A backup offer isn't just wishful thinking—it's a real, legally binding contract that catapults you to the front of the line if the first deal on a house goes south. Think of it as your all-access VIP pass, ready to get you through the door the second the velvet rope drops. It’s a stone-cold strategic play that secures your spot for a property that’s already under contract with someone else.

Decoding the Backup Offer in Real Estate

Ever find that perfect Los Angeles home only to see that gut-wrenching "under contract" status? Hold up. That initial sting doesn't have to be the end of the story. A backup offer is a fully negotiated proposal a buyer submits on a property that already has an accepted offer.

It essentially puts you in the on-deck circle, ready to step up to the plate the moment the first batter strikes out. This isn't some casual note scribbled on a napkin; it's a complete purchase agreement, signed and sealed by both you and the seller, just waiting in the wings.

Why This Strategy Is a Total Game Changer

In a dog-eat-dog market like Los Angeles, backup offers have become a secret weapon for buyers who refuse to lose. The pace is electrifying, and deals fall apart more often than you'd think. According to the National Association of REALTORS®, the typical home was recently getting snatched up in just three weeks. At the height of the market frenzy, Redfin reported that a mind-blowing 74.1% of offers faced bidding wars.

This kind of high-octane environment makes having a Plan B non-negotiable. Learn more about the power of backup offers in competitive markets and see how it can give you a serious tactical edge.

The real power move here is locking in your price and terms before the property ever has a chance to hit the market again. If that first deal craters, your contract automatically slides into first position. No new negotiations, no fresh bidding war. You're in. It’s that simple.

How It Works in Simple Terms

Imagine you're at a sold-out concert and the headliner might bail. A backup offer is like having a pre-purchased ticket for the incredible opening act—you're guaranteed a show no matter what. In real estate, this means you’re not left scrambling if the first buyer’s financing implodes or a home inspection uncovers a deal-killing monster in the basement.

A backup offer gives you a formal, contractual claim on the property. It transforms you from a hopeful spectator on the sidelines into the official next in line. It’s a proactive, boss-level strategy for buyers who refuse to let a little competition stand between them and their dream home.

How the Backup Offer Process Unfolds

So, how does this all play out in the real world? Making a backup offer isn't about casually raising your hand and hoping for the best. It’s a formal, strategic process that unfolds with the same gravity as a primary offer—you’re just second in line.

The journey starts with you and your real estate agent. You’ll work together to draft a compelling purchase agreement, laying out everything from your offer price to your proposed timelines. This isn't some watered-down, informal proposal; it’s the real deal, crafted to be just as appealing—if not more so—than the one the seller already has in hand.

Crafting a Winning Backup Offer

Your offer will include all the standard components of a real estate contract. You'll need to lock in terms like the purchase price, contingency periods for inspections and financing, and the size of your earnest money deposit. This is where you can really make your offer pop.

For example, coming in with a slightly higher price, a larger earnest money deposit, or tighter contingency periods can make your backup offer incredibly attractive to a seller who might be feeling a little jittery about their current deal. It sends a clear signal that you are a serious, qualified buyer ready to move without any drama. If you're wondering about the numbers, our guide on how much to offer on a house has some killer insights into putting together a competitive bid.

The All-Important Addendum

In California, a critical piece of paperwork makes it all official: the Backup Offer Addendum (C.A.R. Form BUO). This is the legal document that gets attached to your main purchase agreement, and it clarifies several key points:

- Your Position: It officially designates your offer as the backup, acknowledging that a primary contract is already in place.

- The Trigger: It specifies that your contract only moves into first position if the seller gives you written notice that the primary deal has been terminated.

- Locked-In Terms: It confirms that once your backup offer is accepted, the terms are set in stone. No last-minute renegotiations if you get the call.

Once the seller signs your offer with the backup addendum attached, you have a legally binding agreement. The waiting game begins, but you’ve successfully secured your spot as the next in line for the property.

This procedural clarity is what makes the whole system work. The seller gets the peace of mind of having a solid Plan B, and you get a pre-approved path to owning the home if the first deal falls apart. It’s a slick process that prevents the chaos of the seller having to re-list and start from scratch, which is a win for everyone involved.

The Seller’s Perspective on Backup Offers

From a seller's point of view, a backup offer isn't just a Plan B. It's a strategic weapon. Think of it as an insurance policy that gives you leverage, security, and a whole lot of peace of mind in the chaotic world of real estate.

Once a deal is in motion, anything can happen. Having a fully vetted, legally binding offer waiting in the wings completely changes a seller's position from one of just hoping for the best to one of real strength. It's a total game-changer that can reshape the entire closing process.

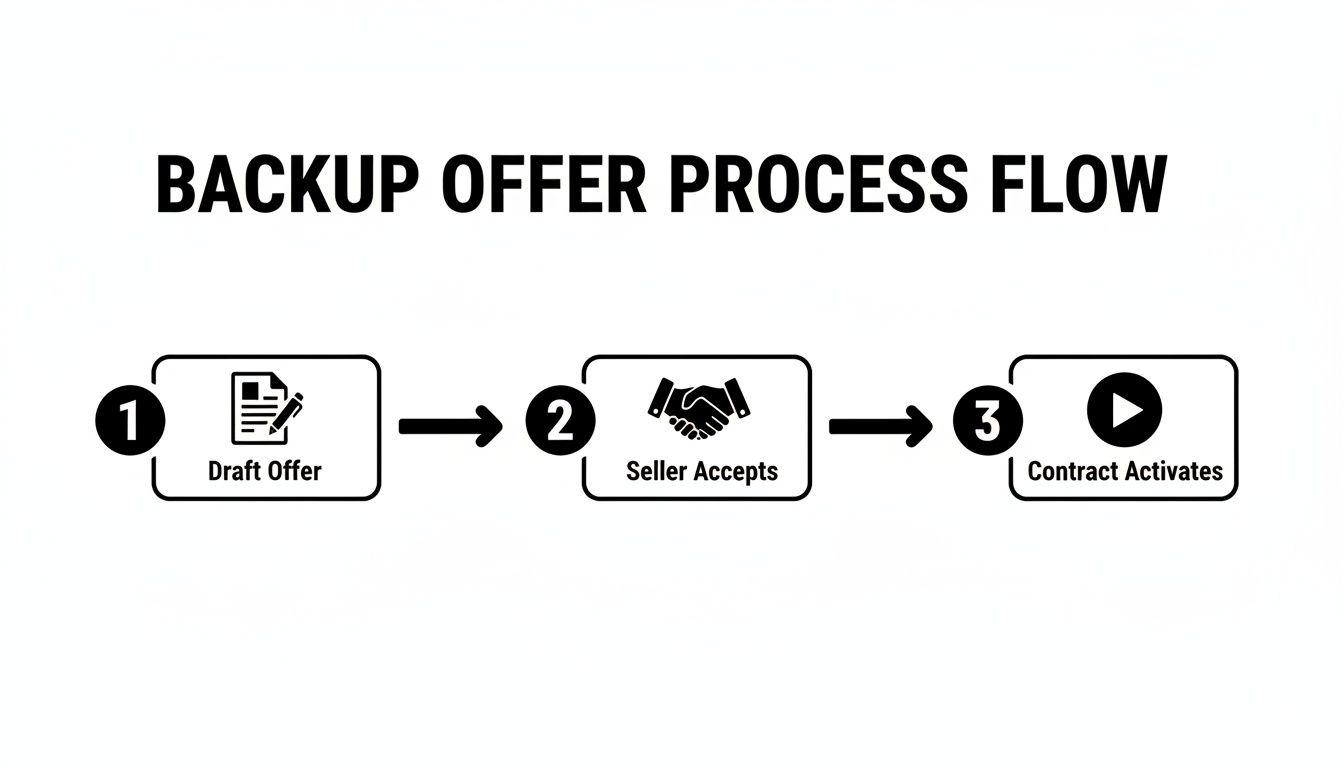

This chart lays out the simple but powerful journey of a backup offer from where the seller sits.

From drafting and accepting it to the moment the contract kicks in, the process creates a smooth handoff if the first deal goes south.

Major Advantages for Homeowners

The most obvious win here is the safety net. Real estate deals fall apart for a million reasons—a buyer’s financing gets denied at the last minute, the home inspection turns into a battle royale, you name it. If that primary contract dies, a backup offer saves you from the headache of re-listing, re-marketing, and showing the property all over again.

This also gives you serious leverage with your primary buyer. Let's say the first buyer comes back with a laundry list of repair requests after their inspection. A seller holding a strong backup offer is in a much better position to just say "no." You know another qualified buyer is ready to go, which dials down the pressure to give away the farm in concessions.

Having a backup offer in hand means you're negotiating from a position of strength, not desperation. It keeps the initial buyer honest and motivated to close the deal smoothly and on time.

Sellers who need a quick house sale will find a backup offer particularly valuable. It slashes the risk of the property going back on the market and adding weeks or months to their timeline.

Seller's Decision Matrix Accepting a Backup Offer

While backup offers are usually a smart play, they aren't without trade-offs. It's crucial to weigh the security they provide against the commitments they require. This table breaks down the core pros and cons from the seller's chair.

| Potential Advantage | Potential Disadvantage |

|---|---|

| Provides a safety net if the primary deal fails. | Legally bound to the backup buyer if the first contract terminates. |

| Strengthens negotiating power on repairs and credits. | Locked in; can't accept a higher offer that comes in later. |

| Reduces downtime and avoids re-listing the property. | Might miss out on a future, more attractive offer (opportunity cost). |

| Keeps the primary buyer motivated to close without issues. | Can sometimes add a layer of complexity to the transaction management. |

| Gives the seller peace of mind throughout the escrow process. | The backup buyer could potentially walk away if a better property appears. |

Ultimately, the decision comes down to your risk tolerance and market conditions. For most sellers, though, the strategic benefits far outweigh the potential downsides.

Potential Considerations for Sellers

While the upsides are huge, there are a few things to keep in mind. When you accept a backup offer, you are contractually obligated to that second buyer if the first deal collapses. This can feel a bit restrictive, as it might stop you from accepting an even better offer that could show up a week later.

Here’s a quick rundown of what sellers need to weigh:

- Security: A backup offer gets rid of the stress and uncertainty of a deal falling through.

- Leverage: It puts you in the driver's seat during negotiations over repairs and credits with Buyer #1.

- Commitment: You are legally on the hook with the backup buyer the second the first contract is canceled.

- Opportunity Cost: You could miss out on a surprise superstar offer while you're tied to the backup.

For most sellers we work with, the security and strategic edge of having a backup offer easily outweigh the risks. It’s just a savvy move in almost any market.

When to Make a Backup Offer as a Buyer

For a buyer, thinking about a backup offer isn't a desperate Hail Mary. It's a calculated chess move. Knowing when to play this card is what separates a smart buyer from a disappointed one, turning potential heartbreak into a strategic win.

The most common trigger is gut-wrenching: you found the one just a few hours too late, right after it went under contract. If a house checks every single box and just feels right, don't just sigh and walk away. A strong backup offer is your way of staying in the game, ready to pounce if the first deal stumbles.

Spotting a Shaky Front-Runner Deal

Sometimes, you can just feel it—the primary contract is built on a house of cards. This is where a sharp real estate agent earns their keep, using their network and street smarts to read the tea leaves.

Is the first offer weighed down with complicated contingencies? An offer contingent on the sale of the buyer's own home is a classic weak link. These home sale contingencies are notoriously fragile; if their sale collapses, so does their purchase. This is the perfect moment for a backup buyer with a cleaner, simpler offer to slide right in.

Another huge red flag is shaky financing. If you hear the first buyer is using a tricky loan program or is stretching their budget to the absolute breaking point, their odds of denial just went up. Suddenly, your solid pre-approval for a conventional loan looks like a sure thing to a nervous seller.

A backup offer sends a clear message to the seller: "I see the weak spots in your current deal, and I'm right here with a straightforward, reliable solution the second you need it." It instantly frames you as the dependable plan B.

The Upside of Locking In Your Terms

One of the biggest tactical advantages of a backup offer is that it freezes the game in your favor. You negotiate your price and terms right now, and if the seller accepts your backup position, they're set in stone.

Should the property pop back on the market, you don't get thrown into another chaotic bidding war. You just step into first place. In a pressure-cooker market like Los Angeles, avoiding that chaos is a massive win. Our guide on how to win a bidding war for a house dives deep into just how brutal those can get.

The tradeoff? You have to be prepared for the main downside: your earnest money gets tied up. While you can almost always withdraw your backup offer if you find another house you love, that deposit sits in escrow. You can't use it to make offers on other properties while you wait. It's a calculated risk—you're sacrificing a little bit of liquidity for a shot at your dream home.

Why Front-Runner Real Estate Deals Fail

It happens way more often than you’d think: a deal that looks like a sure thing completely unravels, leaving the door wide open for a savvy backup buyer. Understanding why these front-runner contracts collapse is the key to seeing a backup offer not as a long shot, but as a calculated, strategic move.

So many deals that look solid on the surface are actually built on shaky ground. In a high-stakes market like Los Angeles, the road from an accepted offer to a closed sale is littered with potential landmines. These aren't freak accidents; they're the everyday realities of real estate.

Common Deal-Breakers

A few classic scenarios can torpedo a primary contract time and time again. A buyer’s financing might crumble at the last minute. Or a low appraisal creates a gap between the loan amount and the sale price that neither side is willing to bridge.

The home inspection is another major hurdle. A report that uncovers a cracked foundation, a decrepit electrical system, or a leaky roof can stop negotiations dead in their tracks. If the buyer and seller can’t agree on who pays for the big-ticket repairs, the deal often dies right there.

Even a buyer who needs to sell their current home first introduces a massive dose of uncertainty. We dive deep into that topic in our guide on what a home sale contingency is.

A primary buyer getting "cold feet" is more than just a saying—it's a very real risk. Life happens. Job relocations fall through, family situations change, or simple buyer's remorse sets in, causing a contract to terminate and creating an instant opportunity for the backup offer.

The Numbers Behind Fallen Deals

Real estate deals fall through more than most buyers realize. In fact, data shows that deal cancellations have been on the rise for a while now, with everything from job insecurity and interest rate hikes to unexpected title issues derailing transactions. And, of course, there are those dreaded home inspection surprises.

For our clients, having a backup offer in place is just acknowledging this reality—a significant chunk of contracts never make it to the closing table. Discover more insights from NAR's research on deal cancellations.

Knowing these failure points isn't about being pessimistic; it's about being pragmatic. Every potential weak spot in the primary contract strengthens the case for your backup offer, turning your position from "just hoping" to "strategically positioned."

Common Questions About Backup Offers

Alright, we’ve covered the basics. But let's get into the real-world "what ifs" that pop up in the trenches of a fast-moving market like Los Angeles. These are the questions we get all the time from buyers and sellers trying to navigate the backup offer game.

Think of this as your rapid-fire Q&A, designed to give you straight, no-fluff answers.

Can I Withdraw a Backup Offer If I Find Another Home?

Yes. One hundred percent. A backup offer is not a pair of handcuffs. Think of it as a placeholder, not a prison.

While it’s a legally binding contract, it's built with flexibility for the backup buyer. The magic is in your contingency periods. With a standard California backup addendum, the clock on your inspections, loan, and appraisal doesn't even start until you get the call that you're in first position.

This creates a crucial window of opportunity. While you're on deck, you should absolutely keep looking. If you find another house you love, you can typically withdraw your backup offer in writing and get your earnest money deposit back. Just have your agent double-check the exact withdrawal language in your agreement. No harm, no foul.

Can a Seller Accept More Than One Backup Offer?

You bet. In a hot market, stacking up backup offers is one of the smartest moves a seller can make. It’s like having multiple safety nets below a high-wire act.

But it has to be done with military precision. The seller must establish a crystal-clear pecking order.

- Backup Offer #1: This is the next in line, the first to be called up if the primary deal falls apart.

- Backup Offer #2: This buyer only gets a shot if both the primary and the first backup fail.

- And so on… A seller can technically stack as many as they feel comfortable managing.

This isn't a chaotic free-for-all. Each backup offer is formally accepted with an addendum that spells out its exact position in the queue (e.g., "second backup position"). This prevents any confusion and ensures everyone knows where they stand. If you're a buyer, knowing your number is everything.

Does a Backup Buyer Know the Primary Offer's Price?

Almost never. The price and terms of the primary offer are confidential. As a backup buyer, you’re flying blind—and honestly, that's how it should be.

Your offer shouldn't be a reaction to someone else's number. It needs to be grounded in three things:

- What the home is actually worth to you.

- What your budget can realistically support.

- What your agent is telling you based on hard market data and comps.

The goal isn't to guess and beat the primary offer by a few bucks. The goal is to write an offer so clean and compelling on its own that the seller sees you as a slam-dunk alternative. A great agent helps you build that kind of proposal without ever needing to see the other player's hand.

How Does a Kick-Out Clause Relate to Backup Offers?

A "kick-out" clause and backup offers are two sides of the same coin—a seller’s ultimate power play. It’s most common when a seller accepts an offer with a home sale contingency, which is a major variable. That buyer has to sell their own house before they can close, which can drag things out.

The kick-out clause gives the seller the right to keep the property on the market and fish for better offers—specifically, backup offers without that same contingency. If a stronger, non-contingent backup offer comes in, the seller can pull the trigger.

This puts the first buyer on the clock. They usually get a tight deadline, like 48-72 hours, to either remove their home sale contingency and commit fully or get "kicked out." If they can't, their contract is terminated, and the seller pivots to the shiny new backup offer. It's the perfect strategy for a seller who wants to lock something down without closing off their options.

Navigating the complexities of backup offers requires skill, strategy, and deep local knowledge. At ACME Real Estate, our team specializes in crafting winning strategies for buyers and sellers across Los Angeles. Whether you're looking to secure your dream home with a smart backup offer or leverage them as a seller, we're here to guide you every step of the way. Start your LA real estate journey with us today.