A Purchase and Sale Agreement (PSA) is the legally binding contract that spells out every last detail of a real estate deal. Think of it as the official game plan for buying or selling a home, turning a verbal agreement or a handshake into a concrete, enforceable commitment for everyone involved.

The Blueprint for Your Real-Life Deal

Welcome to the absolute heart of every real estate transaction—the Purchase and Sale Agreement. If an offer is the exciting opening act, the PSA is the meticulously detailed script that ensures the property gets bought and sold exactly as everyone agreed. It’s hands down the most critical document in the entire process.

This is where all the verbal negotiations get put down in writing, leaving zero room for “he said, she said.” The PSA serves as a comprehensive roadmap, specifying everything from the final price to the closing date, making sure the journey from an accepted offer to handing over the keys is as smooth as possible.

Why This Document Is a Total Game-Changer

Let’s be blunt: without a PSA, a real estate deal is just a conversation. It has no legal teeth. This leaves both the buyer and seller completely vulnerable to misunderstandings, last-minute changes of heart, or someone walking away without any consequences. This agreement is what makes the transfer of property official, providing clarity and—most importantly—protection.

A PSA is a cornerstone document in the world of real estate law. It’s built to do a few key things:

- Define the Terms: It clearly states the purchase price, how it’s being financed, and exactly what property is being sold.

- Set the Timeline: It establishes firm, mutually agreed-upon deadlines for inspections, loan approvals, and the closing date.

- Protect Both Parties: This is huge. It includes contingencies, which are essentially escape hatches that allow either party to safely exit the deal if certain conditions aren’t met.

- Create a Legal Obligation: Once signed, it’s a done deal. The agreement becomes legally binding, and everyone is required to follow through.

In vibrant markets like ours, you simply don’t do a deal without one. In fact, a huge percentage of home purchases in the U.S. rely on these agreements to legally lock down the transaction. This formality is what keeps disputes from derailing the whole process.

A well-crafted Purchase and Sale Agreement doesn’t just outline a transaction; it builds a fortress of clarity around it. It anticipates potential problems and provides a clear, mutually agreed-upon solution before they ever arise.

To give you a clearer picture, the table below breaks down the PSA’s role and why it’s so important from both the buyer’s and seller’s points of view. Think of it as a quick cheat sheet before we dive deeper into the specific clauses and components you’ll need to know.

The Purchase and Sale Agreement at a Glance

| Aspect | Buyer’s Perspective | Seller’s Perspective |

|---|---|---|

| Purpose | Secures the property at an agreed-upon price and locks in the terms of the sale. Provides a clear path to ownership. | Locks in a qualified buyer at a set price and outlines the conditions for a successful closing. |

| Protection | Contingencies (like inspection and financing) allow for a safe exit if issues arise. Protects the earnest money deposit. | Protects against a buyer backing out without a valid reason. Ensures timelines are met to avoid costly delays. |

| Clarity | Defines exactly what is included in the sale (fixtures, appliances) and sets clear deadlines for every step. | Eliminates ambiguity by specifying responsibilities, timelines, and the exact terms of the property transfer. |

| Commitment | Creates a legally binding obligation for the seller to sell the home, preventing them from accepting a higher offer. | Creates a legally binding commitment from the buyer to purchase, provided all conditions in the contract are met. |

This table just scratches the surface. Now, let’s get into the nitty-gritty of what actually goes into this critical document.

Deconstructing the Purchase and Sale Agreement

Alright, let’s pop the hood on the Purchase and Sale Agreement, or PSA. This document can feel like a daunting wall of dense legal text, but once you understand its purpose, the whole thing starts to make a lot of sense.

Think of it as the rulebook for one of the biggest transactions you’ll ever make. Every single clause has a job to do, from identifying who’s playing to spelling out the final score. We’re going to break down the anatomy of a standard PSA, stripping away the jargon to show you what really matters.

Identifying the Key Players and the Prize

At its core, a PSA has to answer two simple questions: who’s involved and what’s being sold? It sounds obvious, but getting this part wrong can derail the entire deal. Precision here is non-negotiable.

First, the agreement must clearly name all the parties in the transaction—and I mean their full legal names. “John and Jane Smith” might work for a dinner reservation, but a contract needs the exact names as they appear on government IDs and property titles. No shortcuts.

Next, and just as important, is the legal description of the property. This isn’t the mailing address you give to Amazon. A mailing address is for letters and pizza delivery; a legal description is what the county uses to identify the property’s exact boundaries and location on a map.

A vague description can literally invalidate the contract. Simply stating “the house at 123 Main Street” could be a huge problem if there’s also a guest house or a second parcel of land involved. The PSA has to be specific, often including the Assessor’s Parcel Number (APN) to kill any and all confusion.

Following the Money Trail

Once we’ve nailed down the who and the what, the PSA gets into the financials. This section meticulously outlines the money side of the deal, leaving absolutely no room for guesswork.

The purchase price is the big headliner, of course—the total amount the buyer has agreed to pay the seller. But the details of how that price gets paid are just as critical. The PSA breaks down the financing, specifying the loan amount, the type of loan (like conventional, FHA, or VA), and the down payment.

The Earnest Money Deposit is more than just a financial step; it’s a powerful signal of commitment. It tells the seller, “I’m serious about this, and I have the financial stability to see it through.”

This brings us to the earnest money deposit. Think of this as the buyer’s skin in the game. It’s a chunk of money put down when the contract is signed to show they’re serious about the purchase. It’s a good-faith gesture that says, “I’m not just window shopping.”

The amount is always negotiable but usually lands somewhere around 1-3% of the purchase price. This deposit doesn’t go to the seller right away; it’s held by a neutral third party, like an escrow company, until the deal closes. If the buyer bails for a reason not covered by a contingency (we’ll get to those later), they risk losing that deposit.

Here’s a quick rundown of these core financial elements:

- Purchase Price: The total agreed-upon cost of the property.

- Financing Terms: A detailed look at the buyer’s mortgage and down payment structure.

- Earnest Money Deposit: The initial funds provided by the buyer to show they’re committed.

- Closing Costs: The agreement will also specify who pays for which closing costs, like title insurance, escrow fees, and transfer taxes.

Getting a handle on these foundational pieces demystifies the bulk of the agreement. With the players, the property, and the payment plan clearly defined, you can read the document with confidence, knowing you grasp the core of what you’re signing.

The Power of Contingencies: Your Contractual Safety Nets

Ever play a board game with a “Get Out of Jail Free” card? In a real estate deal, contingencies are the legal version of that card. They are your safety nets, written directly into the purchase and sale agreement to protect you from the unknown.

Think of them as escape hatches. They give you the right to walk away from the deal—with your earnest money deposit safe and sound—if certain conditions aren’t met. This isn’t about finding loopholes; it’s about acknowledging that buying a home involves massive unknowns. A PSA without contingencies is like performing a trapeze act without a net. It’s a huge gamble with hundreds of thousands of dollars on the line.

Understanding these protections isn’t just about reading clauses. It’s about building a strategic playbook that fiercely protects your financial future.

The Big Three Contingencies

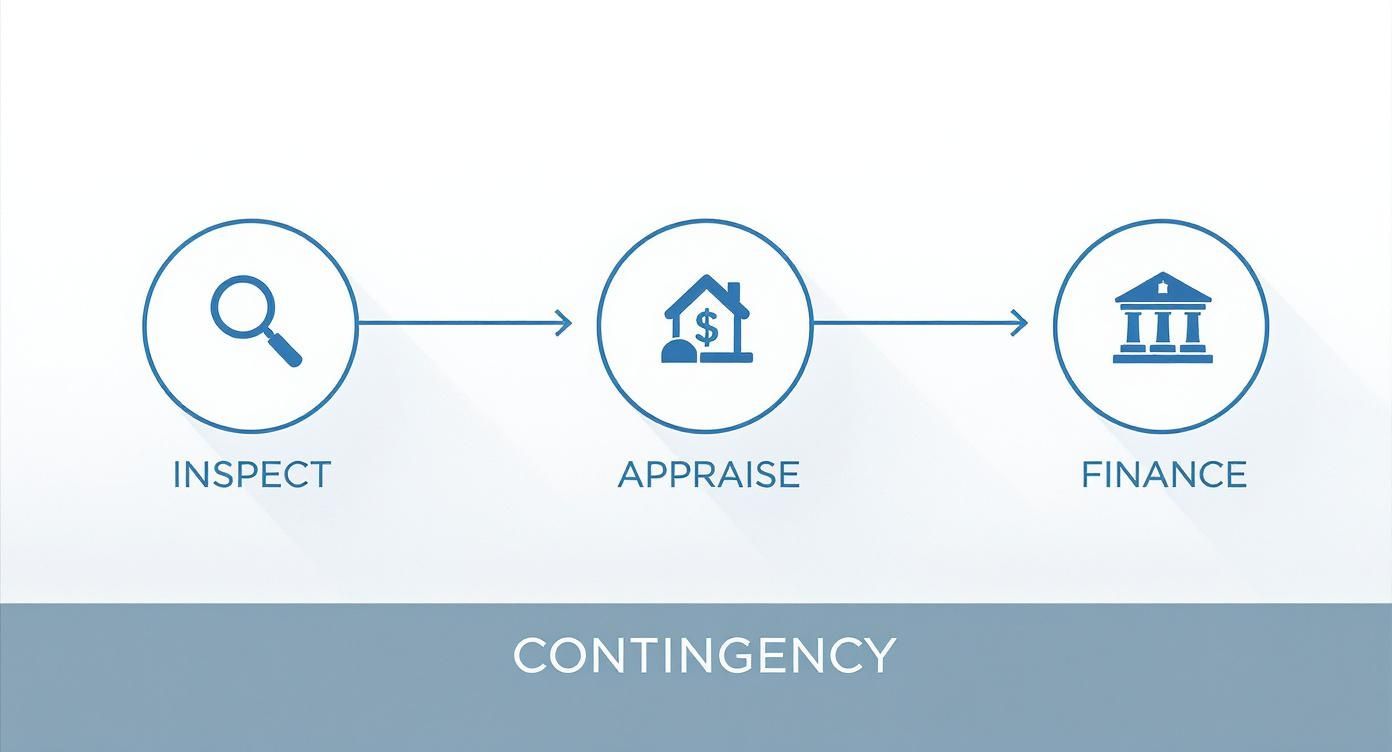

While you can negotiate almost any condition, three specific contingencies are the bedrock of buyer protection in nearly every home purchase. They cover the most common and high-stakes “what ifs” you’re likely to face.

- Inspection Contingency: This is your permission to look under the hood. It gives you the right to hire a professional inspector to check the property from top to bottom. If they uncover a cracked foundation, a leaky roof, or ancient wiring, you can renegotiate the price, ask the seller for repairs, or just walk away.

- Appraisal Contingency: Lenders won’t loan you more money than a house is actually worth. Simple as that. This contingency protects you if the bank’s official appraisal comes in lower than what you offered. It gives you the power to renegotiate with the seller or cancel the contract without losing your deposit.

- Financing Contingency (or Mortgage Contingency): This one is probably the most crucial safety net of all. Even with a pre-approval letter, your final loan isn’t a 100% guarantee. If your financing falls through at the last minute for any reason, this clause lets you back out. Without it, you could be legally forced to buy a house you can’t afford, lose your deposit, and even face a lawsuit.

Think of contingencies as simple “if-then” statements in your contract. If the inspection reveals major structural damage, then the buyer can terminate the agreement. If the appraisal comes in low, then the buyer can renegotiate. They turn uncertainty into a clear, manageable plan.

Time Is Always Ticking

Here’s the catch: contingencies aren’t a free pass to change your mind whenever you want. Each one has a strict, non-negotiable deadline. This window, often called the due diligence period, is when you have to get everything done—your inspections, your appraisal, and your final loan approval.

Typically, you might have 10-17 days for your inspection contingency. If you discover a major issue on day 18, it’s too late. The contract assumes you’ve waived your right to back out, and your leverage is gone. Missing these deadlines is one of the quickest ways to lose your earnest money.

Your agent’s job is to live and breathe this calendar, making sure every task is completed before its deadline expires. This is a vital part of the home-buying process. You can learn more about exactly what goes on during this critical time in our due diligence period in our detailed guide.

Ultimately, contingencies are what make a purchase and sale agreement fair. They give you, the buyer, the power to do your homework thoroughly while assuring the seller that you’re moving forward on a clear, predictable schedule. They are the essential checks and balances that turn a high-stakes deal into a secure investment.

From Signed Agreement to Closing Day

Signing the purchase and sale agreement is a huge milestone, but it’s the starting pistol, not the finish line. The ink is dry and the deal is officially on—so what now? A whole lot, actually. The time between signing and closing is a whirlwind of coordinated activity, all leading up to the moment you finally get the keys.

This phase is all about turning the promises made in the PSA into reality. Think of it as the production phase after the script has been approved. This is where the real work begins: satisfying contingencies, securing funds, and preparing for the legal transfer of the property. It’s a structured journey with clear checkpoints for both the buyer and seller.

The entire process is managed inside a secure, neutral bubble known as escrow.

The Escrow Lifeline

Once the PSA is signed, it’s handed over to a neutral third party—usually an escrow company or a closing attorney. This party acts as the referee of the transaction. They hold onto the buyer’s earnest money deposit, the seller’s property title, and all the necessary documents.

Their job is simple but absolutely critical: make sure no money or property changes hands until every single condition in the PSA has been met. This protects everyone involved. The buyer knows their money is safe, and the seller knows the buyer is serious and has committed the funds. To get a better handle on how this crucial safeguard works, check out our deep dive on what is the escrow process.

With escrow officially open, the contingency clock starts ticking. This is the buyer’s window to do their due diligence, and it’s one of the most active parts of the entire transaction.

This flowchart lays out the step-by-step process a buyer follows to make sure the property is a sound investment, from the physical inspection all the way to financial validation. Each of these steps has to be completed within the strict deadlines laid out in the purchase agreement to keep the deal moving forward.

Key Milestones on the Road to Closing

As the buyer works through their contingencies, a few key things have to happen to push the deal toward completion. Each one is a checkpoint confirming that both sides are holding up their end of the bargain.

- Completing Inspections: The buyer lines up all their desired inspections—general home, pest, roof, you name it. Based on what they find, they might negotiate for repairs with the seller or, if the issues are bad enough, use their contingency to walk away.

- Securing the Appraisal and Loan: The buyer’s lender orders an appraisal to confirm the property’s value. Once the appraisal comes back solid and the buyer’s financial documents are verified, the lender gives the final loan approval.

- Removing Contingencies: This is a huge moment. Once the buyer is satisfied with the inspections and has the loan locked down, they will formally remove their contingencies in writing. At this point, their earnest money deposit typically goes “hard,” meaning it’s no longer refundable if they back out.

- The Final Walk-Through: Right before closing, usually within 24 hours, the buyer walks through the property one last time. This isn’t another inspection; it’s just to verify that the property is in the same condition as when they agreed to buy it and that any negotiated repairs have actually been done.

The final walk-through is your last chance to confirm everything is as it should be. It’s the final check before you legally commit, ensuring there are no last-minute surprises waiting for you after you get the keys.

After a successful final walk-through, both parties head to the closing table. Here, they’ll sign a mountain of final documents, the buyer’s lender will wire the funds, and the seller will officially transfer the title. Once the county records the new deed, the deal is officially closed. The keys are finally yours.

Navigating California and Los Angeles PSAs

All real estate is local. It’s the golden rule, and it applies directly to the contracts you’ll be signing. While the core DNA of a purchase and sale agreement is pretty universal, California—and especially Los Angeles—plays by its own set of rules. We have unique forms and a mountain of mandatory disclosures you won’t find anywhere else.

This isn’t just trivia; it’s critical information that shapes your rights, your responsibilities, and ultimately, your investment.

The California Residential Purchase Agreement Unpacked

To understand a California PSA, you need to get familiar with one key document: the California Residential Purchase Agreement (RPA). This standardized form, created by the California Association of REALTORS®, is the backbone of nearly every residential deal in the state. Think of it less as a template and more as a meticulously crafted contract that’s been refined over years to navigate the legal minefield of California real estate.

What makes the RPA different? For starters, it has a built-in timeline for buyer investigations and seller disclosures, creating a clear, structured process from day one. No guessing games.

More importantly, it forces transparency by integrating state-mandated disclosures directly into the contract’s flow. This ensures buyers get a massive dump of information about the property early on. You’ll see explicit references to disclosures covering things like:

- Natural Hazard Zones: Is the property in a flood zone, a high-fire-risk area, or an earthquake fault zone? The seller has to give you a detailed report.

- Megan’s Law Database: The agreement points you directly to the statewide database of registered sex offenders.

- Lead-Based Paint: For any home built before 1978, sellers are required by both federal and state law to disclose any known lead paint hazards.

In California, transparency isn’t just a nice idea—it’s the law. The RPA is designed to arm you with as much information as humanly possible, so you can make a fully informed decision before you commit.

Before we move on, it’s worth taking a closer look at the key disclosures you’ll encounter. They are a fundamental part of the California PSA process.

| Common California Disclosure Checklist |

| :— | :— | :— |

| Disclosure Type | What It Covers | Why It Matters |

| Transfer Disclosure Statement (TDS) | Known material facts about the property’s condition, from leaky roofs to neighborhood noise. | This is the seller’s sworn statement about the property’s health. It’s your first line of defense against hidden defects. |

| Natural Hazard Disclosure (NHD) Report | Identifies if the property is in a state-mapped hazard zone (fire, flood, earthquake fault, etc.). | This affects your safety, insurance costs, and potentially your ability to build or remodel in the future. |

| Seller Property Questionnaire (SPQ) | A more detailed questionnaire asking about repairs, insurance claims, pets, and other specifics. | It fills in the gaps left by the TDS, giving you a much deeper understanding of the property’s history. |

| Lead-Based Paint Disclosure | Required for homes built before 1978; discloses known lead paint and provides an informational pamphlet. | Lead exposure is a serious health risk, especially for children. This is a non-negotiable federal requirement. |

These disclosures aren’t just paperwork; they’re your primary tools for due diligence. They give you the power to investigate, negotiate, or walk away based on what you find.

Los Angeles Local Flavor

Now, let’s zoom in on Los Angeles. This is where things can get even more complex. L.A. isn’t just one city; it’s a sprawling collection of cities and unincorporated areas, each with its own quirks and potential requirements. A truly savvy agent knows to look for local addenda that could trip up a deal.

For instance, some parts of L.A. have specific ordinances mandating energy or water conservation retrofits before a sale can close. Sellers might have to provide proof of compliance for things like low-flow toilets or smoke detectors.

This is exactly why hyper-local expertise isn’t just a bonus—it’s an absolute necessity here. From the Hollywood Hills to the South Bay, knowing the local playbook gives you a real advantage, preparing you not just for any transaction, but for a successful one right here in Southern California.

Pro Tips for Negotiation and Avoiding Common Pitfalls

A Purchase and Sale Agreement isn’t just a form you fill out—it’s the battleground where the deal is won or lost. Whether you’re buying a dream home or selling a prized asset, this is where you move from just understanding the PSA to making it work for you.

Think of it less like a simple handshake and more like a strategic negotiation. Every offer, every counter, and every contingency matters. A well-negotiated contract doesn’t just get the deal closed; it protects your interests long after you’ve moved in or moved on.

Buyer’s Playbook: Crafting an Offer That Wins

As a buyer in a cutthroat market like Los Angeles, your offer needs to do more than just flash a big number. It has to tell the seller you’re a serious, reliable buyer who can get to the closing table without any drama.

Look beyond the price. You can make your offer shine by putting down a larger earnest money deposit to show you’re all in, or by offering a flexible closing date that works with the seller’s schedule. These moves often make your offer more appealing than a slightly higher one from a buyer who seems difficult from the start.

When the inspection report lands with a list of problems, it’s time to negotiate. Don’t sweat the small stuff. Focus on the big-ticket items—health, safety, or structural issues. A leaky roof or ancient wiring is a legitimate concern; scuffed paint is not. A short, reasonable list of essential repairs is always more effective than hitting the seller with a novel of minor cosmetic complaints.

Seller’s Strategy: Juggling Offers and Protecting the Deal

For sellers, getting multiple offers is a fantastic problem to have, but you need a sharp strategy to handle it. Don’t automatically grab the highest offer. You have to look at the whole package. How solid is the buyer’s financing? How many contingencies are they asking for? An all-cash offer for a little less might be a much safer bet than a higher offer tied to a shaky loan.

When you send a counteroffer, move quickly. A fast, clear response keeps the momentum going and shows you’re serious. Dragging your feet or being vague can make a buyer nervous enough to walk away. The goal is to lock down the agreement while their excitement is still high.

Handling repair requests is a delicate dance. You should be prepared to address legitimate safety or structural problems—any inspector for any buyer will likely flag them anyway. But stand your ground on cosmetic fixes or minor upgrades. Agreeing to fix every little thing will eat into your profits and signal to the buyer that you’re a pushover.

The golden rule of negotiation: This isn’t about total domination. The best deals happen when both sides feel like they won. A fair PSA is the clearest path to a smooth closing where everyone walks away happy.

Sidestepping Common Pitfalls

So many deals fall apart over completely avoidable mistakes. These are the landmines hiding in the fine print that can blow up a transaction right before the finish line.

Keep a close eye out for these classic tripwires:

- Ambiguous Language: Vague phrases like “repairs to be completed soon” are a recipe for disaster. Get specific. Use exact dates, clear descriptions of the work, and spell out who is responsible for what.

- Unrealistic Timelines: Never agree to a 10-day inspection period if you know the inspectors in town are booked two weeks out. Set realistic deadlines for everything to avoid unnecessary stress and potential breaches of contract.

- Overlooking Small Clauses: That tiny clause about whether the fancy chandelier or the smart thermostat stays or goes can turn into a massive fight during the final walk-through. You have to read every single line.

Negotiating a bulletproof PSA is a skill, and you can sharpen your game by diving into more advanced real estate negotiation strategies in our comprehensive guide. By playing both strong offense and smart defense, you can craft a deal that truly protects you.

Your Burning PSA Questions, Answered

Let’s cut through the noise and tackle the questions I hear most often about Purchase and Sale Agreements. Getting these answers straight can kill a lot of the anxiety that comes with signing on the dotted line.

Can I Get Out of This Deal if I Change My Mind?

Yes, but it’s not as simple as just walking away. Your power to back out cleanly is tied directly to the contingencies written into your contract. Think of these clauses as your pre-approved escape hatches.

If a home inspection turns up a cracked foundation or your financing unexpectedly falls through, a contingency gives you a legal way out, letting you cancel the deal and get your deposit back. The key is you have to act within the timeline spelled out in the contract.

But here’s the catch: backing out for a reason that isn’t covered by a contingency—like a simple case of cold feet—is a breach of contract. That move could cost you your entire earnest money deposit, and in some cases, the seller could even sue you for damages.

What if the Seller Tries to Back Out?

It’s a whole different ballgame for sellers. Once they’ve signed that PSA, they are legally on the hook to sell the property, assuming you, the buyer, hold up your end of the bargain. It’s incredibly difficult for them to terminate the agreement without consequences.

If a seller gets seller’s remorse and tries to bail, the buyer has some serious leverage.

You can sue for “specific performance,” which is a legal action where a court can actually force the seller to go through with the sale. If that feels too aggressive, you can also sue for financial damages to recoup all the money you’ve spent on inspections, appraisals, and other related costs.

Who Actually Writes the Purchase Agreement?

Typically, the buyer’s real estate agent is the one who drafts the PSA. They’ll use a standardized, state-approved form (like the California RPA here in LA) and fill in all the specific details of your offer—the price, the proposed closing date, and any contingencies you’re requesting.

That initial offer then gets passed to the seller’s agent. From there, the seller has three choices: accept it as is, reject it flat out, or come back with a counteroffer proposing different terms. While we’re focused on purchase agreements here, getting familiar with other real estate documents, like rental agreement templates, can give you a much broader understanding of how property contracts work.

Making sense of a PSA is where having an experienced pro in your corner makes all the difference. At ACME Real Estate, we live and breathe these documents every single day, making sure your interests are protected from start to finish. Ready to make your next move with total confidence? Contact us today and let’s get started.