Let’s get straight to it. Private Mortgage Insurance (PMI) is basically your lender’s security blanket. It’s an insurance policy you pay for, but it protects them, not you. If you default on your mortgage, the lender gets paid.

So why would you agree to that? Simple. It’s often the only way to buy a home without scraping together a massive 20% down payment.

PMI Can Be The Key To Your First Home

If saving up 20% of a home’s price feels like climbing Everest in flip-flops, you’re not wrong. For most people, especially in today’s market, that giant pile of cash is the single biggest roadblock to buying a home. This is exactly where PMI swoops in and changes the game.

PMI lowers the risk for banks and other lenders. That gives them the confidence to say “yes” to buyers with much smaller down payments—sometimes as low as 3% to 5%.

A Simple Way To Think About It

Imagine you want to borrow a rare, expensive guitar from a collector. They trust you, but they’re still a little nervous about it. To put their mind at ease, you offer to pay for a special insurance policy that covers them just in case you accidentally drop it. Now you get to play the guitar, and they can relax.

That’s exactly how PMI works. The lender is the collector, the mortgage is the rare guitar, and PMI is that temporary insurance policy. It’s the price of admission that gets you into the homeownership club years sooner than you’d be able to otherwise.

And this isn’t some niche product; it’s incredibly common. In just one year, PMI helped over 800,000 borrowers buy homes, backing almost $300 billion in mortgages. With about 65% of those being first-time homebuyers, it’s pretty clear that PMI is a major key to unlocking the door to a first home.

Of course, a down payment is just one piece of the puzzle. Lenders will look at your whole financial picture, so getting familiar with how to qualify for a mortgage is a smart move.

To make this even clearer, let’s break down who’s actually involved in a PMI agreement.

The Key Players in Your PMI Agreement

This table lays out the three main parties in any PMI deal and what their role is. It’s a simple arrangement once you see how everyone fits together.

| Who It Is | What They Do | Why It Matters to You |

|---|---|---|

| The Borrower (You) | Pays the monthly PMI premium as part of your total mortgage payment. | You get to buy a home with less cash upfront, which can speed up your timeline by years. |

| The Lender | Gets financial protection from the PMI policy if you can’t make your payments. | They feel comfortable lending you a huge amount of money with less than 20% down because their risk is covered. |

| The PMI Company | Insures a piece of the loan and pays the lender if a default happens. | They’re the third party that makes the whole deal possible, bridging the gap between your down payment and the lender’s risk tolerance. |

At the end of the day, PMI is a tool. You pay a fee for the privilege of buying a home with less money down, getting you out of the rent trap and into an appreciating asset sooner.

Why Lenders Require PMI and When It Applies

So why are lenders so hung up on PMI? It all comes down to a single, powerful word: risk.

From the lender’s perspective, they’re fronting hundreds of thousands of dollars, and your down payment is your skin in the game. The smaller that down payment is, the more nervous they get. A buyer putting down only 5% has far less to lose by walking away than someone who invested 25% upfront.

While you see your future home, the lender sees an asset they need to protect. PMI isn’t for you; it’s their insurance policy against the possibility of you defaulting on the loan.

This isn’t some arbitrary fee. It’s a fundamental part of how lenders manage their exposure, a decision made during the critical mortgage underwriting process where your entire financial picture gets a thorough review.

The Magic Number for Avoiding PMI

The industry-wide standard for dodging PMI on a conventional loan is putting down 20% of the home’s purchase price. Simple as that.

When you hit that 20% mark, you instantly have significant equity, transforming you from a higher-risk borrower into a safer bet. This means your loan-to-value (LTV) ratio is 80% or less—a key metric calculated by dividing the loan amount by the home’s value.

A loan-to-value ratio of 80% or lower is the golden ticket. It proves you have a substantial stake in the property, giving lenders the confidence to waive the PMI requirement. This saves you real money every single month.

Conventional Loans vs. Government-Backed Loans

It’s crucial to know that Private Mortgage Insurance applies specifically to conventional loans. These are mortgages that aren’t backed by the federal government, hence the “private” label—the policy comes from a private insurer.

Government-backed loans have their own versions of mortgage insurance, and they play by different rules.

- FHA Loans: These come with a Mortgage Insurance Premium (MIP). The big catch? If you put down less than 10%, you could be stuck paying MIP for the entire life of the loan.

- USDA Loans: They use a “guarantee fee” that acts a lot like insurance, with one fee paid upfront and another paid annually.

- VA Loans: Here’s the outlier. Thanks to the Department of Veterans Affairs’ guarantee, these loans typically skip monthly mortgage insurance altogether. Instead, most veterans pay a one-time VA funding fee.

Bottom line: if you’re getting a conventional loan with less than 20% down, get ready to talk about PMI. It’s the standard tool that makes low-down-payment homeownership a reality in the private lending world.

How Your PMI Cost Is Actually Calculated

Let’s pull back the curtain on the numbers game. Private mortgage insurance isn’t some arbitrary fee tacked onto your loan; it’s a carefully calculated risk assessment, and your financial habits directly determine the price you’ll pay.

Think of it like getting car insurance. A driver with a clean record in a sensible sedan pays a lot less than someone with a history of speeding tickets who drives a high-performance sports car. In the mortgage world, lenders see buyers with strong credit and more of their own money in the deal—more “skin in the game”—as a much safer bet. And they reward that lower risk with lower PMI premiums.

The Core Factors That Drive Your PMI Rate

Your monthly PMI cost boils down to a few key variables that paint a clear picture of your financial health. Getting a handle on these is the first step to understanding—and potentially lowering—what you’ll actually owe.

- Your Credit Score: This is the heavyweight champion of the bunch. A high credit score is a signal of financial discipline, and it can dramatically lower your PMI rate. A score of 760 or above usually gets you the best possible terms, while scores dipping below 680 will mean you’re paying significantly more.

- Your Down Payment Percentage: The more you put down, the less you pay. It’s that simple. A 15% down payment is far less risky for a lender than a 5% one, and your insurance cost will reflect that. This is directly tied to your loan-to-value ratio.

- Loan-to-Value (LTV) Ratio: LTV is just the industry’s way of looking at your down payment from the other side. If you put 10% down, your LTV is 90%. The higher that LTV, the higher the lender’s risk, and the higher your PMI premium will be.

- Debt-to-Income (DTI) Ratio: Even with a great credit score, a high DTI can be a red flag for insurers. It shows how much of your monthly income is already spoken for by other debt payments. If you’re stretched too thin, they’ll charge you more. Knowing how to calculate your debt-to-income ratio is a non-negotiable skill for any serious homebuyer.

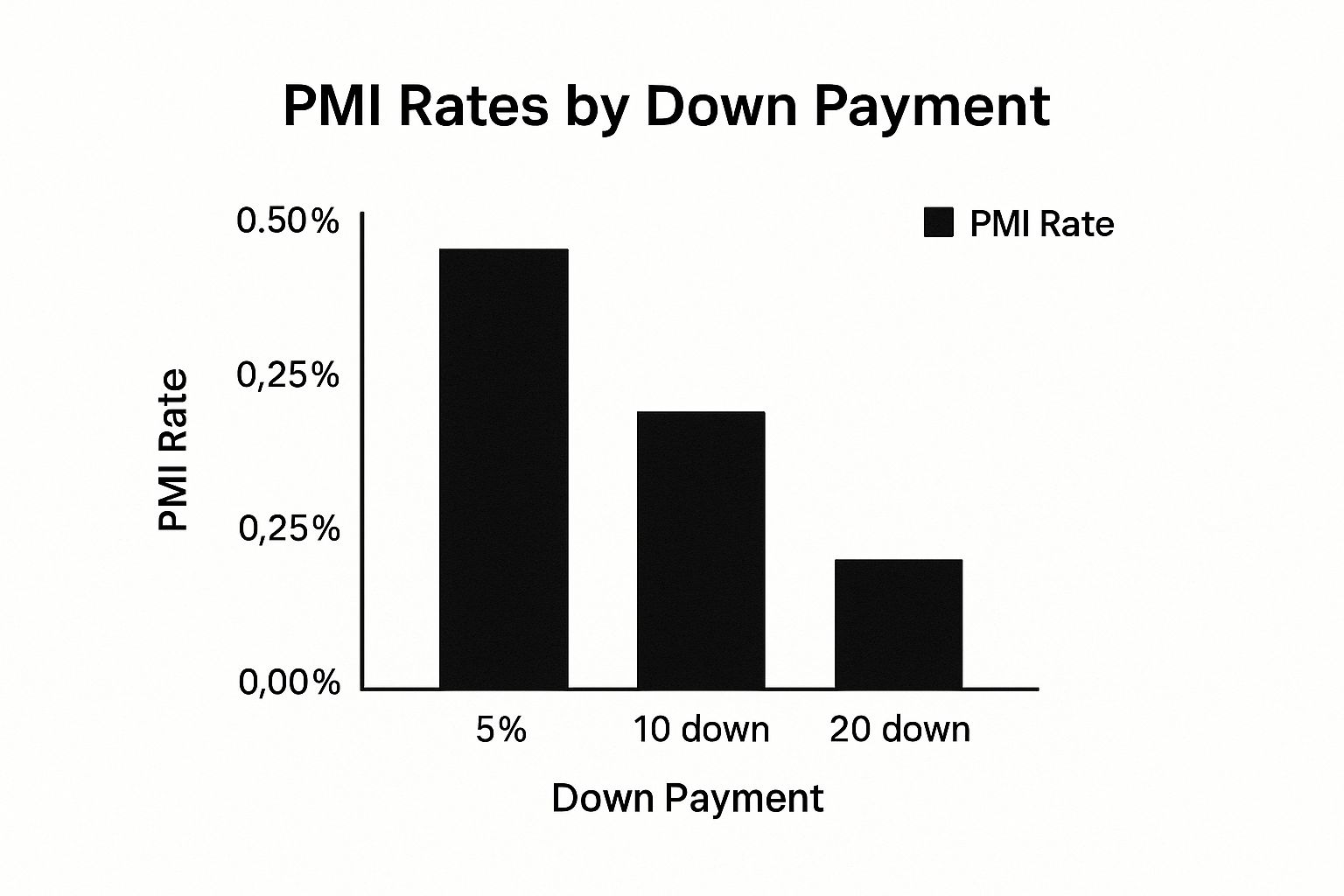

This chart shows just how much your down payment can move the needle on your PMI rate.

As you can see, jumping from a 5% down payment to 10% can literally cut your PMI rate in half. That’s real money back in your pocket every month.

Putting It All Together: A Real-World Example

Let’s meet Jordan. She’s found a $350,000 house she loves, has a solid 720 credit score, and has saved up a 10% down payment ($35,000). This leaves her with a total loan amount of $315,000.

Because of her good credit and decent down payment, her lender offers her a PMI factor of 0.25%.

Here’s the simple math:

$315,000 (Loan Amount) x 0.0025 (PMI Rate) = $787.50 per year

$787.50 / 12 months = $65.63 per month

So, Jordan’s PMI will add an extra $65.63 to her monthly mortgage payment. But what if her situation were different? A lower credit score or a smaller down payment can make those numbers jump dramatically.

The difference between a great credit score and a fair one can mean paying thousands of extra dollars over just a few years. It pays, quite literally, to manage your credit well before you apply for a mortgage.

To see just how much these factors matter, take a look at the table below. It shows the estimated monthly PMI for the same $350,000 loan, but with different credit scores and down payment amounts.

Estimated Monthly PMI Costs by Credit Score and Down Payment

| Credit Score Range | 5% Down Payment (Est. PMI) | 10% Down Payment (Est. PMI) | 15% Down Payment (Est. PMI) |

|---|---|---|---|

| 760+ (Excellent) | ~$130 | ~$60 | ~$45 |

| 700-759 (Good) | ~$185 | ~$80 | ~$60 |

| 660-699 (Fair) | ~$270 | ~$155 | ~$115 |

The lesson here is crystal clear. Every point on your credit score and every dollar you can add to your down payment has a direct and significant impact on how much you’ll pay in the long run.

Your Game Plan for Ditching PMI

Look, paying for private mortgage insurance is a necessary evil for some, but it’s definitely not a life sentence. The good news? PMI is built to be temporary. Your mission is to get this extra cost off your monthly statement as fast as humanly possible, and thankfully, there’s a clear playbook to get it done.

You’re not going into this fight alone, either. The law is actually on your side. The Homeowners Protection Act of 1998, sometimes called the “PMI Cancellation Act,” gives you specific rights. It basically forces your lender to drop PMI once you’ve built up enough equity.

There are two main ways to win this game: letting it happen automatically (the lender’s job) or taking matters into your own hands (your proactive move). Let’s break down how to make both work for you.

The Slow-and-Steady Route: Automatic Termination

Think of this as the safety net. Your lender is legally required to automatically kill your PMI payment on the date your mortgage balance is scheduled to hit 78% of your home’s original value. This only works if you’re up-to-date on your payments, of course.

This is the “set it and forget it” approach. If you just keep making your regular payments month after month, year after year, the PMI will eventually just disappear.

But who wants to be slow and steady when you can be fast and strategic?

Your Proactive Play: Borrower-Requested Cancellation

This is where you take control of the timeline. Instead of waiting patiently for that 78% loan-to-value (LTV) mark, you can demand that your lender cancel PMI as soon as your loan balance hits 80% of the original home value. That 2% difference might sound tiny, but it can easily translate into months, or even years, of payments you don’t have to make—saving you hundreds, if not thousands, of dollars.

The key takeaway is that PMI is not permanent. Federal law mandates automatic cancellation when your mortgage hits 78% of the property’s original value. But you can—and should—actively request its removal sooner, once you reach 80% LTV. This might mean getting a new appraisal, but it’s almost always worth it. To get into the nitty-gritty, you can explore more about these PMI regulations and your rights as a homeowner to understand the specifics.

To get the ball rolling on an early cancellation, you’ll need to have your ducks in a row. The bank isn’t just going to take your word for it.

- Make a Formal Request: You have to actually ask for it. This isn’t a phone call; it’s a formal written request sent directly to your mortgage servicer.

- Have a Good Payment History: No surprises here. Lenders want to see you’ve been a reliable borrower. Being current on your payments is completely non-negotiable.

- No Other Liens on the Property: You can’t have other loans hanging around, like a second mortgage or a home equity line of credit (HELOC).

- Prove Your Home’s Value: This is the big one. If your equity has shot up because the market is hot—not just because you’ve been paying down your loan—you’ll almost certainly need to pay for a new home appraisal to prove it.

The Home Value Game Changer

In a rising real estate market, your home’s value can climb much faster than your loan balance drops. This is your golden ticket to getting rid of PMI way ahead of schedule.

Let’s run the numbers. Say you bought a home for $400,000 with a $380,000 loan. Two years fly by, and you’ve paid the loan down to $370,000. But the market in your neighborhood has been on fire. A new appraisal shows your home is now worth $480,000.

Your new LTV isn’t based on what you paid; it’s based on what it’s worth now. In this case, your new LTV is 77% ($370,000 loan / $480,000 value). You’ve just blown past the 80% threshold. That $300-$500 you spend on an appraisal could save you thousands in future PMI payments. It’s a no-brainer.

Here’s your checklist for making the request:

- Check Your Mortgage Statement: Find your current principal balance.

- Estimate Your Home’s Value: Use online tools as a rough guide, but don’t treat them as gospel.

- Contact Your Lender: Call them up and ask for their specific PMI cancellation requirements. Every servicer has its own process.

- Order a New Appraisal (If Needed): Your lender will help coordinate this. They have a list of approved appraisers.

- Submit Your Written Request: Once you have the appraisal in hand, send your formal, written request to have the PMI removed.

Smart Strategies to Avoid PMI from the Start

While getting rid of private mortgage insurance is a solid goal, avoiding it altogether is the ultimate power move. Of course, the most direct path is putting down 20%, but let’s be real. In a market where monthly home payments can skyrocket 82% in just a few years, scraping together that much cash can feel like an impossible mountain to climb.

The good news? A massive down payment isn’t the only way to win this game. With some creative thinking and a bit of strategy, you can sidestep this extra monthly cost entirely.

Look Into Piggyback Loans

One of the sharpest tools in the shed is the “piggyback loan,” usually structured as an 80-10-10 mortgage. It sounds like industry jargon, but the idea behind it is brilliant.

Here’s the breakdown:

- Your Down Payment: You bring 10% of the purchase price to the table.

- Your Main Mortgage: The primary lender finances 80% of the home’s value—the magic number that lets you dodge PMI.

- The Piggyback Loan: You take out a smaller, second mortgage for the remaining 10%.

Sure, you’ll have two mortgage payments instead of one. But often, the combined total is actually less than what you’d pay for one big mortgage plus that pesky PMI fee. On top of that, the interest on the second loan might even be tax-deductible.

This strategy is a clever financial workaround. It lets you satisfy the lender’s 80% loan-to-value requirement without needing the full 20% down payment in cash, saving you a ton of money in those critical first years of homeownership.

Consider Lender-Paid Mortgage Insurance

Another route is Lender-Paid Mortgage Insurance (LPMI). With this setup, you won’t see a separate PMI charge on your monthly statement. Instead, the lender covers the insurance policy upfront and, in exchange, charges you a slightly higher interest rate for the life of the loan.

The catch is permanence. You can eventually cancel traditional PMI, but that higher interest rate from LPMI is with you until you sell the house or refinance. It’s a classic trade-off: lower monthly payments right now for potentially higher costs over the long haul.

Bridge the Gap with Assistance Programs

Never, ever underestimate the power of a helping hand. Down payment assistance (DPA) programs exist specifically to help buyers get over that first major financial hurdle. These programs can provide grants (which you don’t have to repay) or low-interest loans to cover a chunk, or even all, of your down payment.

If you can secure enough assistance to hit that 20% threshold, you eliminate the need for PMI right out of the gate. So many buyers, especially first-timers, have no idea these resources are even out there. Digging into the various down payment assistance programs in California is a crucial first step for anyone looking to buy in the Golden State. It’s the kind of research that could turn your dream of owning a home into a reality much sooner than you think.

Common Questions About Private Mortgage Insurance

Even after you think you’ve got PMI figured out, a few questions always seem to linger. Let’s cut through the noise and give you the straight answers. Think of this as the final cheat sheet to clear up any confusion before you move forward.

Is Private Mortgage Insurance Tax Deductible?

The tax deductibility of PMI has been a moving target for years. Congress seems to love playing with this one. What was deductible last year might not be this year, and vice versa.

Whether you can write it off depends entirely on the current tax code when you file. This is non-negotiable: consult with a qualified tax professional or check the latest IRS rules. Don’t ever assume it’s a sure thing based on old information—that’s a recipe for a nasty surprise.

What Is the Difference Between PMI and FHA Mortgage Insurance?

The simplest way to think about it is that they’re tied to different loan types. PMI is for conventional loans—the kind you get from a private bank or lender. Mortgage Insurance Premium (MIP), on the other hand, is exclusively for government-backed FHA loans.

The real kicker is how long you’re stuck with it. FHA MIP, especially on loans with less than 10% down, is often for the entire life of the loan. You can’t just cancel it. PMI, however, is designed to disappear once you’ve paid down your loan and built up enough equity.

Another key difference is how the rates are set. PMI rates are very personal; they’re heavily based on your credit score and how much you put down. FHA MIP rates are much more standardized for all borrowers, regardless of their individual financial picture.

Can I Pay PMI as a Single Lump Sum?

Yes, you can. It’s often called “single-premium PMI,” and it means you pay the entire insurance cost in one big chunk at closing.

The upside is obvious: you completely wipe out that extra monthly PMI payment, which makes your regular mortgage payment lower. But there’s a trade-off. It requires a lot more cash upfront, and you typically won’t get a refund if you sell or refinance the house just a few years later. It’s a gamble—betting higher upfront costs against lower monthly payments down the road.

Navigating the home buying process, from tricky details like PMI to finally getting the keys, takes real expertise. The team at ACME Real Estate is here to give you clear, honest advice so you can make the smartest moves on your path to homeownership. See what’s possible with us at https://www.acme-re.com.