In real estate, guessing is a fool’s game. Whether you’re a homebuyer trying to find the right neighborhood in Los Angeles, a seller pricing your property to move, an investor hunting for the next big score, or a flipper calculating potential ROI, gut feelings don’t cut it. You need data, and you need it fast. The right real estate market analysis tools are the difference between a savvy investment and a costly mistake. They transform raw numbers into actionable insights, helping you understand market trends, property values, and the unique pulse of a neighborhood.

This guide cuts through the noise and gets straight to the good stuff. We’re diving deep into the best platforms out there, from the enterprise-grade titans of commercial real estate to the nimble tools perfect for individual investors. For each one, you’ll get a no-fluff breakdown of its core features, honest pros and cons, pricing, and who it’s really for. We’ve included screenshots and direct links to get you started immediately. These platforms aggregate complex info from countless sources—to get a peek under the hood at how they do it, exploring a comprehensive property data API guide is a solid move. Let’s find the perfect tool to sharpen your market edge.

1. CoStar Market Analytics

CoStar Market Analytics is the heavyweight champion of commercial real estate (CRE) data. If you’re a serious investor, broker, or developer, this platform is your command center for making high-stakes decisions. It’s not about finding a single listing; it’s about an institutional-grade deep dive into market and submarket performance, from vacancy rates and rental trends to the new construction pipeline.

What makes CoStar one of the best real estate market analysis tools is its sheer scale and obsession with verified data. We’re talking about millions of properties and tens of millions of sales and lease comps, all vetted by a massive research team. This lets you generate robust forecasts and customized reports that can justify a major investment or guide a lending decision with confidence.

Key Info & Considerations

- Best For: Commercial real estate investors, appraisers, lenders, and brokers who need the best data money can buy.

- Pricing: Enterprise-level subscription; requires a demo and custom quote. This is a premium, high-cost tool.

- Pros: Unmatched depth of verified CRE data, powerful forecasting models, integrated with property-level details.

- Cons: Prohibitively expensive for individuals or residential agents; it’s laser-focused on commercial assets.

The platform isn’t for a casual homebuyer, but for those navigating the complex world of CRE, CoStar provides the intelligence needed to operate like a pro.

Website: CoStar Market Analytics

2. LoopNet

While CoStar is the research engine, LoopNet is the massive public-facing marketplace where commercial real estate deals happen. Think of it as the Zillow for CRE, providing unparalleled visibility for property listings. For brokers and owners, its primary function isn’t deep-dive analytics but rather market exposure, connecting available properties with a vast audience of potential tenants and investors.

What makes LoopNet a crucial part of the real estate market analysis tools ecosystem is its direct connection to on-the-ground action. While its analytics are more basic, reviewing active listings, absorption rates, and asking prices on LoopNet gives you a real-time pulse of a specific submarket, like what’s happening with Los Angeles real estate market trends. The platform leverages paid ad packages to boost a listing’s visibility, making it a key marketing tool rather than a pure research suite.

Key Info & Considerations

- Best For: Commercial real estate brokers, property owners, and tenants looking for market exposure and active listings.

- Pricing: Paid listing packages (Silver, Gold, Platinum, Diamond) with opaque pricing; requires a custom quote.

- Pros: Access to a massive audience for faster lease/sale times, flexible listing packages, great for gauging real-time market activity.

- Cons: Analytics are limited compared to dedicated research suites; premier listing placement can be costly.

LoopNet excels at the marketing and discovery phase, offering the reach you need to get deals done in a competitive arena.

Website: LoopNet Ad Packages

3. CREXI Intelligence

CREXI Intelligence is the accessible yet powerful analytics engine built directly into the popular CREXI commercial real estate marketplace. While the main site connects brokers and buyers, the Intelligence plan unlocks a layer of data that transforms it into a formidable real estate market analysis tool. It’s designed for the modern broker or investor who needs to move fast from spotting an opportunity to validating it with hard data.

What sets CREXI Intelligence apart is its seamless integration of market data with its active listing platform. You can analyze over 150 million property records, dig into millions of sales comps, and then immediately see what’s for sale in that same submarket. Its interactive mapping tools overlay crucial data like traffic counts, demographics, and even flood zones, providing context that helps you make smarter, faster decisions without toggling between platforms.

Key Info & Considerations

- Best For: Commercial real estate brokers, investors, and principals needing integrated market data and listing access.

- Pricing: Intelligence plan has clear monthly or annual subscription options; PRO and Enterprise plans require custom quotes.

- Pros: Straightforward pricing for its core analytics plan, practical map layers, and direct integration with an active marketplace.

- Cons: Data may be less comprehensive than top-tier dedicated research platforms in some smaller markets; PRO plan costs can vary.

This platform hits a sweet spot, offering robust analytics without the enterprise-level price tag or complexity of more institutional tools.

Website: CREXI Intelligence

4. MSCI Real Capital Analytics (RCA)

When your focus shifts from a single property to the global flow of capital, MSCI Real Capital Analytics (RCA) is the tool you need. This platform is less about a building’s specs and more about understanding large-scale investment trends, transaction volumes, and pricing dynamics. It’s built for the institutional players who need to track where money is moving, who is buying, and at what price, on a global scale.

What makes RCA one of the most powerful real estate market analysis tools is its laser focus on transaction data and capital markets. With a database covering millions of deals across 170+ countries, it provides unparalleled insight into commercial real estate pricing through its respected RCA CPPI indices. This macro-level view is critical for portfolio managers and institutional investors performing high-level real estate due diligence.

Key Info & Considerations

- Best For: Institutional investors, portfolio managers, and global CRE analysts.

- Pricing: Enterprise-level, quote-based subscription. Not intended for individuals or small firms.

- Pros: Unmatched global data on CRE capital flows and pricing, powerful proprietary indices (RCA CPPI), and strong API integration capabilities.

- Cons: Extremely high cost, making it inaccessible for most users; its exclusive focus on commercial transactions offers little for the residential market.

For those operating at the highest echelons of the CRE world, RCA provides the essential intelligence to navigate global market currents.

Website: MSCI Real Capital Analytics (RCA)

5. Yardi Matrix

Yardi Matrix is the specialist’s toolkit, especially for those deep in the multifamily, student, and affordable housing sectors. While other platforms cast a wide net, Yardi drills down with exceptional granularity, providing property-level research, meticulously tracked rent and occupancy comps, and detailed construction pipeline data. It’s the go-to resource when your investment thesis hinges on the nuances of apartment building performance.

What makes Yardi Matrix one of the sharpest real estate market analysis tools is its focus on asset-specific operational data. You can access owner and management contacts, explore existing loan data with maturity dates, and leverage robust forecasts for rent and occupancy. This empowers developers, lenders, and owners to not just see the market, but to understand the key players and capital stacks driving it.

Key Info & Considerations

- Best For: Multifamily investors, developers, lenders, and brokers focused on apartment, student, or affordable housing.

- Pricing: Enterprise-level; requires a custom quote and demo. There is no public pricing available.

- Pros: Unparalleled depth in multifamily and affordable housing data, includes valuable operational details like owner contacts and loan info, produces frequent and insightful market reports.

- Cons: Pricing is customized and not transparent; market coverage can be less comprehensive for asset classes outside of its core focus.

For those navigating the competitive multifamily landscape, Yardi Matrix delivers the specialized intelligence needed to gain a serious edge.

Website: Yardi Matrix

6. Moody’s Analytics CRE

Moody’s Analytics CRE brings its legendary financial modeling and forecasting prowess to commercial real estate. Where some platforms focus purely on property data, Moody’s excels at layering in complex economic and climate risk data, making it a powerhouse for sophisticated underwriting and long-term strategic planning. This isn’t just about what a market is doing now; it’s about projecting its future performance under various economic scenarios.

What sets Moody’s apart among real estate market analysis tools is its powerful integration of CMBS (Commercial Mortgage-Backed Securities) data and forward-looking climate risk overlays. This unique combination allows institutional investors and lenders to stress-test their portfolios against both financial and environmental factors, providing a more holistic view of asset resilience. It’s the tool you turn to when the “what ifs” are just as important as the “what is.”

Key Info & Considerations

- Best For: Institutional investors, capital markets, and lenders focused on CRE underwriting and portfolio risk management.

- Pricing: Enterprise-level pricing with custom quotes based on data needs; not structured for individual users.

- Pros: Exceptional forecasting capabilities, unique integration of climate risk and CMBS data, and deep analyst narratives for market insights.

- Cons: Pricing is less transparent and geared toward large institutions; its exclusive CRE focus makes it unsuitable for residential use cases.

For pros who need to justify multi-million dollar decisions with rigorous, forward-looking analytics, Moody’s provides an unmatched level of depth.

Website: Moody’s Analytics CRE

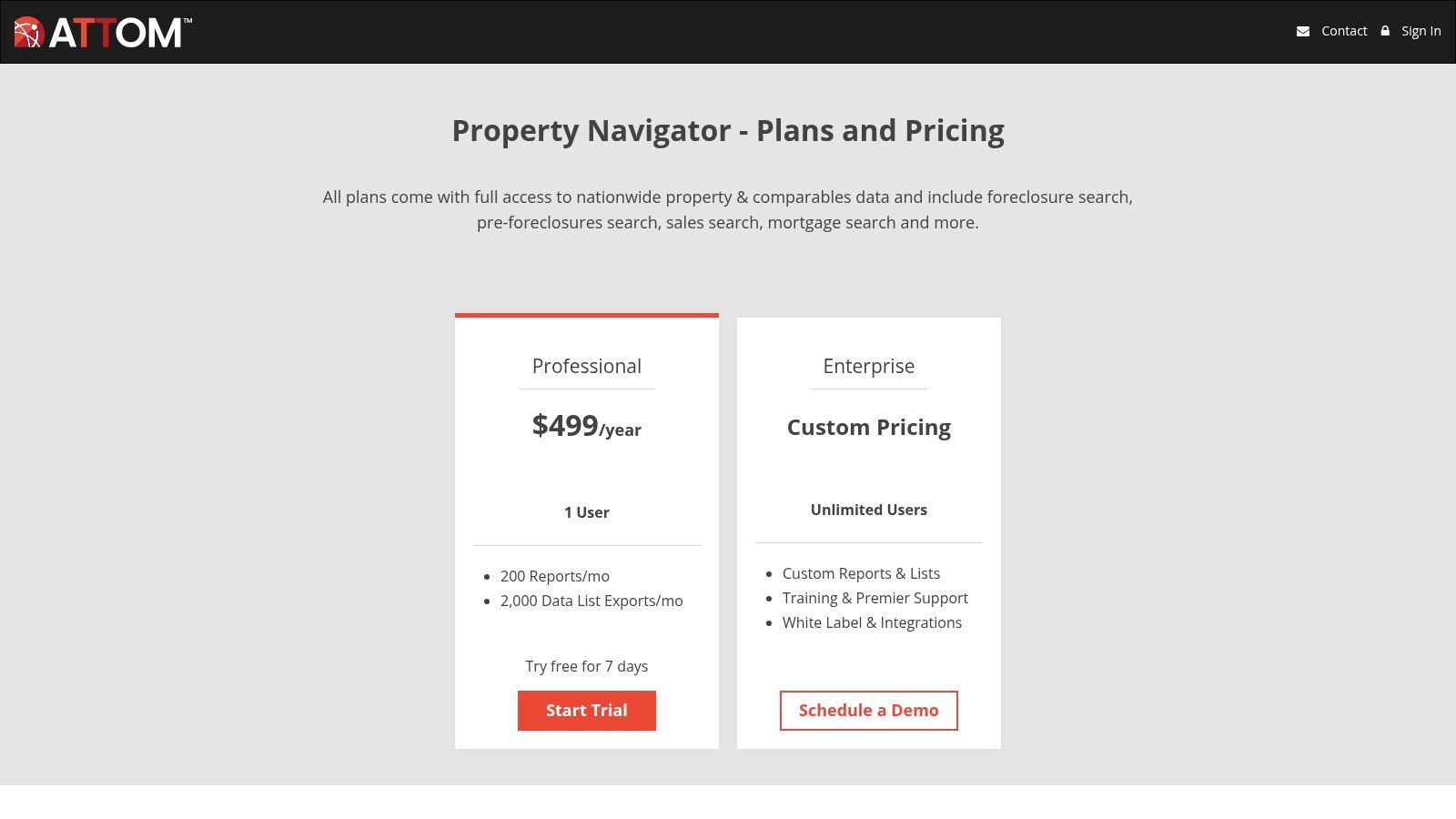

7. ATTOM Property Navigator

ATTOM Property Navigator strikes a powerful balance, offering a comprehensive U.S. property database that serves both residential and commercial real estate pros without the enterprise-level price tag. It’s a workhorse for investors, brokers, and appraisers who need to move beyond basic listings to access deep property data, including foreclosure activity, automated valuation models (AVMs), and comparable sales reports across a staggering 150 million properties.

What makes ATTOM one of the most practical real estate market analysis tools is its focus on accessible, exportable data. You can pull detailed property lists for marketing campaigns or analysis, complete with rental AVMs and environmental data like flood zones. This functionality makes it an excellent engine for identifying investment opportunities or building a hyper-targeted client list, bridging the gap between free public records and high-cost institutional platforms.

Key Info & Considerations

- Best For: Real estate investors, data-driven agents, and smaller brokerages.

- Pricing: Annual subscriptions available, with plans like the “Professional” tier offering specific monthly report and export quotas. This is more accessible than enterprise solutions.

- Pros: Affordable entry-point for serious data, great balance of features for investors and agents, robust data export capabilities.

- Cons: Report and export limits on lower-tier plans can be restrictive for power users; advanced analytics are less comprehensive than top-tier competitors.

For professionals who need to generate leads and perform due diligence with reliable data, ATTOM provides a scalable and robust toolkit.

Website: ATTOM Property Navigator

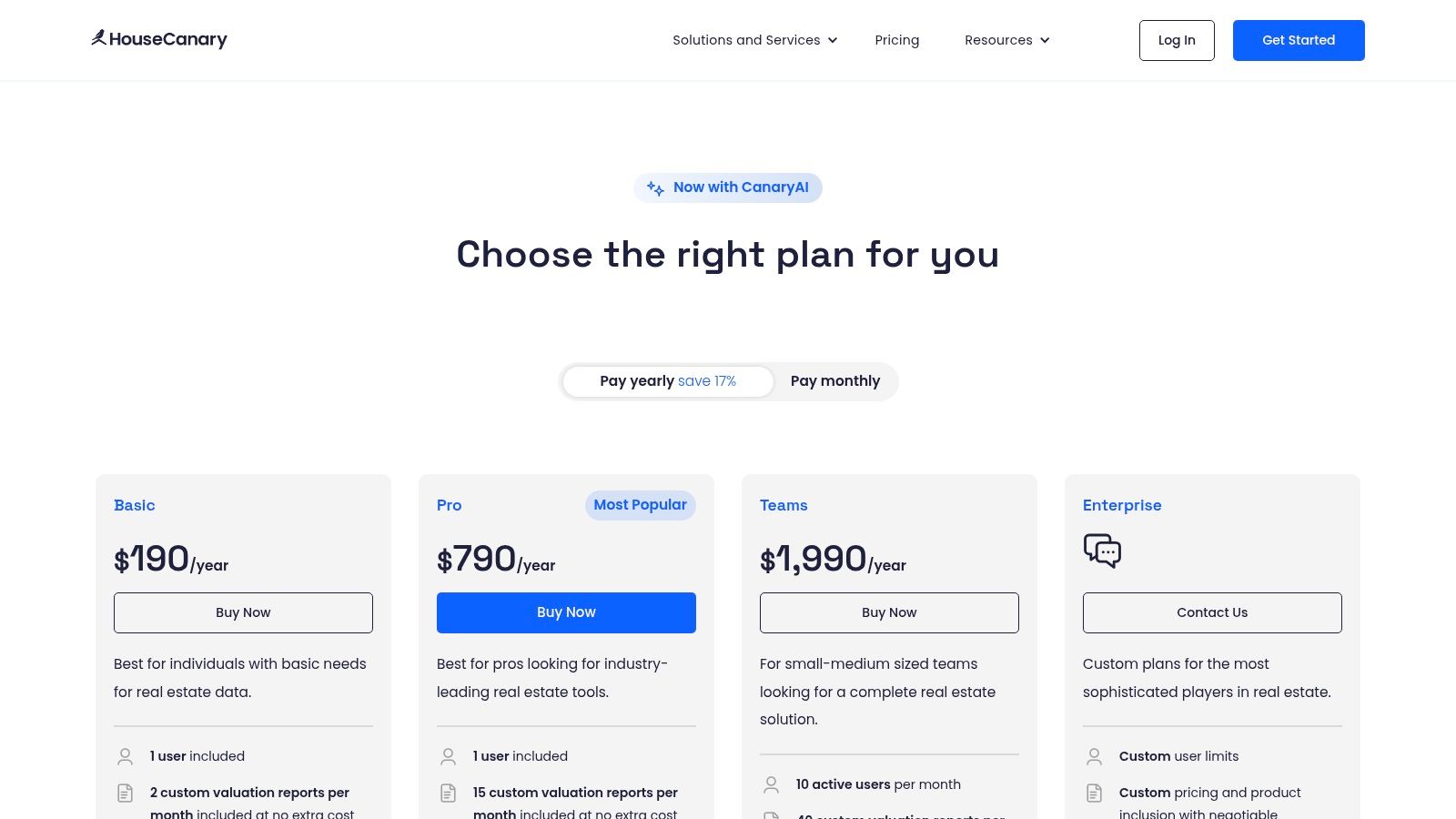

8. HouseCanary

HouseCanary delivers residential market intelligence with a serious tech edge, blending automated valuation models (AVMs) with powerful forecasting. It’s a go-to platform for investors, lenders, and brokerages who need to move beyond simple comps and integrate sophisticated valuation workflows into their operations. Think of it as a crystal ball for your residential assets, powered by data science.

What makes HouseCanary one of the sharpest real estate market analysis tools is its API access and dedicated solutions for professional teams. You can pull detailed property analytics and process data in bulk, a game-changer for scaling investment strategies or brokerage services. Its CanaryAI and detailed market insights provide a forward-looking perspective that is critical for navigating volatile housing markets with confidence.

Key Info & Considerations

- Best For: Residential investors, lenders, iBuyers, analysts, and brokerages needing advanced valuation and forecasting.

- Pricing: Transparent tiered pricing is available, from individual reports to enterprise API access. Per-report and API usage fees can apply.

- Pros: Strong valuation and forecasting tools, services tailored for brokerages and institutions, transparent pricing tiers.

- Cons: Focused exclusively on the residential market; lower tiers may incur significant per-use fees.

For those who treat residential real estate as a science, not a guessing game, HouseCanary provides the high-octane data needed to build and manage a profitable portfolio.

Website: HouseCanary

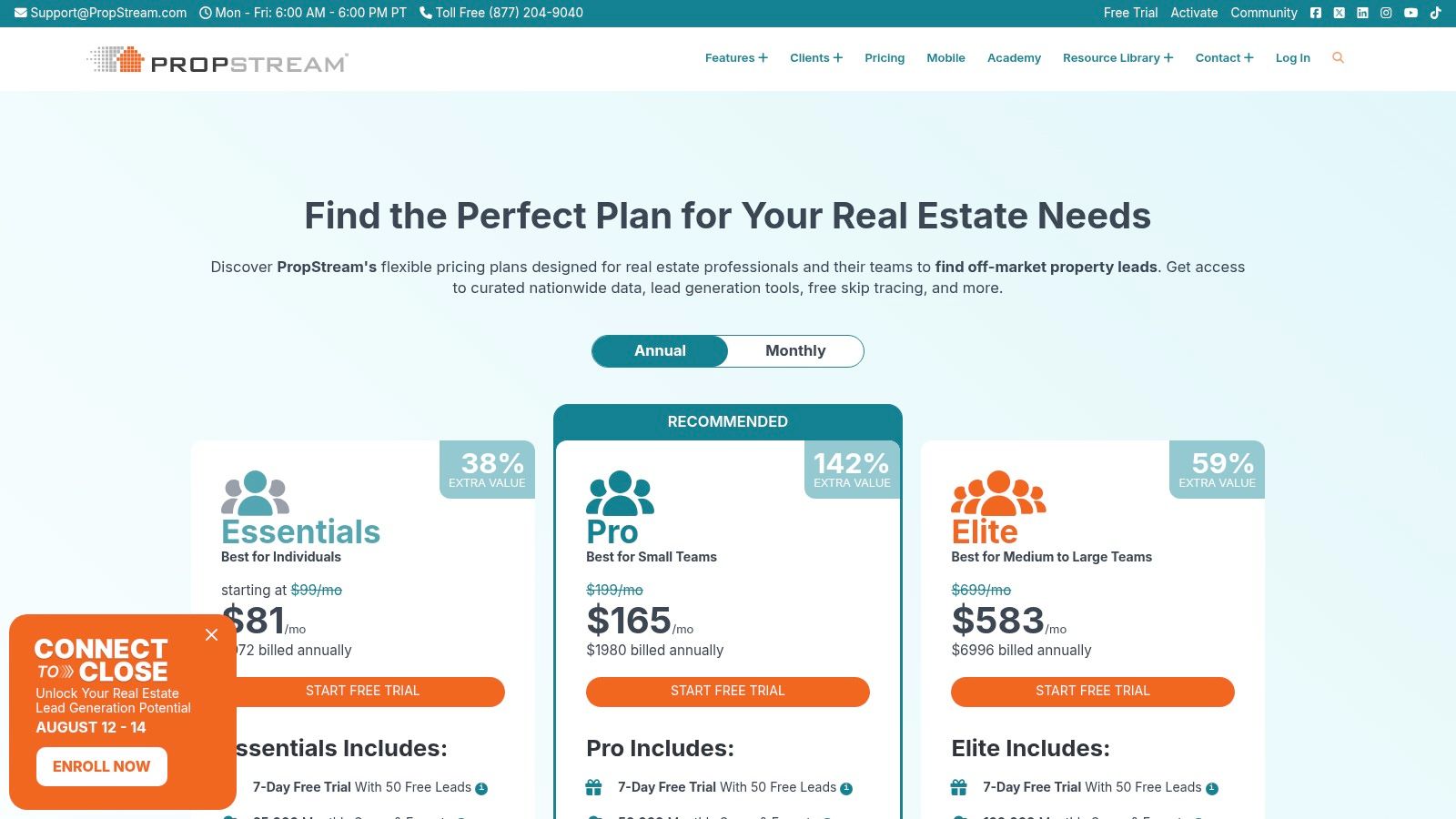

9. PropStream

PropStream is the Swiss Army knife for real estate investors, flippers, and wholesalers who need to find deals, not just analyze markets. It brilliantly merges robust property data with powerful lead generation and marketing tools, creating a one-stop shop for active acquisition. You can go from identifying a promising neighborhood using heat maps to pulling a targeted list of distressed properties and launching a direct mail campaign, all within a single platform.

What makes PropStream a standout among real estate market analysis tools is its action-oriented design. Instead of just presenting data, it gives you over 160 million property records and 165+ filtering options (like pre-foreclosures or high equity) to pinpoint motivated sellers. This focus on finding and acting on opportunities, rather than just passive analysis, gives investors a serious leg up in competitive markets.

Key Info & Considerations

- Best For: Real estate investors, wholesalers, flippers, and agents focused on lead generation.

- Pricing: Monthly subscription plans available, typically starting around $99/month, with add-ons for team members and extra services.

- Pros: Excellent for finding off-market deals, integrates lead generation with property analysis, mobile app for on-the-go research.

- Cons: Some marketing and skip tracing features cost extra per use; data depth can vary in certain rural or non-disclosure areas.

For the investor on the hunt, PropStream provides the intel and the tools needed to turn market insights into profitable deals.

Website: PropStream

10. Reonomy by Altus Group

Reonomy is the ultimate prospecting tool for commercial real estate professionals hunting for off-market deals. Where other platforms focus on broad market trends, Reonomy drills down into property-level intelligence, helping you uncover not just what a property is, but who owns it. This makes it a goldmine for brokers, investors, and service providers aiming to connect directly with decision-makers.

What truly sets Reonomy apart as one of the best real estate market analysis tools is its uncanny ability to unmask the ownership behind LLCs. It connects disparate properties to a single owner, revealing entire portfolios you wouldn’t otherwise see. With over 200 filters, you can slice and dice its massive database of 54 million properties to find hyper-specific opportunities, from properties with a certain loan-to-value ratio to those in specific opportunity zones.

Key Info & Considerations

- Best For: Commercial real estate brokers, investors, and service providers focused on prospecting and off-market deal sourcing.

- Pricing: Enterprise-level subscription; requires a demo and custom quote. Not designed for individual or residential use.

- Pros: Excellent ownership unmasking capabilities for targeted outreach, flexible data delivery via web app, API, or bulk feeds.

- Cons: No publicly available pricing makes it difficult to budget for; data coverage and predictive accuracy can vary by market.

For those whose success hinges on finding the next deal before it hits the market, Reonomy provides the intel to build a powerful and targeted pipeline.

Website: Reonomy by Altus Group

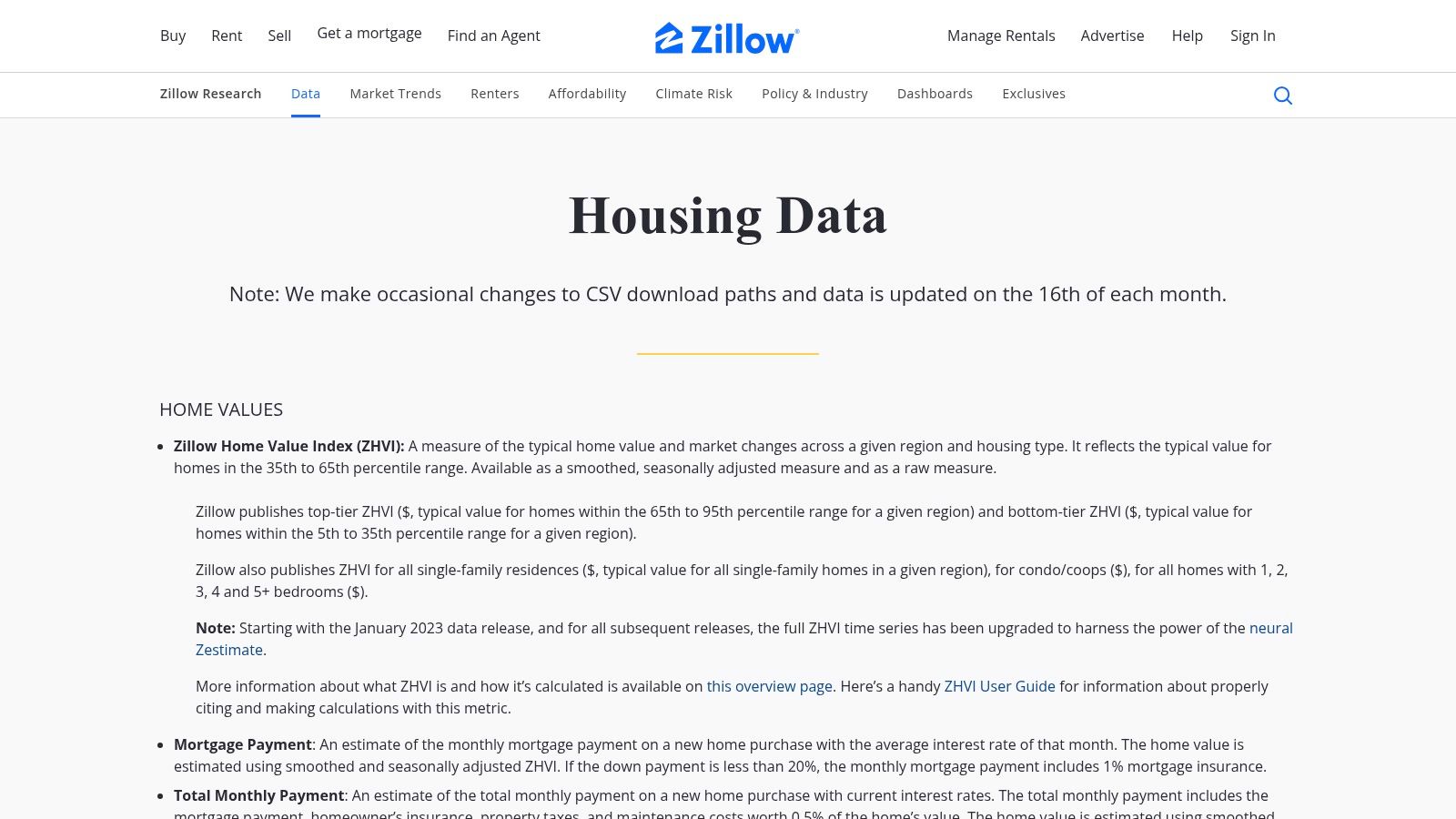

11. Zillow Research Data

For analysts, data scientists, and academics who want to get their hands dirty with raw market data, Zillow Research Data is an indispensable resource. This isn’t an interactive dashboard; it’s a public data library offering free, downloadable datasets that power Zillow’s own market reports. It provides a treasure trove of aggregated time-series data covering home values, rental prices, inventory, and sales forecasts across the U.S.

What makes Zillow Research one of the most powerful free real estate market analysis tools is its granularity and accessibility. You can pull clean CSV files for specific metro areas, counties, or even ZIP codes, making it perfect for custom modeling, tracking long-term trends, or supplementing your own research. While it lacks property-specific details, its value lies in providing the high-level metrics needed to understand market momentum and how to determine home value on a macro level.

Key Info & Considerations

- Best For: Data analysts, journalists, academics, and investors performing custom quantitative analysis.

- Pricing: Completely free.

- Pros: No-cost access to extensive, regularly updated housing data; high geographic granularity (down to ZIP code); comprehensive documentation for its methodologies.

- Cons: Lacks property-level details like ownership; data is aggregated, not transactional; methodologies can change over time, requiring users to stay updated.

For those comfortable with spreadsheets and raw data, Zillow’s repository offers the building blocks for creating truly bespoke market insights without a hefty price tag.

Website: Zillow Research Data

12. Redfin Data Center

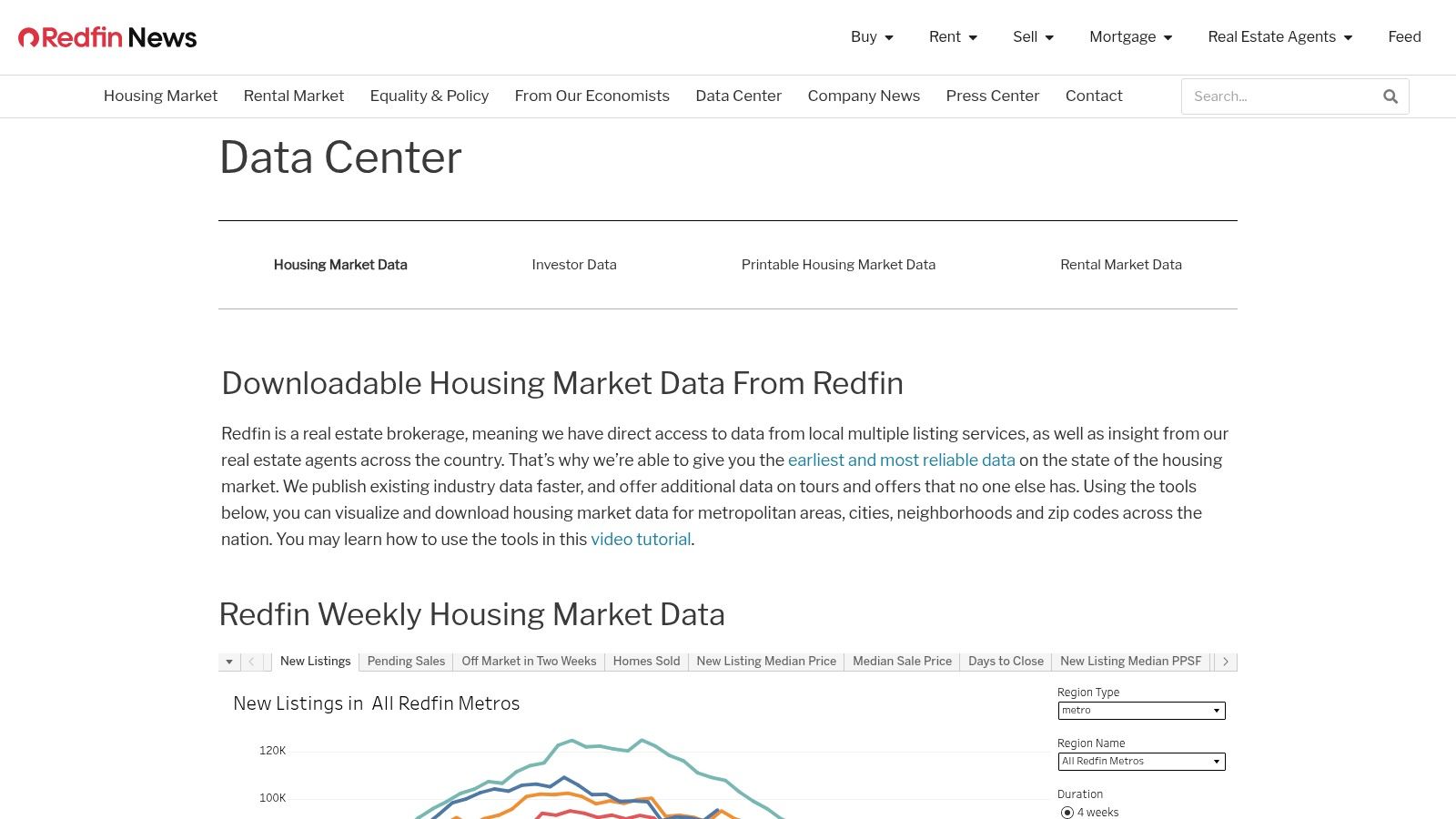

For those who need a finger on the pulse of the U.S. residential market without a hefty price tag, the Redfin Data Center is a goldmine. This isn’t just a blog with housing news; it’s a publicly accessible repository of raw, downloadable housing data, offering a surprisingly granular look at local and national trends. It provides key performance indicators like median sale prices, inventory levels, and sale-to-list price ratios updated on a weekly basis.

What makes the Redfin Data Center one of the most accessible real estate market analysis tools is its commitment to open data. You can download datasets by metro, county, city, or even ZIP code, allowing agents, investors, and even curious homebuyers to conduct their own analysis. The faster publication cadence compared to many government sources gives you a more current snapshot of market velocity and consumer behavior.

Key Info & Considerations

- Best For: Residential agents, data-savvy investors, journalists, and market analysts.

- Pricing: Completely free to access and download data.

- Pros: No-cost access to timely, high-frequency residential data; clear methodology and definitions; broad geographic coverage down to the ZIP code level.

- Cons: Data is sourced from Redfin’s brokerage activity and MLS feeds, so it’s subject to revisions and may not capture all market transactions.

This platform is perfect for tracking market shifts in near real-time, empowering you to back up your market commentary or investment thesis with fresh, relevant statistics.

Website: Redfin Data Center

Top 12 Real Estate Market Analysis Tools Comparison

| Platform | Core Features & Analytics | User Experience & Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| CoStar Market Analytics | CRE market/submarket KPIs, forecasts, comps | Robust data depth ★★★★★, analyst commentary | Enterprise-grade insights, extensive CRE data | Investors, lenders, brokers | Massive verified CRE database 🏆, forecasting | Enterprise-level pricing |

| LoopNet | CRE listings, ad packages, performance reports | Large audience reach ★★★☆☆ | Flexible listing packages for exposure | Property owners, brokers | Tiered promotion with media add-ons ✨ | Paid tiered packages; can be high |

| CREXI Intelligence | Nationwide property records, demographics | Clear pricing ★★★☆☆, interactive maps | Straightforward plans with marketing tools | Investors, brokers | Map layers + comps integration ✨ | Annual/monthly plans |

| MSCI Real Capital Analytics | Global deals & pricing trends | Institutional grade ★★★★★ | Deep capital & trend insights | Institutional investors, portfolio managers | Global data, RCA CPPI indices 🏆 | Quote-based enterprise pricing |

| Yardi Matrix | Multifamily data, rent/occupancy, pipeline | Frequent detailed reports ★★★★☆ | Strong multifamily & affordable housing data | Owners, lenders, developers | Affordable housing module ✨ | Custom/enterprise pricing |

| Moody’s Analytics CRE | CRE forecasts, climate risk, CMBS data | Deep insights with analyst narratives ★★★★☆ | CRE-focused, forecast-rich | Institutional underwriters | Climate & CMBS overlays ✨ | Customized pricing |

| ATTOM Property Navigator | Residential/CRE data, AVMs, rental comps | Balanced toolkit ★★★☆☆ | Affordable vs enterprise suites | Investors, brokerages | Rental AVMs + flood overlays ✨ | Affordable annual pricing |

| HouseCanary | Residential AVMs, valuation, forecasts, API | Transparent tiers ★★★★☆ | Residential valuation focus | Investors, lenders, brokerages | CanaryAI, API access ✨ | Tiered pricing + usage fees |

| PropStream | MLS/public records, lead lists, marketing | Comprehensive but variable data depth ★★★☆☆ | Combined marketing & analytics | Real estate investors | Lead Automator & marketing tools ✨ | Subscription + per-use fees |

| Reonomy by Altus Group | CRE off-market discovery, ownership data | Flexible delivery ★★★☆☆ | Enterprise data platform | CRE professionals, brokers | Ownership unmasking, multiple delivery modes ✨ | Enterprise-only pricing |

| Zillow Research Data | Free residential market datasets | Free & broad coverage ★★★★☆ | Public access to metrics & forecasts | Analysts, researchers | Free, multi-geo & frequent updates 🏆 | Free |

| Redfin Data Center | Free weekly/monthly residential data | Timely updates ★★★★☆ | Near real-time market trends | Analysts, agents | Fast publication cadence ✨ | Free |

Final Thoughts

Navigating the real estate market without the right instruments is like trying to sail across the ocean with a paper map and a prayer. As we’ve seen, the modern landscape is packed with sophisticated real estate market analysis tools designed to replace guesswork with data-driven strategy. From institutional powerhouses like CoStar and Moody’s Analytics CRE to the accessible, granular insights offered by PropStream and ATTOM, there’s a solution engineered for nearly every objective and budget.

The key takeaway isn’t that you need to subscribe to every platform here. Instead, it’s about understanding that the most successful investors, agents, and even savvy homebuyers leverage technology to gain a competitive edge. These tools don’t just show you what a property is worth today; they help you forecast future value, identify emerging neighborhood trends, and understand the deep-seated economic and demographic forces shaping the market—all while staying compliant with Federal Fair Housing guidelines by focusing on objective data, not demographics.

Choosing Your Toolkit: A Practical Guide

So, how do you move from reading this article to making a confident decision? It boils down to a clear-eyed assessment of your specific needs. Start by answering these fundamental questions:

- What is my primary goal? Are you a commercial investor analyzing multi-million dollar deals (think MSCI or Yardi Matrix), a residential flipper hunting for undervalued properties (PropStream is your friend), or a homebuyer trying to make a smart purchase in a specific neighborhood (Zillow and Redfin’s data centers are excellent starting points)?

- What is my budget? Your financial commitment will be the single biggest filter. Be realistic. Enterprise-level tools provide unparalleled depth but come with a price tag to match. Don’t overextend yourself on a tool whose advanced features you’ll never use.

- How much time can I invest in learning? Some platforms like HouseCanary offer intuitive, almost plug-and-play dashboards. Others, particularly those geared toward commercial real estate, have a much steeper learning curve and require a genuine commitment to mastering their capabilities.

Once you’ve defined your goals and constraints, revisit the tools on our list that align with your profile. Take advantage of free trials and demos whenever possible. This hands-on experience is invaluable and will reveal more about a platform’s real-world utility than any marketing brochure ever could. Remember, the best tool is the one you will actually use consistently and effectively. By integrating the right platform into your workflow, you’re not just buying data; you’re investing in clarity, confidence, and a smarter path to achieving your real estate ambitions.

Feeling empowered but still want a human expert to help translate all this data into a winning strategy? The team at ACME Real Estate uses best-in-class tools and decades of market experience to guide clients through every step of their journey. Let us handle the complex analysis so you can focus on making your next move with total confidence.