Let's be real, the term "title insurance" sounds about as thrilling as a tax seminar. But trust me on this—it’s the single most important piece of financial armor you’ll buy for your new home, and most people have no idea what it actually does.

Forget the stiff, robotic definitions. Title insurance is a deep-dive background check on your property's history. It’s a one-time policy designed to make sure no financial ghosts from the past—like a previous owner's unpaid debts, surprise heirs, or shoddy paperwork—can crawl out of the woodwork and challenge your right to own your home. It’s your home’s personal bouncer.

Your Home's Financial Armor

Think of it like this: car insurance protects you from future accidents. Title insurance flips that script. It protects you from the property's past.

While your standard homeowner's insurance covers future disasters like fires or break-ins, title insurance digs into a property's history to find and defuse landmines before you even get the keys. This is an absolutely non-negotiable step in the home buying process timeline that locks down your investment from the second you close.

So, What Does It Actually Do?

Before you even think about signing closing papers, a title company gets to work, digging through mountains of dusty public records. They’re hunting for any "defects" or "clouds" on the title—legal-speak for anything that could give someone else a claim to your property.

Here are some of the all-too-common skeletons they uncover:

- Unpaid Property Taxes or Liens: A previous owner might have bailed on a contractor's bill or conveniently "forgot" to pay their taxes, leaving a debt stapled to the property.

- Undiscovered Heirs: You'd be shocked how often a long-lost cousin of a former owner pops up out of nowhere, claiming they inherited a chunk of the property.

- Fraud or Forgery: It happens more than you think. Someone could have forged a signature on a past deed, making a previous sale totally illegitimate.

- Clerical Errors: Simple typos or filing mistakes in public records can snowball into massive legal nightmares years down the road.

If the title company finds a problem, they work to fix it before you sign. And if some sneaky issue manages to slip through and only rears its ugly head after you've moved in? That's when your title insurance policy swoops in, covering your legal fees and any financial losses.

A clean title is the bedrock of property ownership. It's the official, undisputed proof that you—and only you—have the right to your property. Without it, your ownership is built on quicksand.

Title Insurance At a Glance

To cut through the noise, here's the CliffsNotes version of the core concepts.

| Concept | Simple Explanation |

|---|---|

| What is it? | An insurance policy protecting you from ownership claims and financial skeletons from the property's past. |

| How it Works | A title company plays detective, researching property records before you buy to spot trouble. |

| What it Covers | Financial loss and legal fees from title defects that could cost you your home. |

| When you Pay | A one-time fee paid at closing that protects you for life. |

This table just scratches the surface, but it drives home the fundamental role title insurance plays in securing your biggest asset.

A Growing Market for Peace of Mind

More and more buyers are wising up to how critical this protection is. The North America title insurance market was valued at $2 billion in 2023 and is expected to climb to $2.8 billion by 2032. This isn't just random growth; it's fueled by a smarter generation of homebuyers who refuse to leave their largest investment exposed.

At the end of the day, understanding how to properly own your real estate is step one. Securing it with title insurance is step two. That one-time premium is a tiny price to pay to ensure your dream home doesn't become a legal nightmare over someone else's past mistakes.

Owner's Policy vs. Lender's Policy: Know the Difference

When you get to the closing table, you'll likely see two different title insurance policies in that mountain of paperwork. It’s easy to assume they’re the same, but they have completely different jobs. Getting this right isn’t a minor detail—it’s the key to protecting your own skin in the game.

One policy is for your lender, and the other is for you. They may both be called "title insurance," but they protect different parties from different risks. Mistaking one for the other is a common—and potentially devastating—rookie mistake.

The Lender's Policy: Your Bank's Shield

If you’re taking out a mortgage, your lender will absolutely, 100% require you to purchase a lender's title insurance policy. This is not optional. The bank is fronting a massive pile of cash for your home, and this policy is their armor, protecting their investment against any title defects.

The lender's policy ensures their loan has first dibs if a title claim pops up. It protects their money, not yours. As you pay down your mortgage, the coverage on the lender's policy shrinks, eventually vanishing once the loan is fully paid off.

The Owner's Policy: Your Personal Financial Defense

This is where your protection comes in. An owner's title insurance policy is your personal safeguard. While a lender's policy is mandatory, an owner's policy is technically "optional"—but skipping it is like leaving the front door of your brand-new home wide open for financial disaster.

This policy protects your equity and your right to the property for as long as you or your heirs own it. Unlike the lender's policy, its coverage never fades. It defends you against the same title defects but from your perspective, ensuring you don't lose your down payment and every last penny of equity you've built.

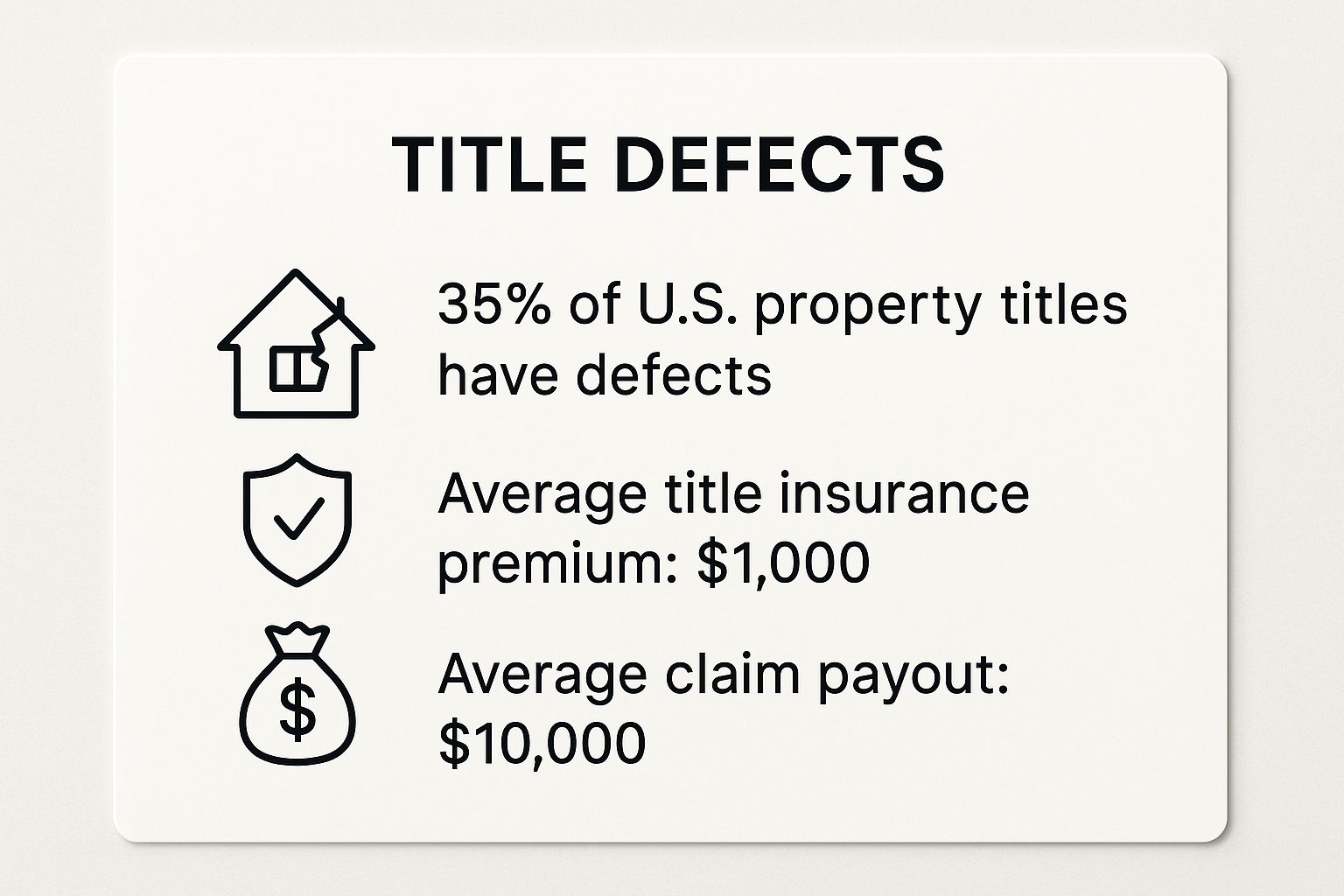

The data below shows exactly why this protection is so critical.

This visual breakdown makes it painfully clear: with over a third of titles having defects and potential claims costing ten times the premium, the risk of going uninsured is just too high to ignore.

A Side-by-Side Showdown

Let's break this down to make it crystal clear. These two policies serve very different masters.

| Feature | Owner's Title Insurance | Lender's Title Insurance |

|---|---|---|

| Who It Protects | The homebuyer/property owner (YOU!) | The mortgage lender/bank |

| Is It Required? | Optional, but skipping it is financial suicide. | Almost always required by the lender. |

| How Long It Lasts | As long as you or your heirs own the property. | Until the mortgage is paid off. |

| What It Covers | Your equity and right of ownership. | The lender's financial investment in the property. |

| Cost | One-time premium paid at closing. | One-time premium, often rolled into your costs. |

Seeing the policies side-by-side reveals their distinct roles. One is a lifelong shield for your investment; the other is a temporary safeguard for the bank's loan.

The industry's growth screams importance. In the first quarter of 2025 alone, the title insurance industry generated $3.9 billion in premiums, an 18% increase from the previous year. This surge, with states like New York seeing a massive 42.7% jump, shows a growing recognition of the essential security these policies provide. You can discover more insights about the title insurance market on ALTA.org.

Hidden Nightmares That Title Insurance Prevents

So, what are you actually paying for? This isn’t about some vague, hypothetical threat. It’s about protecting you from the real-life skeletons that could be rattling around in your property's closet. The peace of mind is great, but the protection is against very real, very expensive monsters.

Picture this: you've signed the closing papers, popped the champagne, and got the keys. Then a letter arrives. It’s from a construction company, informing you they've slapped a mechanic's lien on your property. The previous owner never paid for a kitchen remodel five years ago, and now that unpaid bill has become your legal and financial nightmare. This is the exact kind of landmine a title policy is designed to defuse.

Without this protection, you’re left holding the bag for someone else's mess. You could even face foreclosure to satisfy a debt that was never yours. Title insurance steps in to fight these claims for you, covering the legal bills and any financial losses.

Skeletons in the Property's Closet

The title search is your first line of defense, but some issues are buried so deep they don’t surface for years. Your owner's policy is the safety net for these delayed-action disasters. And don't think these are just rare, "it won't happen to me" cases. Research shows that title issues pop up in roughly one-third of all property title searches. Problems are way more common than you think.

Here are a few of the most shocking—and surprisingly frequent—title defects that ambush unsuspecting homeowners:

- Forgery and Fraud: What if a signature on a past deed was a fake? It happens. That one phony signature could invalidate the entire chain of ownership, potentially voiding your claim to the property without warning.

- Undiscovered Heirs: The person who sold you the house might not have been the sole owner. A long-lost cousin or forgotten sibling of a previous owner could suddenly materialize with a valid legal claim to a piece of your property.

- Clerical Errors in Public Records: A simple typo, an incorrectly filed document at the county recorder's office, or a misplaced decimal point in a legal description can create massive ownership battles years later.

These scenarios sound like plot twists from a TV legal drama, but they are real-world problems that happen every single day. Each one could cost you tens of thousands in legal fees or, in the worst-case scenario, cost you the home itself.

Real-World Horror Stories

Boundary disputes are another classic title nightmare. You finally build that awesome new fence, only for your neighbor’s survey to reveal part of it is on their land. This can spiral into an expensive legal war that might end with you being forced to tear your new structure down.

Then there are undisclosed easements. This is when a utility company—or even a neighbor—has a legal right to access or run pipes right through your backyard. An easement you never knew about could completely torpedo your plans for a pool or a home addition, tanking your property's value.

Imagine this: A couple buys their dream home, only to find out months later that the seller’s "divorce" was never actually finalized. The supposedly ex-spouse, who never signed off on the sale, still has a legal ownership claim. Suddenly, the new homeowners are facing a lawsuit that challenges their very right to be there.

This isn't just a scary story; it's exactly the kind of mess an owner's policy is built to clean up. Without that coverage, the homeowners would be on their own, facing a legal fight that could drain their life savings and potentially strip them of their home. This is why understanding what is title insurance is so critical—it's your only real defense against the secrets of the past.

How the Title Search Process Uncovers Property Secrets

Let’s pull back the curtain on the “title search”—the serious detective work that kicks off the moment you go under contract. This isn't just shuffling papers. It’s a deep-dive, a meticulous investigation into your property's entire life story. Think of it as a forensic audit for real estate.

A dedicated title professional becomes a property historian, combing through decades of public records. They’re digging into everything: deeds, mortgages, court judgments, tax records, and even old divorce decrees. The goal is to piece together the property's chain of title—a complete, unbroken record of ownership stretching from the current seller all the way back in time.

This is where potential nightmares get spotted and shut down before they can ever become your problem. It's the preventative medicine that gives your title insurance policy its real power.

Piecing Together the Property Puzzle

The title search isn’t a single action but a whole series of checks. It's all designed to verify one crucial thing: that the seller has the legal right to hand over the property to you, free and clear of any hidden claims. This is a non-negotiable part of any solid real estate due diligence checklist and a cornerstone of protecting your investment.

Here’s exactly what these property detectives are hunting for:

- A Clean Chain of Title: They confirm that ownership has passed correctly from one owner to the next, with no weird gaps or questionable transfers.

- Unresolved Liens: This means looking for any unpaid debts latched onto the property, like a mechanic’s lien from a disgruntled contractor or outstanding local, state, or federal tax bills.

- Easements and Encumbrances: They’ll uncover any rights that other parties might have to your property, like a utility company’s right to run lines through your backyard.

- Legal Judgments: The search also scans for court rulings against previous owners that could cloud the property's title and become your headache.

The title search is where theoretical risks become real. It’s the process that confirms whether the beautiful home you see on the surface has a clean bill of health on paper or a hidden history of problems.

From Search to Commitment

Once the deep dive is done, the title company issues what’s called a title commitment (or preliminary report). This document is a summary of their findings, laying out any existing liens or issues that need to be cleared up before you can close the sale. If the title is clean, you move forward with confidence. If they find problems, those issues are dealt with before you sign on the dotted line.

This rigorous process is the backbone of the whole title insurance industry. Its importance is reflected in the market's explosive growth; the global title insurance market was valued at about USD 67.42 billion in 2024 and is expected to nearly double by 2033. That kind of expansion is fueled by the critical need for the security and peace of mind that only a thorough title search can provide. You can read more about the title insurance market's growth on Business Research Insights.

Understanding the Cost of Title Insurance

Let's talk money. You’ve heard about the protection title insurance offers, but what does this financial armor actually cost? The good news is, it’s not another monthly bill chipping away at your budget.

Title insurance is a one-time premium paid at closing. That single payment protects you for as long as you or your heirs own the property. Think of it less like car insurance and more like a permanent upgrade to your home's security system.

The cost is directly tied to the value of your home—the more expensive the property, the higher the premium. This makes sense; the insurer is taking on a much bigger financial risk with a multi-million dollar property than a starter home.

What Determines the Final Price

So, what goes into that final number on your closing statement? While costs vary by state and even county, a few key factors drive the price tag.

- Purchase Price of the Home: This is the big one. Your premium is typically calculated as a percentage of the home's sale price.

- Loan Amount: For the lender's policy, the cost is based on how much you’re borrowing.

- State Regulations: Title insurance rates are regulated at the state level. This means the cost for the same-priced house can be wildly different in California versus Florida.

That one-time fee covers everything—the deep-dive detective work of the title search and the insurance policy itself. You’re paying for both the effort to uncover past problems and the protection against any that slipped through the cracks. When you weigh this single payment against a potentially catastrophic, six-figure title claim down the road, it's one of the best investments you'll make in the entire homebuying process.

The average owner's title insurance policy costs around $1,000 for a $250,000 home, but that's just a ballpark figure. The real value isn't the price—it's the transfer of immense financial risk from your shoulders to the insurance company's.

How to Potentially Lower Your Premium

While many costs are set in stone, you’re not totally powerless. One of the best ways to save some cash is to ask for a "reissue rate" or "reissue credit."

If the home was sold within the last few years, a title policy already exists. Since the title company has a head start on their research and doesn't have to go back as far, they often pass those savings on to you with a pretty hefty discount.

This is a smart play for managing your closing costs without cutting corners on protection. Just like you need to understand if earnest money is required for your offer, being proactive about asking for discounts can save you real money at the closing table. Always ask your title agent or real estate attorney if you qualify for a reissue rate. It never hurts to ask, and it could save you hundreds.

Your Title Insurance Questions, Answered

You've made it this far, so the fog around title insurance is probably starting to lift. But it's totally normal to still have a few questions rattling around. Let's hit the most common ones I hear from clients to give you that last bit of clarity.

Think of this as the lightning round. No fluff, just straight-up answers to help you navigate one of the biggest purchases of your life with total confidence.

Do I Really Need Title Insurance For a Brand-New House?

Yes. One hundred percent, yes. This is probably the biggest misconception out there. Just because the house is new doesn't mean the ground it sits on has a clean slate.

That land has a history. It's been bought, sold, and carved up for decades, maybe centuries. The builder could have unpaid liens from contractors, or there could be old boundary fights and undiscovered easements from a previous landowner. Your shiny new construction inherits all the historical baggage of the dirt it's built on, which makes an owner's policy an absolute must-have.

How Long Does My Coverage Last?

This is the best part. Unlike just about every other insurance policy you own, your owner's title insurance doesn't need to be renewed. Ever. It lasts for as long as you or your heirs own the property.

It's a one-and-done deal. That single premium you pay at the closing table protects your ownership rights for life, acting as a permanent shield against past title screw-ups that could pop up years or even decades down the road.

This is what makes understanding what title insurance is so vital; its value protects your legacy for generations, not just for the next 12 months.

What Happens if I Have to File a Claim?

If a title issue crawls out of the woodwork after you've closed, the process is pretty straightforward. You just notify your title insurance company that someone is making a claim against your property. This is where your policy really earns its keep.

The insurance company takes over from there, handling all the heavy lifting. This usually means they:

- Hire and pay for lawyers to go to bat for you and defend your ownership in court.

- Cover all the costs to fix the problem, like paying off a newly discovered lien.

- Pay you for any financial loss you suffer because of the title defect, all the way up to your policy's full value (which is typically your home's purchase price).

Instead of you facing a legal nightmare alone and burning through your savings, you’ve got a well-funded ally fighting in your corner.

Can I Pick My Own Title Company?

Yes, and you absolutely should. Your lender or real estate agent will probably suggest a title company they know and trust, but the final choice is yours.

It’s always a smart move to get quotes and compare the services from a few different companies. Look for one with a solid reputation, great customer service, and competitive pricing. Spending a little extra time choosing your own company gives you more control and could even save you a bit of cash on closing costs. This is your biggest asset—being proactive about who helps protect it is always the right call.

Navigating the wild world of real estate doesn’t have to be a solo mission. At ACME Real Estate, we connect you with trusted professionals every step of the way, making sure your journey to homeownership in Los Angeles is secure and successful. Find your dream home with a team that has your back at https://www.acme-re.com.