’s moving plans can make your offer the clear winner. And never underestimate the power of a personal letter. Explaining why you fell in love with the home can create an emotional connection that a sterile, corporate cash offer just can’t match.

What Matters More to Sellers: A Lower Price or Better Terms?

This is the million-dollar question, and the answer comes down to one thing: the seller’s motivation. Some are obsessed with hitting the highest possible price. Others just want a fast, clean, drama-free closing so they can move on with their lives.

A sharp agent from ACME Real Estate will do the detective work to figure out what’s really driving the seller. We’ve seen sellers take a slightly lower offer because it had a short inspection period and no repair requests. On the flip side, if a seller needs to close by a specific date for their own move, your willingness to match that timeline could be worth more than a few thousand extra dollars. It’s almost never just about the number.

Your LA real estate journey starts with the right partner. At ACME Real Estate, we believe buying a home should be an exciting milestone, not a stressful ordeal. Our team has the local expertise and strategic mindset to guide you through every question and challenge.

Ready to find out what Los Angeles has to offer? Contact ACME Real Estate today and let’s make your dream home a reality.