You’ve found the house, you beat out the other offers, and you’re already picturing where the sofa will go. But before you get the keys, there’s one last financial gauntlet: the closing cost on a house. Set aside 2% to 5% of the home’s final price for these expenses. This isn’t optional—it’s the final tollbooth on the road to homeownership.

What Are Closing Costs, Really?

Think of the purchase price as the ticket to the main event. Closing costs are all the backstage passes, crew salaries, and setup fees required to make the show happen. They’re a medley of charges from everyone working behind the scenes to get the property legally and financially out of the seller’s name and into yours.

Each fee pays a specific pro for a specific job, from the lender who processes your loan to the title company that ensures the property has a clean history. Without them, the deal crashes and burns. It’s that simple.

The Key Players You’re Paying

So, who gets a piece of this pie? It’s not one big check, but a whole menu of charges for the services that make a real estate transaction legitimate and secure.

Here’s who is on the payroll:

- Your Lender: They charge for the administrative lift of creating, underwriting, and funding your mortgage. You’re borrowing a massive amount of cash, and this is their fee for managing that risk and paperwork.

- Title and Escrow Companies: These are the neutral third parties who act like the referees of the transaction. They handle the legal transfer, verify ownership history, and make sure all the money goes to the right people at the right time.

- Third-Party Appraisers and Inspectors: The appraiser confirms the home’s value for the bank (so they don’t lend you more than it’s worth), and the inspector gives you a professional deep-dive into the home’s physical condition.

- Government Agencies: Yep, Uncle Sam gets his cut. These are the recording fees and transfer taxes that make the sale an official public record.

The good news is, closing costs are never a last-minute surprise. By law, your lender has to give you a Loan Estimate early on and a final Closing Disclosure three days before you sign. This gives you time to review every single line item, so you know exactly where your money is going.

To get a clearer picture, let’s break down the main categories of fees you’ll encounter. Think of them as buckets that different costs fall into.

Your Closing Cost Categories at a Glance

| Fee Category | What It Covers | Typically Paid By |

|---|---|---|

| Lender & Loan Fees | Services like loan origination, underwriting, and appraisal. | Buyer |

| Title & Escrow Fees | Title search, title insurance, and escrow services. | Buyer/Seller (negotiable) |

| Prepaid Expenses | Homeowners insurance, property taxes, and mortgage interest. | Buyer |

| Transfer Taxes & Recording Fees | Government fees to record the sale and transfer ownership. | Buyer/Seller (varies by location) |

Each of these categories contains multiple line-item charges, but understanding the big picture helps demystify that final settlement statement.

Why You Can’t Afford to Ignore Closing Costs

Forgetting to budget for closing costs is the number one rookie mistake buyers make, and it causes a world of stress right before the finish line. If you’re buying a $700,000 home in Los Angeles, you could be on the hook for anywhere from $14,000 to $35,000—on top of your down payment.

Knowing this number from day one puts you in the driver’s seat. It lets you budget correctly, compare loan offers intelligently, and even negotiate some of the fees. Services are also emerging to help manage this final, often confusing, part of the process; for instance, you can explore the ‘Closing Concierge’ product to see how they aim to simplify these final hurdles. Preparation turns panic into power.

A Detailed Breakdown of Buyer Closing Costs

Alright, let’s pop the hood on your closing statement. Seeing that long list of fees for the first time can feel like reading a foreign language, but it’s pretty straightforward once you know what you’re looking at.

Think of it as the itemized receipt for your home purchase. Everything gets broken down into three main buckets: lender fees, third-party fees, and prepaids.

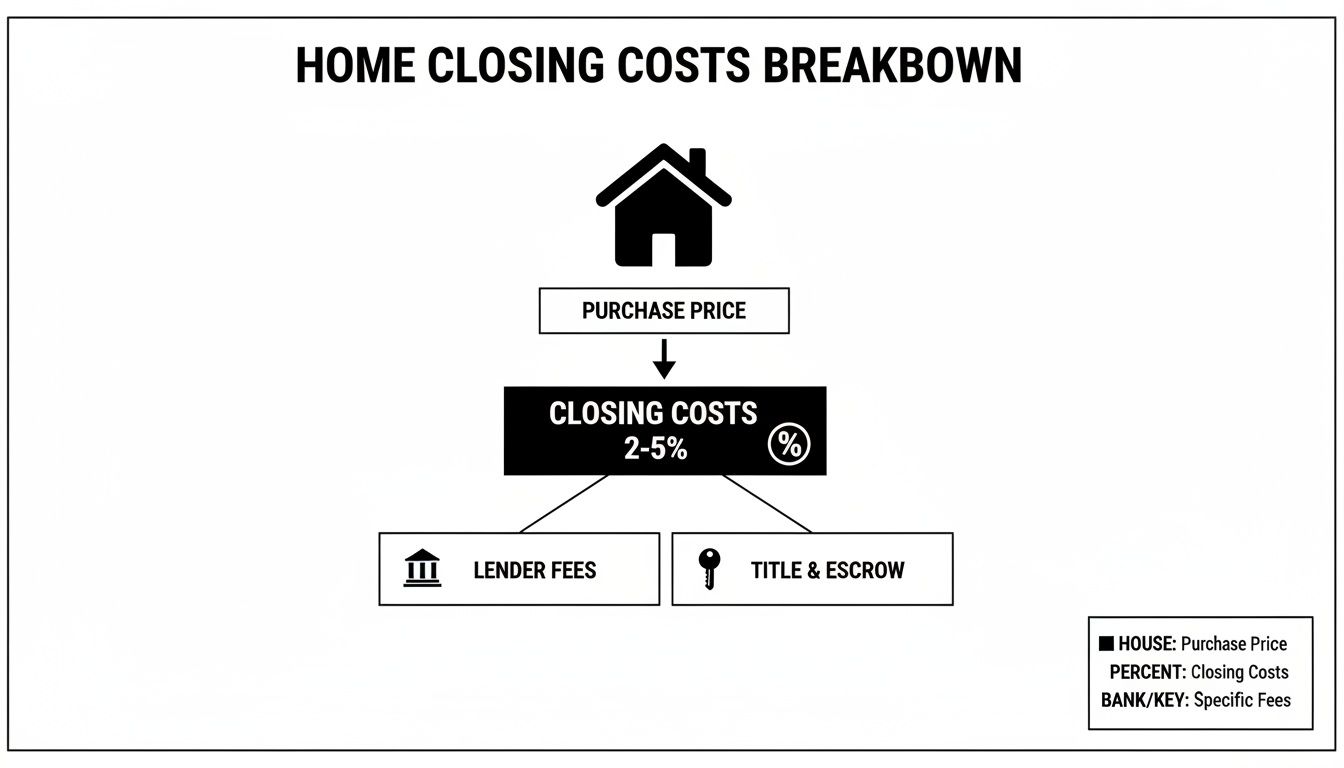

This diagram gives you a quick visual of how closing costs fit into the whole picture, separating the big chunks like lender and title fees.

As you can see, these costs are a totally separate chunk from the home’s purchase price, managed by your lender and the title company.

The Bank Gets Its Cut: Lender Fees

Your lender isn’t just handing over a giant pile of cash for free. They charge for the service of creating, approving, and managing your loan. These are the most common charges you’ll see coming directly from them.

- Origination Fee: This is the lender’s main profit center for putting your loan together. It’s usually around 0.5% to 1% of the total loan amount. We’ve got a full guide that dives deeper into what is a mortgage origination fee if you want to become an expert.

- Underwriting Fee: Think of this as paying the financial detectives who verify your income, assets, and credit. They’re the ones who give your loan the final green light.

- Processing Fee: This covers the administrative grunt work—gathering your documents and prepping your loan file for the underwriter.

- Discount Points: These are optional. You can pay points upfront to “buy down” your interest rate, which lowers your monthly payment. One point typically costs 1% of the loan and might knock about 0.25% off your rate.

While you can’t avoid these fees entirely, their costs can vary wildly between banks. This is exactly why you have to shop around and compare Loan Estimates from at least three different lenders.

Paying the Rest of the Team: Third-Party Fees

Next up are the fees for all the other pros who play a crucial role in getting the deal done. Your lender coordinates these, but the money goes to independent service providers.

- Appraisal Fee: Before finalizing your loan, the bank needs to confirm the house is worth what you’re paying. They hire an independent appraiser to assess the property’s value, and you cover their fee.

- Credit Report Fee: A small charge for the lender to pull your credit history from the major bureaus.

- Title Search & Title Insurance: This one’s a big deal. A title company digs through public records to make sure there are no hidden liens, ownership disputes, or other claims against the property. You then buy a lender’s title insurance policy (to protect the bank) and an owner’s policy (to protect yourself). It’s your financial shield against the past.

- Home Inspection Fee: Technically not a closing cost since you usually pay it when the service is done, but it’s a critical upfront expense. A professional inspector examines the home’s condition, from the roof to the foundation, flagging potential problems.

- Escrow or Attorney Fees: A neutral third party (an escrow company or an attorney, depending on the state) handles all the funds and paperwork. This fee pays them to manage the closing process smoothly.

These third-party costs can add up fast. They often catch first-time buyers off guard, especially in high-value markets like Los Angeles where an ACME Real Estate professional can guide clients through every line item. According to ClosingCorp’s data, the average closing costs for a single-family home nationwide range from $6,800 to $18,000, but this number swings wildly by state and home price. In California, where the median home price hovers around $793,424, buyers face about $7,953 in closing costs—roughly 1.0% of the sale price.

Paying in Advance: Prepaid Items

Finally, you have prepaids. These aren’t fees for services already rendered; they’re payments you make at closing for expenses you’ll owe down the road. The lender collects them upfront to make sure the bills get paid on time.

Think of prepaids as stocking the pantry of your new home’s finances. You’re loading up your escrow account so the bills for property taxes and homeowners insurance can be paid on time, without any drama.

The most common prepaids include:

- Homeowner’s Insurance: You’ll typically pay for your first full year’s premium at closing.

- Property Taxes: You’ll prepay several months of property taxes into an escrow account. How much depends on when taxes are due in your area and your exact closing date.

- Mortgage Interest: You’ll prepay the interest that accrues between your closing date and the end of the month. Pro tip: closing at the very end of the month is a classic trick to reduce this specific cost.

Understanding Seller Closing Costs to Maximize Your Profit

When you’re selling your home, closing costs aren’t just a list of random fees—they’re a direct hit to your final profit. Buyers have their own mountain of small charges to climb, but sellers usually get hit with a few heavy hitters that really shape the final number. Nail down what these costs are, and you’ll know exactly what you’re walking away with when the deal is done.

Think of your home’s sale price as your gross revenue. Closing costs are the cost of doing business. What’s left over is your net profit, and that’s the number that really matters for your next big move.

The Elephant in the Room: Agent Commissions

For almost every seller, the biggest line item by far is the real estate agent commission. This fee isn’t just for showing up on closing day; it covers the immense amount of work done by both your agent and the buyer’s agent. We’re talking about marketing your property, vetting potential buyers, navigating tough negotiations, and wrestling with the mountain of paperwork needed to get a deal to the finish line.

Typically, the commission runs between 5% to 6% of the final sale price, and it gets split between the two agents. On a $900,000 home in Los Angeles, that’s a serious chunk of your equity. You can run the numbers yourself with a good real estate commission calculator to see how it impacts your bottom line.

Unpacking Other Common Seller Expenses

Beyond commissions, you’ve got a handful of other costs to plan for. They might seem smaller, but they add up and are absolutely necessary for a clean, legal transfer of ownership.

Here’s what else you’ll almost certainly see on your side of the settlement statement:

- Transfer Taxes: This is the government’s fee for the privilege of transferring the property title. Here in Los Angeles, sellers get hit with both a county and a city transfer tax, which can be a pretty hefty sum.

- Owner’s Title Insurance Policy: As the seller, you’re usually on the hook for the owner’s title insurance. This policy is a crucial protection for the new buyer, shielding them from any old ownership claims or liens that might pop up after the sale.

- Escrow Fees: This pays the neutral, third-party escrow company that holds all the funds and paperwork, making sure every dollar and signature is handled correctly.

- Prorated Property Taxes & HOA Dues: You’re responsible for property taxes and any HOA dues right up to the day of closing. The escrow company will do the math, calculate your share, and pull it directly from your proceeds.

Sometimes, sellers sweeten the deal by offering to cover some of the buyer’s costs. If you’re thinking about that strategy, our guide on what is a seller concession breaks down exactly how they work and when to pull that lever.

The Bottom Line on Seller Costs

Sellers definitely have their own financial hurdles at closing. One recent study found the national average to be around $8,000. While California sellers often pay a lower percentage than those in states like New York, our high property values from Pasadena to the Hollywood Hills mean the total dollar amount can still be substantial.

Your net sheet is your North Star. This document, which your ACME Real Estate agent can prepare for you, estimates your total closing costs and calculates your net proceeds based on a proposed sale price. Reviewing it early and often is the best way to avoid surprises and make informed financial decisions.

Seeing It in Action: Los Angeles Closing Cost Scenarios

Theory is one thing, but seeing real numbers makes everything click. Let’s stop talking about percentages and line items and put this stuff into practice. I’m going to walk you through two different scenarios pulled straight from the Los Angeles market so you can see how the closing cost on a house actually shakes out.

These examples break down the estimated costs for both the buyer and the seller, giving you a complete 360-degree view of the transaction. You’ll see exactly how local transfer taxes and other LA-specific fees hit the bottom line.

Scenario 1: The Urban Condo in DTLA

First up, imagine a sleek, modern condo in Downtown Los Angeles with a purchase price of $750,000. The buyer is putting 20% down ($150,000), which means they’re taking out a $600,000 loan.

In this scenario, the seller is cashing out to move on to their next chapter.

Buyer’s Estimated Costs (Approx. $16,775):

- Lender Origination Fee (1%): $6,000

- Appraisal Fee: $650

- Lender’s Title Insurance Policy: $1,300

- Escrow Fee (50%): $1,625

- Prepaid Property Taxes (6 months): $4,688

- Prepaid Homeowner’s Insurance (1 year): $1,200

- Recording & Miscellaneous Fees: $1,312

Seller’s Estimated Costs (Approx. $54,125):

- Agent Commissions (5.5%): $41,250

- Owner’s Title Insurance Policy: $2,400

- Escrow Fee (50%): $1,625

- LA City Transfer Tax: $3,375

- LA County Transfer Tax: $825

- Miscellaneous Fees (HOA docs, etc.): $1,650

- Prorated Property Taxes/HOA Dues: $3,000

Take a look at the difference. The seller’s single biggest hit is the agent commission, by a long shot. The buyer’s costs, on the other hand, are a mix of loan fees and prepaids. And notice how the seller gets stuck with the full bill for LA’s notorious double-whammy transfer tax.

Scenario 2: The Suburban Home in Pasadena

Now, let’s head to a tree-lined street in Pasadena. We’re looking at a charming single-family home selling for $1,200,000. The buyers are also making a 20% down payment ($240,000), leaving them with a loan of $960,000. The sellers have lived there for years and are downsizing.

Buyer’s Estimated Costs (Approx. $25,560):

- Lender Origination Fee (1%): $9,600

- Appraisal Fee: $800

- Lender’s Title Insurance Policy: $1,800

- Escrow Fee (50%): $2,300

- Prepaid Property Taxes (6 months): $7,500

- Prepaid Homeowner’s Insurance (1 year): $2,500

- Recording & Miscellaneous Fees: $1,060

Seller’s Estimated Costs (Approx. $76,120):

- Agent Commissions (5.5%): $66,000

- Owner’s Title Insurance Policy: $3,500

- Escrow Fee (50%): $2,300

- LA County Transfer Tax: $1,320

- Miscellaneous Fees: $1,000

- Prorated Property Taxes: $2,000

The big story here is what’s missing: the hefty LA City transfer tax. Because Pasadena is its own city, sellers there only pay the county tax. That small detail saves them thousands of dollars compared to their DTLA counterparts.

To make this even clearer, here’s a side-by-side comparison of the numbers we just walked through.

Sample Closing Cost Breakdown: Los Angeles Scenarios

| Fee Item | Urban Condo (Buyer) | Urban Condo (Seller) | Suburban Home (Buyer) | Suburban Home (Seller) |

|---|---|---|---|---|

| Purchase Price | $750,000 | $750,000 | $1,200,000 | $1,200,000 |

| Lender Origination Fee (1%) | $6,000 | – | $9,600 | – |

| Appraisal Fee | $650 | – | $800 | – |

| Agent Commissions (5.5%) | – | $41,250 | – | $66,000 |

| Lender’s Title Insurance | $1,300 | – | $1,800 | – |

| Owner’s Title Insurance | – | $2,400 | – | $3,500 |

| Escrow Fee (50% Split) | $1,625 | $1,625 | $2,300 | $2,300 |

| Transfer Taxes | – | $4,200 | – | $1,320 |

| Prepaid Taxes & Insurance | $5,888 | – | $10,000 | – |

| Prorated Dues & Taxes | – | $3,000 | – | $2,000 |

| Recording & Miscellaneous | $1,312 | $1,650 | $1,060 | $1,000 |

| Total Estimated Closing Costs | $16,775 | $54,125 | $25,560 | $76,120 |

Laying it out like this shows you how dramatically the numbers can shift based on price and, most importantly, location.

These are solid estimates, but they reveal a critical truth: your final costs are deeply tied to your specific location and the price of the home. This is why a generic online calculator will always let you down. Only a local expert can run a detailed net sheet and give you a precise financial picture.

Recent data backs this up. One analysis of over 450,000 sales found the national average for total closing costs was $4,661, or just 1.06% of the home’s price. But with fees for things like appraisals and credit checks on the rise, the median loan costs for buyers have jumped nearly 22% in recent years. To see how these numbers stack up across the country, you can explore more 2025 closing cost data and reports. It just reinforces why having hyper-local, up-to-the-minute estimates isn’t just nice—it’s absolutely essential.

Smart Strategies for Reducing Your Closing Costs

So, you get the breakdown now. You’ve seen the numbers in action. The real question is how to keep your hard-earned cash from flying out the door on closing day.

While some fees are locked in by the government, a surprising number of them are absolutely up for grabs. This isn’t about being cheap; it’s about being a smart consumer. Knowing where to push and what to ask for can shave thousands off your final bill.

For Buyers: Your Action Plan to Save Money

As a buyer, you have more leverage than you think. A few strategic moves can make a huge difference in the cash you need to bring to the table.

Here’s where to focus:

- Shop Your Loan: Never, ever take the first loan offer you get. Get a Loan Estimate from at least three different lenders and compare them line by line. Pay close attention to origination fees, underwriting costs, and other lender-specific charges—they can vary by hundreds, if not thousands, of dollars.

- Negotiate with the Seller: This is your secret weapon. Asking for seller concessions is a formal request for the seller to pay a percentage or a flat dollar amount of your closing costs. In a balanced market, sellers are often willing to do this to lock in a solid, ready-to-go buyer.

- Explore Assistance Programs: Don’t overlook this. California has a number of down payment and closing cost assistance programs, especially for first-time homebuyers. These can come in the form of grants or low-interest loans that drastically reduce your upfront expenses.

A seller concession can be a total game-changer. Let’s say you’re buying an $800,000 home. Asking for a 2% concession could get you $16,000 to put toward your closing fees. This one move can turn a massive expense into something far more manageable, but it all comes down to careful negotiation.

A skilled agent from ACME Real Estate lives and breathes the local market. They’ll know exactly when a seller is likely to accept a concession and how to frame the offer so it’s a win for everyone.

For Sellers: Protecting Your Bottom Line

Sellers, your goal is simple: maximize what you walk away with. While you have fewer individual fees to pick apart, your overall strategy is just as critical.

A well-priced and expertly marketed home puts all the leverage in your hands. When you start fielding multiple offers, you’re in the driver’s seat. You get to choose the strongest offer—not just the highest price, but the one with the fewest strings attached and the most qualified buyer. This strength puts you in a position to reject requests for concessions or repair credits, protecting your profit. This is exactly where an ACME Real Estate agent’s pricing strategy and marketing muscle becomes your greatest asset.

The Art of the Deal: Negotiation Is Everything

Whether you’re buying or selling, almost every part of this process can be negotiated. From the agent’s commission to who pays for the title insurance policy, it all comes down to what’s agreed upon in the purchase contract.

This is where a seasoned pro is worth their weight in gold. They understand the nuances of the contract and can guide you through the give-and-take. For a deeper dive into the specific tactics we use, check out our guide on how to negotiate closing costs.

Ultimately, successfully reducing the closing cost on a house comes down to preparation, knowledge, and expert guidance. Don’t leave thousands of dollars on the table simply because you didn’t know you could ask for it.

Got Questions? We’ve Got Answers.

We’ve crunched the numbers and walked through the strategies. But real estate deals are never one-size-fits-all, and you probably still have a few questions rattling around about the closing cost on a house.

Think of this as the rapid-fire round. We’re tackling the most common questions we hear from clients at ACME Real Estate to clear up any lingering confusion. We want you walking into that closing appointment feeling like you own the room—because you’re about to.

Can I Roll Closing Costs into My Home Loan?

This is the big one, especially for buyers trying to keep their cash-to-close as low as possible. The short answer is yes, you can, but it’s not as simple as tacking them onto your loan balance. It’s more of a strategic play.

Here are a couple of smart ways to make it happen:

- Negotiate for Seller Concessions: This is your most direct route. You ask the seller to cover a specific amount of your closing costs, which then gets deducted from their proceeds at the closing table. It’s less cash out of your pocket, plain and simple.

- Take a Lender Credit: Some lenders will offer to pay for some or all of your closing costs, but there’s a trade-off. In exchange, you accept a slightly higher interest rate. You save a chunk of cash today but pay more over the life of the loan.

You have to run the numbers. This is where your ACME agent and your lender become your brain trust, helping you figure out which move saves you the most money in the long run.

When Will I Know My Exact Closing Costs?

You won’t be flying blind into the most important financial transaction of your life. Federal law has your back here, specifically to prevent that last-minute sticker shock.

The law requires your lender to give you the Closing Disclosure (CD) at least three business days before you’re scheduled to close. This five-page document is the final, itemized breakdown of every single dollar in the deal.

That three-day window is your power play. Use it to go over every line item with a fine-tooth comb. Compare it to the Loan Estimate you got at the beginning and call out anything that seems off. At ACME, we review the CD with every single client—it’s just standard practice to make sure everything is 100% accurate before you sign.

Are Property Taxes Part of Closing Costs?

Absolutely. They actually pop up in two different ways, and getting a handle on them is critical for budgeting.

First, you’ll almost certainly set up an escrow account (sometimes called an impound account). At closing, you’ll prepay a few months’ worth of property taxes into this account. From then on, your lender manages it and pays your tax bills for you when they’re due.

Second, you’ll deal with prorated taxes. The escrow officer does the math, figuring out exactly how many days the seller owned the home in the current tax period and how many days you will. You’ll end up reimbursing the seller for any taxes they’ve already paid for the time you’ll be living there.

Why Are Los Angeles Closing Costs Often Higher?

If you’ve been looking at homes in LA, you’ve probably noticed the closing costs feel a bit heavier. It’s not your imagination. Two main things are going on here.

First, the biggest fees—like title insurance and transfer taxes—are calculated as a percentage of the purchase price. Since LA homes cost more than in most other places, the dollar amount of those fees gets inflated. An 0.5% fee on a $900,000 house in Silver Lake is a lot more cash than the same fee on a $300,000 house somewhere else.

Second, the City of Los Angeles hits sellers with its own “documentary transfer tax” on top of the county’s tax. It’s another layer of cost that makes having a local expert from ACME in your corner absolutely essential. We know these nuances inside and out.

Getting through the final steps of buying a home doesn’t have to be a black box. With the right team fighting for you, you can close your deal with total confidence. The experts at ACME Real Estate are here to guide you through every line item and every negotiation, making sure your LA real estate journey ends in a win.

Ready to make your move? Visit us at https://www.acme-re.com to connect with an agent today.