So you’re diving into the real estate mosh pit, and you hear the term “appraisal contingency.” What is it? Think of it as your ripcord if the deal starts to go into a nosedive. Plain and simple, this clause is a non-negotiable part of a smart offer. It lets you back out of the contract—with your deposit in hand—if a licensed appraiser decides the home is worth less than what you agreed to pay. It’s your ultimate protection against overpaying or getting stuck with a bad mortgage before you even get the keys.

Your Financial Safety Net in the Home Buying Game

Let’s play this out. You find a place that feels like the one, you beat out a handful of other offers, and the seller accepts. The adrenaline is pumping, but so are the financial risks. This is precisely where the appraisal contingency clause proves its worth, acting as your personal parachute if things go sideways.

Think of it as a get-out-of-jail-free card in the sometimes-brutal game of real estate. Without it, you could be legally handcuffed to a deal for a price that an impartial, professional appraiser has flagged as inflated.

Why This Clause Is Your Best Friend

So, what does an appraisal contingency actually do for you? It’s a condition written directly into the purchase agreement that gives you an exit hatch. If the appraisal comes in low, this clause activates, and suddenly you have the power.

Here’s what you can do:

- Renegotiate the price with the seller to match the new, lower appraised value.

- Walk away from the entire deal and, most importantly, get your earnest money deposit back.

- Pay the difference in cash if you absolutely love the home and can’t bear to lose it. But crucially, that’s your choice.

This protection became standard practice after the 2008 housing crisis when everyone—lenders and buyers alike—woke up to the danger of mortgages being larger than a property’s true value. In fact, between 2019 and 2020, the use of appraisal contingencies increased by about 15% as savvy buyers armed themselves in a white-hot market.

To give you a quick cheat sheet, here’s how the appraisal contingency breaks down in a real transaction.

Appraisal Contingency at a Glance

| Component | What It Means for You |

|---|---|

| The Clause | A specific condition in your offer making the sale dependent on a satisfactory appraisal. |

| The Trigger | A professional appraisal that values the home for less than your agreed-upon purchase price. |

| Your Options | Renegotiate the sale price, pay the cash difference, or cancel the contract and get your deposit back. |

| The Goal | To protect your investment and ensure your lender will finance the loan based on the home’s verified worth. |

Ultimately, having this in your back pocket gives you leverage and options when you need them most.

The appraisal contingency isn’t just about the numbers; it’s about giving you control and confidence. It ensures the price you pay is backed by the property’s verified market worth, preventing you from starting your homeownership journey on shaky financial ground.

Of course, knowing what an appraiser is looking for is half the battle. Learning how smart upgrades can add value to your home gives you a homeowner’s perspective on what truly drives a property’s worth.

How the Appraisal Contingency Actually Works

So, you’ve put an appraisal contingency in your offer—great move. Now what happens? Let’s walk through the actual process, from the moment the seller signs to the day you get that all-important appraisal report. This isn’t some tangled legal mess; it’s a straightforward sequence of events designed to protect you and your money.

First, your agent writes the contingency clause directly into your purchase agreement. Once the seller signs on the dotted line, your offer is officially accepted, and the clock starts ticking on your contingency timeline.

Kicking Off the Appraisal Process

The very first thing that happens is your mortgage lender gets to work. They are the ones who order the appraisal from an independent, licensed appraiser. Why them? Because they have a massive stake in the property’s value.

Think about it: the bank isn’t going to lend you hundreds of thousands of dollars for an asset that isn’t worth the price. They need a professional, third-party opinion to verify the home’s value before they commit that kind of capital.

The appraiser’s job is to be completely unbiased. They have no skin in the game—they don’t care if your deal closes or falls apart. Their only task is to determine the home’s fair market value. They do this by analyzing recent sales of similar nearby homes (comps), inspecting the property’s condition, and noting its unique features. If you want to dive deeper into how this all works, our guide on how to determine home value breaks it all down.

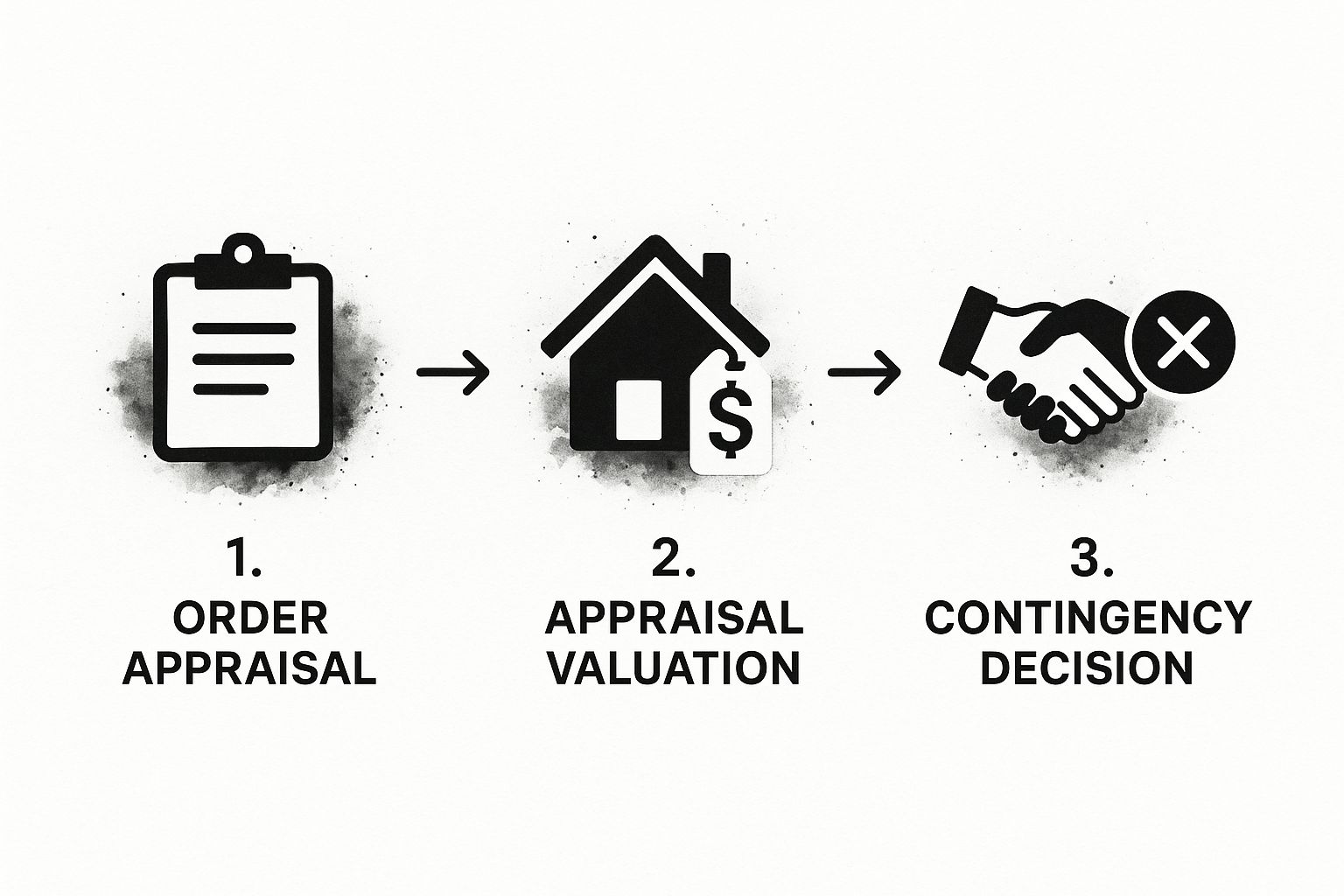

The whole process is a pretty simple chain of events.

As you can see, the lender’s order sets the valuation in motion, which leads directly to a decision based on what your contingency allows.

The Moment of Truth: The Appraisal Report

After the appraiser inspects the property and crunches the numbers, they send a formal appraisal report to your lender. This report is the moment of truth.

- If the value is at or above your offer: Perfect! The deal moves forward as planned. Your contingency did its job by confirming the home’s worth, and you can head toward closing with total confidence.

- If the value comes in low: This is when your appraisal contingency is triggered. It doesn’t automatically kill the deal. What it does is give you options and serious leverage. Your financial safety net has just been deployed.

An appraisal contingency isn’t just a piece of paper; it’s the mechanism that turns a professional valuation into real power for you, the buyer. It transforms the appraiser’s report from a simple number into a critical tool for negotiation or a safe way out.

What to Do When the Appraisal Comes in Low

This is the moment every buyer dreads. The email lands, you open the report, and the number is… lower than your offer. A lot lower. But this is exactly where your appraisal contingency proves its worth. A low appraisal isn’t a deal-killer; think of it as a fork in the road where you suddenly get to decide which path to take.

When the appraised value comes in below what you agreed to pay, your contingency kicks in, and the ball is suddenly in your court. This isn’t a time to panic—it’s a time for strategy. You now have leverage, hard data, and most importantly, options.

This isn’t just a hyper-local issue; buyers everywhere are waking up to the need for this protection. In markets across the world, savvy buyers are protecting their investments from the risk of overpaying. You can discover more insights about these purchasing practices on howardhanna.com.

Your Three Strategic Paths Forward

With that low appraisal in hand, you have three primary moves. Each one comes with its own trade-offs, so you have to weigh them against your financial reality and just how much you want this specific house.

- Renegotiate with the Seller: This is almost always the first and most practical option. You have an independent, professional valuation showing the home’s market value. It’s not your opinion—it’s a fact-based report you can use to bring the seller back to the table.

- Cover the Appraisal Gap: If the seller won’t budge and you absolutely love the home, you can pay the difference in cash. This is what’s known as “covering the gap.” Your lender will only finance the appraised value, so the rest has to come straight from your pocket.

- Walk Away from the Deal: This is the ultimate safety net. If you can’t strike a new deal and you aren’t willing or able to cover the difference, you can cancel the contract. Thanks to the contingency, you get your earnest money deposit back in full.

Let’s break down how to approach each choice.

Making a Smart, Unemotional Decision

When the pressure is on, it’s easy to let emotion take the wheel. Here’s how to think through your options with a clear head.

Option 1: Renegotiate the Price

This is where your agent earns their commission. Their job is to go back to the seller and negotiate the purchase price down to match the new, appraised value. If you want to sharpen your own skills, our guide on how to negotiate a home price has more strategies. Sometimes a seller will only meet you halfway, meaning you’d still need to bring some cash to closing, but hopefully a lot less than the full gap.

Option 2: Cover the Gap

Before you start moving money around, run the numbers. Seriously. Does paying thousands of extra dollars out-of-pocket still make this a good long-term investment for you? Make sure you’ll still have plenty of cash left for closing costs, moving expenses, and a healthy emergency fund. Don’t leave yourself house-poor.

A low appraisal is a powerful reality check. It forces you to pause and re-evaluate if the home is truly worth the price you offered, protecting you from starting your homeownership journey with negative equity.

Option 3: Walk Away

Walking away can feel like a failure, but it’s often the smartest financial move you can make. There will always be another house. Recovering from a bad investment is a much harder, longer road. Your contingency exists for this exact scenario—to let you get out clean when a deal just doesn’t make sense anymore.

Should You Ever Waive the Appraisal Contingency?

In a blistering hot market, sellers are flooded with offers. To stand out, buyers get creative, and the temptation to waive the appraisal contingency is real. It’s a bold move, a power play that tells the seller you’re all-in. But let’s be crystal clear: this is a high-stakes gamble. You need to know exactly what you’re putting on the line before you play this card.

Waiving this contingency means you’re legally bound to buy the home for the agreed-upon price, no matter what the appraiser says it’s worth. If there’s an appraisal gap, you’re on the hook to cover every single dollar of it out of pocket. That could mean scrambling to find tens of thousands of dollars you never planned to spend.

When Waiving Might Make Strategic Sense

While it sounds terrifying—and it often is—there are a few specific scenarios where waiving the appraisal contingency can be a calculated risk, not just a reckless one. It’s definitely not a move for everyone, but for the right buyer, it can be the key to unlocking a dream home.

Think about these situations:

- You’re an all-cash buyer: If there’s no lender, there’s no appraisal requirement. The valuation is purely for your own peace of mind, and you have the final say on what the property is worth to you.

- You have deep financial reserves: If you have more than enough cash sitting on the sidelines to comfortably cover a large appraisal gap without breaking a sweat, waiving can be a powerful negotiating tool.

- You’re in a brutal bidding war: In some markets, waiving contingencies is practically the price of admission. If you and your agent have done your homework and feel confident in the property’s value, it might be the only way to get your offer accepted.

Even in the most competitive areas, the appraisal contingency remains a standard safety net. In many high-value markets, a significant majority of financed offers still include one to protect the investment. That alone shows just how vital this clause is for most people navigating high prices and low inventory. You can learn more about how contingencies play out in real estate transactions on usrealtytraining.com.

Major Red Flags to Consider

For the vast majority of buyers, especially anyone financing their purchase, waiving the appraisal contingency is a massive risk. If you don’t have the extra cash to bridge a potential gap, you could walk straight into a financial nightmare.

Waiving your appraisal contingency is like going all-in during a poker game. You might win big, but if your hand isn’t as strong as you think, you could lose your entire stake—in this case, your earnest money deposit.

Before you even entertain the idea, you need to have a brutally honest conversation with yourself. Are you truly prepared for the worst-case scenario? This is a decision that must be based on your personal risk tolerance and financial stability, not just the pressure of a cutthroat market.

To help you think it through, let’s lay out the potential upsides against the very real dangers.

Weighing the Pros and Cons of Waiving the Contingency

| Potential Pros (Why You Might Waive It) | Significant Cons (Why It’s Risky) |

|---|---|

| Makes your offer stronger: In a bidding war, a non-contingent offer can easily beat a higher offer that still has contingencies. | You could overpay: The appraisal is a professional, third-party valuation. Without it, you’re guessing what the home is actually worth. |

| Appeals to seller certainty: Sellers love a sure thing. Waiving shows them you’re serious and less likely to back out, which can be very persuasive. | You’re on the hook for the gap: If the home appraises low, you must cover the difference between the appraisal value and the sale price in cash. |

| Can win you the house: In hyper-competitive markets, it might be the only way your offer gets a second look, let alone accepted. | Your earnest money is at risk: If you can’t cover the gap, you could be forced to walk away and forfeit your entire earnest money deposit. |

| Speeds up the closing process: Fewer contingencies mean fewer potential delays, leading to a smoother and faster transaction for everyone involved. | You lose your negotiating power: The contingency gives you leverage to renegotiate the price or walk away. Without it, you have none. |

Ultimately, waiving the appraisal contingency boils down to a risk-reward calculation that is deeply personal. For a small fraction of buyers with the right financial cushion, it’s a strategic tool. For everyone else, it’s a gamble that could turn the dream of homeownership into a financial catastrophe.

Your Agent Is Your Front-Line Strategist

Think of your real estate agent as more than just a person who unlocks doors. They are your strategic partner, your negotiator on the front lines, and your expert on the ground. When it comes to the appraisal contingency, their experience is one of your most powerful assets.

A great agent doesn’t just fill in blanks on a form; they help you build an offer that’s both aggressive enough to win and smart enough to protect your finances.

This all starts with a brutally honest conversation before you even look at making an offer. You have to be upfront about your financial limits and how much risk you’re actually comfortable with. A seasoned agent takes that information and builds a strategy that keeps you safe without knocking you out of the running for a home you love.

Asking the Questions That Matter

Tapping into your agent’s real value begins with asking the right questions. Their answers give you a real-time snapshot of what’s happening in the market, helping you structure an offer that makes sense.

Before you sign anything, sit down with your agent and get answers to these points:

- Local Appraisal Reality: “How are homes in this specific neighborhood appraising right now? Are they hitting the sale price, or are we seeing gaps?”

- The ‘Comps’ We Can Defend: “What recent comparable sales back up our offer? How can we prove to the seller—and the appraiser—that our price is justified?”

- The Seller’s Mindset: “What do we actually know about the sellers? Do they need the absolute highest dollar, or is a quick, guaranteed closing more important to them?”

The answers here are everything. They turn your offer from a shot in the dark into a data-backed, strategic move. For more on this, check out our guide on how to find a good real estate agent who can deliver this kind of insight.

Building an Offer with Flexibility

In a competitive market, a simple all-or-nothing appraisal contingency often isn’t enough to win. A sharp agent will bring up more creative solutions, like a partial appraisal gap clause. This is a powerful middle ground where you agree to cover a potential appraisal shortfall, but only up to a specific amount you’re comfortable with.

For example, you could write an offer that includes this line: “Buyer agrees to pay up to $10,000 above the appraised value, not to exceed the purchase price.”

A single sentence like that can make your offer stand out immediately. It tells the seller you’re serious, confident, and have the cash to close even if the appraisal comes in a little low. This instantly reduces their fear of the deal collapsing.

Working with your agent this way ensures you’re making decisions based on strategy, not just crossing your fingers and hoping for the best.

Got Questions? We’ve Got Answers

As we wrap up, let’s hit a few of the most common questions that pop up around appraisals. Getting these straight can save you a lot of last-minute stress and really cement why this clause is your best friend in a real estate deal.

Appraisal vs. Financing Contingency

This one comes up all the time: “What’s the difference between an appraisal contingency and a financing contingency?” It’s a great question because they work together, but they protect you from two totally different landmines.

- The appraisal contingency is all about the house’s value. It’s your escape hatch if the property isn’t worth what you agreed to pay.

- The financing contingency is all about your loan. It protects you if, for some reason, your financial situation changes and the bank pulls your mortgage approval.

Think of it this way: one protects you from a bad deal on the house, and the other protects you if the bank decides you can’t afford the deal at all.

Fighting a Low Appraisal

So, what happens if the appraisal comes in low? Can you actually fight it? The short answer is yes, through a process called a “Reconsideration of Value.” But let’s be real—it’s an uphill battle.

You can’t just call up and say you disagree. You and your agent need to bring cold, hard facts. You have to prove the appraiser made a clear error—like getting the square footage wrong—or completely missed better, more recent comparable sales that justify the price you offered. Success isn’t a given, but if you have solid data, it’s a fight worth having.

The key to a successful appraisal challenge isn’t emotion; it’s data. You need to present indisputable facts—like incorrect square footage or much better recent comps—that justify a second look at the property’s value.

How Long Does This Take?

The timeline for an appraisal contingency is negotiable, but you’re typically looking at a 14- to 21-day window.

That period isn’t random. It’s calculated to give the lender time to order the appraisal, for the appraiser to do their inspection and research, and for everyone to get the final report back. It’s a crucial waiting game, and the outcome pretty much dictates the next move in your journey to closing day.

Navigating the wild world of real estate means having a partner who gets every angle of the deal. At ACME Real Estate, we make sure our clients are protected and empowered from the first offer to the final handshake. Find your dream home with a team that actually has your back at https://www.acme-re.com.