So, you’re diving into the wild world of home loans and you’ve hit a big, chunky line item called the mortgage origination fee. What the heck is it? Think of it as the lender’s cover charge for getting you into the homeownership club. It’s what they bill for all the gritty, behind-the-scenes work required to process your application, underwrite the loan, and wire a mountain of cash for your new keys.

It’s not some bogus junk fee—it’s a bundled payment for the services that turn your “For Sale” sign dreams into a financial reality.

Cracking the Code on Your Origination Fee

When “origination fee” pops up on your Loan Estimate, it can feel like you’re trying to decipher ancient hieroglyphics. But here’s the unvarnished truth: it’s the lender’s paycheck for the administrative heavy lifting it takes to get your loan from application to the closing table. It’s often one of the biggest closing costs you’ll face.

This single charge covers a whole spectrum of essential services that ensure your loan is properly vetted, approved, and funded. It’s how the lender pays for their team’s time, expertise, and the operational machinery of their business.

The “Why” Behind the Fee

Lenders aren’t just charities handing out money; they’re running a high-stakes, complex operation. The origination fee exists to cover the real, tangible costs of building a new mortgage from the ground up.

Let’s pull back the curtain on what that fee is actually paying for.

Mortgage Origination Fee at a Glance

| Component | What It Covers | Typical Cost Range |

|---|---|---|

| Loan Processing | Gathering & verifying all your documents (pay stubs, tax returns, bank statements). | Varies by lender |

| Underwriting | The crucial risk-assessment deep dive where an underwriter pores over your file to give the final thumbs-up. | Varies by lender |

| Document Prep | Drawing up all the legal paperwork needed to make the loan official at closing. | Varies by lender |

| Admin Costs | Paying the salaries of the loan officers, processors, and underwriters who make it all happen. | Varies by lender |

In short, this fee covers the entire journey from the moment you hit “submit” on your application to the moment you’re handed the keys.

Lenders juggle a ton of moving parts, and those costs are very real.

The cost to originate a mortgage has climbed significantly. According to Freddie Mac, the average cost for a lender to produce a single mortgage is now around $11,800. This number reflects everything from inflation and regulatory hurdles to paying the skilled professionals who make the loan happen. You can get more details from Freddie Mac’s detailed insights.

At the end of the day, understanding this fee demystifies a huge part of your closing costs. It’s not a sneaky charge—it’s a straightforward payment for the essential work needed to secure your home financing. Once you know what you’re paying for, you can walk into closing with a lot more swagger.

What the Origination Fee Actually Pays For

When you first see the “mortgage origination fee” on a loan estimate, it can feel like a big, mysterious number. Where is all that cash going? The best way to think about it isn’t as a single charge, but as the lender’s cost to run the entire machine that gets your loan from application to closing.

This isn’t just about shuffling papers. It’s a complex, multi-stage process handled by a team of specialists. Your fee pays for their expertise, their time, and the secure systems required to handle your most sensitive financial data.

The Two Engines: Processing and Underwriting

At its core, the origination process is powered by two critical functions: loan processing and underwriting. This isn’t just boring industry jargon; these are the two engines driving your mortgage application forward.

First up, you have loan processing. Think of this stage as an administrative marathon. Your loan processor is like a master project manager for your financial life, tasked with hunting down, verifying, and organizing every single document needed to build your loan file.

- Document Collection: They’re the ones chasing down everything from your last two pay stubs and W-2s to your bank statements and tax returns.

- Verification: Next, they meticulously confirm your employment history, your income, and the source of your down payment funds.

- Third-Party Coordination: They also order the property appraisal, the title search to check for liens, and any other reports needed to ensure all the puzzle pieces fit perfectly.

Once the processor has built a bulletproof, fully verified file, they pass the baton to the underwriter.

The Final Green Light

Underwriting is the high-stakes risk-assessment stage. An underwriter is the lender’s detective, meticulously combing through your entire financial picture to ensure you meet every single guideline for the specific loan program you’ve applied for. They are the ultimate decision-makers.

Their job boils down to one critical question: “Does this loan pose an acceptable level of risk to us?” They analyze your credit history, debt-to-income ratio, and the property’s appraised value to give the final yes or no. This role is fundamental to keeping the entire lending market stable.

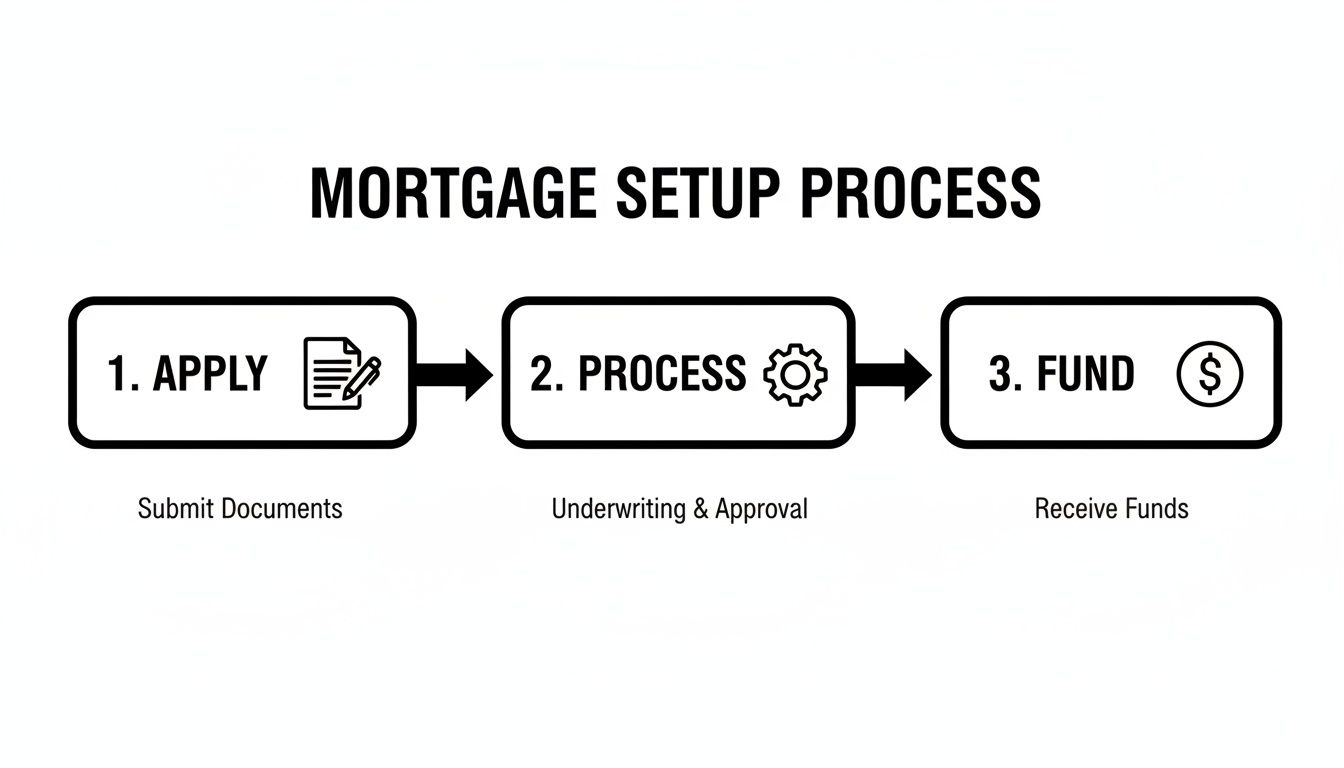

This visual gives you a simplified look at the journey from your initial application to the moment the loan is actually funded.

As you can see, processing and underwriting are the critical middle steps where the lender’s team does the real grunt work—and that’s precisely what the origination fee covers.

The origination fee allows lenders to manage this complex system while staying in business. It’s a key piece of a much larger financial puzzle and just one of several expenses you’ll see at the closing table. To get fully prepared, check out our comprehensive guide on closing costs for home buyers.

How Lenders Calculate Your Origination Fee

Let’s get straight to the numbers. The mortgage origination fee isn’t some random figure pulled out of a hat. It’s almost always a percentage of the total amount you’re borrowing.

It’s a direct relationship: the bigger the loan, the bigger the fee in raw dollars.

You’ll typically see this fee hover somewhere between 0.5% and 1% of your total loan principal. While that percentage sounds tiny, it can easily translate into thousands of dollars, making it a major line item in your closing costs.

For example, a 1% fee on a $300,000 mortgage is a cool $3,000. If you’re buying in a pricey market like Los Angeles and need a $750,000 loan, that same 1% fee balloons to $7,500. This is exactly why you need to nail down the math when budgeting your upfront homebuying costs.

What Pushes the Percentage Up or Down?

So, why isn’t the percentage the same for every borrower? It all boils down to the lender’s perception of risk and complexity. A more complicated loan application means more work for their team, and that fee reflects the extra elbow grease.

Here are a few factors that can move the needle:

- Your Credit Score: A killer credit history signals lower risk. This can sometimes earn you a lower origination fee as a reward for being financially awesome.

- Loan Type: Different loan programs come with different bureaucratic hoops. The underwriting for government-backed loans, for instance, can be more intensive. To see how these stack up, check our guide on the conventional loan vs an FHA loan.

- Financial Profile Complexity: Are you self-employed with fluctuating income? Is your financial history a bit of a tangled web? If so, the lender’s team will have to do more digging, and that extra work can mean a higher fee.

Example Origination Fee Calculations

Seeing the numbers side-by-side makes the impact hit home. The table below shows just how much the fee can swing based on the loan amount and the percentage charged.

| Total Loan Amount | Origination Fee at 0.5% | Origination Fee at 1.0% |

|---|---|---|

| $300,000 | $1,500 | $3,000 |

| $500,000 | $2,500 | $5,000 |

| $750,000 | $3,750 | $7,500 |

| $1,000,000 | $5,000 | $10,000 |

This table makes it painfully obvious why you must shop around and compare offers from multiple lenders. Even a quarter-point difference in the origination fee can save you a serious chunk of change at closing.

Origination Fees vs. Discount Points Explained

When you’re staring at a Loan Estimate, it’s dangerously easy to get mortgage origination fees and discount points confused. They both show up as upfront closing costs, but they do completely different jobs. Nailing this difference is mission-critical for making a smart financial move.

Here’s a simple way to break it down: The origination fee is like the mandatory cover charge at a club. It pays the staff—the processors, underwriters, and loan officers—for getting you in the door. You can’t get inside without paying it.

Discount points, on the other hand, are like paying extra for the VIP table once you’re inside. It’s an optional, upfront cost that scores you a better deal (a lower interest rate) for the rest of the night—or in this case, for the life of your loan. One fee is for the work being done now; the other is an investment in future savings.

The Strategy Behind Paying for Points

So, when does it actually make sense to pay for that VIP table and buy down your rate? It all comes down to one thing: time.

By paying more upfront for points, you save a little bit of cash every single month on your mortgage payment. The whole game is figuring out if you’ll stay in the home long enough for those small monthly savings to add up and completely wipe out what you paid for the points in the first place.

This calculation is called finding your break-even point.

Your break-even point is the exact moment when your total monthly savings from the lower interest rate equal the upfront cost of the discount points. Past that point, you’re officially in the money every month.

Calculating Your Break-Even Point

Let’s run the numbers with a quick example. Imagine you’re taking out a $500,000 loan, and your lender gives you two choices:

- Option A (No Points): You get a 6.5% interest rate. Your monthly principal and interest payment is $3,160.

- Option B (With Points): You pay one discount point (1% of the loan amount, or $5,000) to lower your rate to 6.25%. Your new monthly payment drops to $3,077.

The difference in your monthly payment comes out to $83 in savings.

To find the break-even point, you just divide the cost of the point by your monthly savings:

$5,000 (Cost of Point) ÷ $83 (Monthly Savings) = 60.2 months

That means it will take you just over 60 months, or exactly five years, to recoup the $5,000 you paid upfront. If you see yourself chilling in that home for more than five years, paying for the point is a brilliant move. But if you think you might sell or refinance before then, you’d be better off skipping the points and keeping that cash in your pocket.

Smart Strategies to Negotiate Your Origination Fee

Here’s a little secret that can save you thousands: the mortgage origination fee is almost always negotiable. Yes, it covers the lender’s real costs, but it’s also a key area where they compete for your business.

With the right game plan, you can absolutely chip away at this hefty closing cost. It’s not about being aggressive; it’s about showing up prepared and proving you’re the kind of low-risk, no-drama borrower they drool over.

Leverage Your Position as a Strong Borrower

Lenders are businesses, and like any good business, they roll out the red carpet for their A-list customers. If you walk in with a rock-solid application, you’re in a fantastic position to ask for a better deal on their fees.

So, what does a “strong borrower” look like in a lender’s eyes? Someone who presents almost zero risk. This usually means:

- A high credit score—think 740 or above. This proves you have a stellar track record of paying your debts on time.

- A low debt-to-income (DTI) ratio. This shows you have more than enough monthly cash flow to comfortably handle a new mortgage payment.

- A significant down payment, ideally 20% or more. This reduces their risk and saves you from the headache of private mortgage insurance.

- Stable employment and income history. This gives them confidence that you can repay the loan over the long haul.

When you have all your financial ducks in a row like this, you’re not just some person asking for a loan. You’re offering them a high-quality, low-risk investment. That alone gives you a solid foundation to start talking fee reductions.

Your Best Tool is the Loan Estimate

The most powerful weapon in your negotiating arsenal is the official Loan Estimate. This standardized, three-page document is your key to making an apples-to-apples comparison between what different lenders are really charging you.

The Loan Estimate is a form required by federal law that breaks down all the costs associated with your mortgage. Lenders must provide it to you within three business days of receiving your application.

Here’s how to play it, step-by-step:

- Apply with Multiple Lenders: Don’t just wander into your regular bank. Apply with at least three to five different lenders—think big banks, local credit unions, and independent mortgage brokers—to get competing offers on your desk.

- Compare Section A: Once you have the Loan Estimates, flip straight to “Section A: Origination Charges.” This is where the lender’s fee is spelled out in black and white.

- Create Competition: This is where the magic happens. Let’s say Lender A has a killer interest rate but a high $4,000 origination fee. Meanwhile, Lender B has a slightly higher rate but only charges a $2,000 fee. You now have leverage. Go back to Lender A and ask them, “Can you match or beat Lender B’s fee to win my business?”

This simple strategy puts you in the driver’s seat, forcing lenders to compete on both the interest rate and their fees. For a deeper dive, our guide on how to negotiate closing costs has even more tactics. A little organization and proactive communication can turn a standard process into a massive cost-saving win.

Navigating Origination Fees in Los Angeles

Everything costs more in a high-stakes real estate market like Los Angeles, and closing costs are no exception. Because the mortgage origination fee is a direct percentage of your loan amount, LA’s elevated property values mean this single line item can easily balloon into a five-figure expense.

On a median-priced home here, a 1% origination fee isn’t just a minor detail; it’s a serious financial hurdle. This makes understanding—and more importantly, negotiating—this cost absolutely critical for any savvy LA homebuyer or investor. Strong negotiation skills aren’t just a bonus in this town; they’re essential for protecting your bottom line.

Turning a Competitive Market to Your Advantage

The good news? The LA area is flooded with lenders. You’ve got the big national banks, local credit unions, and an army of specialized mortgage brokers all fighting for your business. This fierce competition is a massive opportunity if you play your cards right. Don’t just take the first offer that lands in your inbox.

When you’re trying to get a handle on origination fees, especially in a market this complex, it pays to connect with experienced mortgage brokers. These pros have established relationships with dozens of lenders and can quickly source competitive offers, helping you score better terms on both your interest rate and your fees.

The key is to treat shopping for a mortgage like you’re shopping for a car. Get multiple quotes—in this case, Loan Estimates—and compare them line by line. Don’t be afraid to take a competitor’s lower origination fee to your preferred lender and ask them to match it.

Actionable Tips for LA Homebuyers

To get an edge, focus on what you can actually control. Here are a few strategies that work:

- Boost Your Borrower Profile: Before you even think about applying, get your credit score as high as possible and your debt-to-income ratio down. A stronger financial profile makes you a much more attractive client, giving you more negotiation power.

- Get Pre-Approved with Several Lenders: This move forces lenders to put their best foot forward from the start. You’ll be amazed at how much better the offers get when they know you have options.

- Question Every Single Fee: Make the lender walk you through every charge in Section A of your Loan Estimate. If you don’t understand what you’re paying for, you can’t effectively negotiate it.

Frequently Asked Questions

Even after you think you’ve got it all figured out, a few questions about the mortgage origination fee always seem to pop up. Let’s tackle the big ones so you can walk to the closing table with confidence, not confusion.

Is the Origination Fee the Same as Closing Costs?

Nope, but it’s an easy mistake to make.

Think of it this way: closing costs are the entire bar tab for the party you’re throwing to buy your house. The origination fee is just one of the most expensive drinks on that tab—like paying for the top-shelf stuff.

Closing costs cover everything—the appraisal, title insurance, property taxes, and a dozen other things. The origination fee is specifically what you’re paying the lender for the work of creating your loan. It’s a huge piece of your closing costs, but it’s not the whole shebang.

Can I Roll the Origination Fee into My Loan?

You can, sometimes. Lenders love to market “no-closing-cost” mortgages, which sounds like a dream come true. What they’re really doing is rolling the origination fee and other charges into your total loan amount.

But there’s no free lunch in real estate. To make up for covering those upfront costs, the lender will almost certainly hit you with a higher interest rate for the entire life of the loan. Over 15 or 30 years, that higher rate could cost you way more than just paying the fee at closing.

Why Do Some Lenders Not Charge an Origination Fee?

If you see a lender advertising a “no origination fee” loan, your BS detector should immediately start beeping. Lenders are in business to make a profit, and that money has to come from somewhere.

When they waive this fee, they usually claw it back in less obvious ways:

- A higher interest rate than their competitors are offering.

- Inflated fees with different names, like a suspiciously high “underwriting fee” or “processing fee.”

This is why you always compare the full Loan Estimate from every lender. Don’t get seduced by a single “no fee” promise. A loan that has an origination fee can absolutely be the better, cheaper deal in the long run.

Ready to navigate the Los Angeles real estate market with a team that has your back? ACME Real Estate is here to guide you through every step, from understanding fees to finding your perfect home. Visit us at https://www.acme-re.com to start your journey.