Welcome to the wild, often weird world of property taxes in Los Angeles. If you’re staring at your bill feeling like you’re trying to read an ancient scroll written in a dead language, you’re in good company. Most people see the final number, grit their teeth, and pay it, with zero clue how the county magicians actually conjured it up.

Here’s the deal: yes, your bill is based on your home’s value, but the final amount is way more than a clean 1% calculation. It’s a messy, complicated cocktail of state laws, local add-ons, and bonds your neighbors voted for years ago.

Your Roadmap to LA Property Taxes

Think of this guide as your personal cheat sheet. We’re slicing through the dense legal jargon and bureaucratic static to give you the straight-up, actionable info you need to master the system that funds our city.

This isn’t just about paying a bill; it’s about understanding the “why” behind it. Your property tax payments are the financial engine that powers Los Angeles County—funding everything from local schools and parks to the salaries of firefighters and police officers. When you pay your taxes, you’re making a direct investment in your community. Let’s make sure it’s a smart one.

Why Your Bill Looks Like a Ransom Note

At first glance, your property tax bill can feel intimidating. It’s a jumble of rates and special assessments that seem almost designed to confuse. But once you know what you’re looking at, the core pieces are surprisingly straightforward.

It all starts with your property’s assessed value, a figure cooked up by the LA County Assessor’s office. This value, stirred together with the base tax rate and any extra voter-approved taxes, creates your final bill. For anyone just jumping into the LA market, nailing these costs down is a non-negotiable part of the journey, which is why we built a comprehensive guide on buying a home in Los Angeles.

What You’ll Actually Learn in This Guide

This guide is designed to make you dangerous (in a good way). We’ll start with the basic math behind your taxes before getting into the nitty-gritty details.

The goal isn’t just to help you pay your taxes, but to help you own them. By the end, you’ll have the confidence to rip open that bill, spot the key info, and know exactly where every one of your hard-earned dollars is going.

We’ll cover the critical stuff, giving you a full picture of the system from start to finish. Here’s a sneak peek at what’s ahead:

- The Calculation Formula: A simple breakdown of the math behind the madness.

- Proposition 13: The legendary law that calls all the shots for California property owners.

- Exemptions and Savings: Real, actionable ways you can potentially slash what you owe.

- Deadlines and Penalties: How to pay on time and dodge that brutal 10% late fee.

Let’s dive in and start demystifying the beast that is the LA property tax system.

How LA County Calculates Your Property Tax Bill

So, how does Los Angeles County actually cook the books to figure out what you owe? Let’s yank back the curtain on the math. It’s less like rocket science and more like ordering a complicated latte—there’s a base price, but then you start adding extra shots and special syrups, and the final total looks way different than where you started.

The whole process kicks off with a straightforward 1% general tax levy based on your property’s “net taxable value.” This is the foundational number determined by the LA County Assessor, and it’s the bedrock of your entire bill.

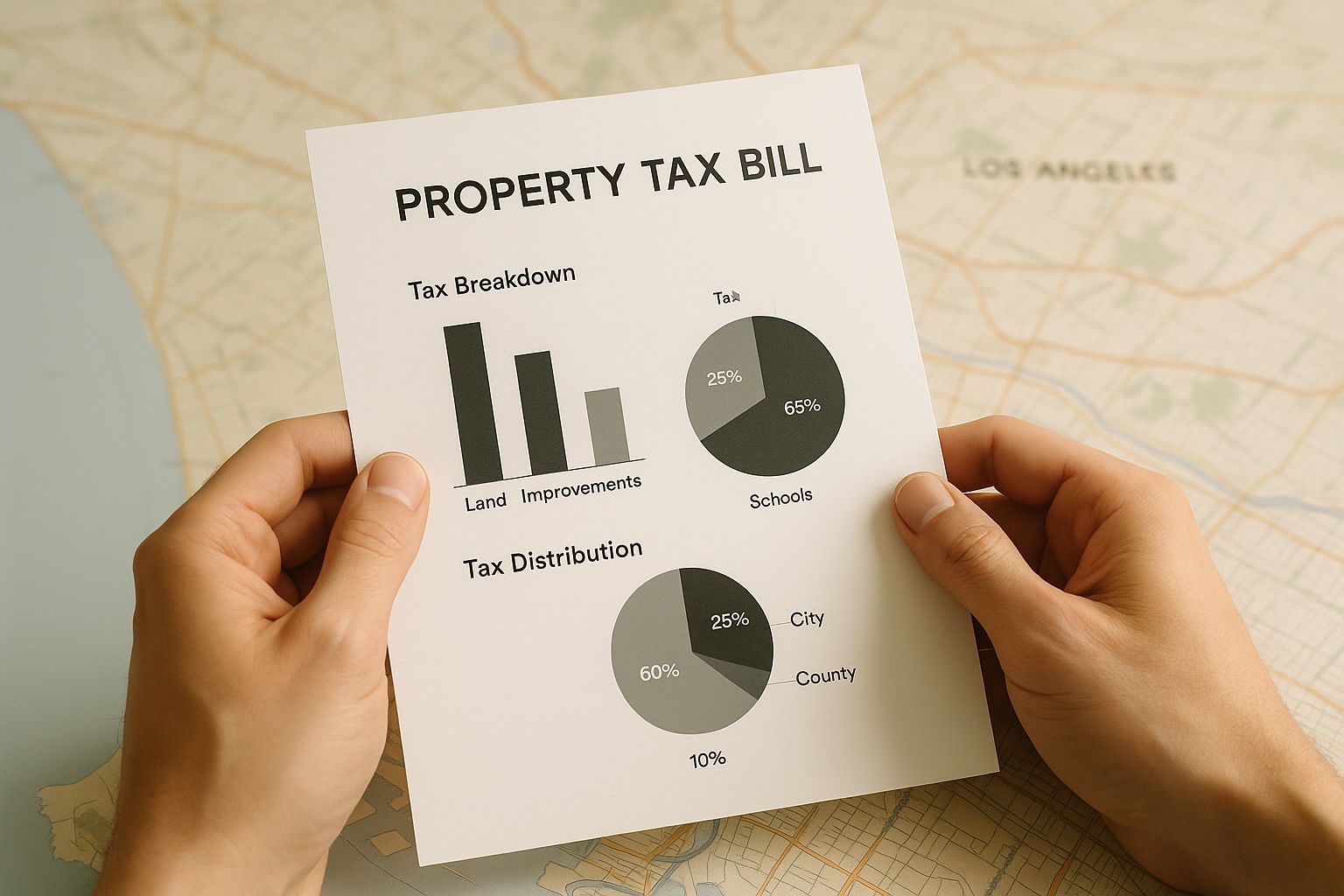

This image gives you a visual breakdown of how a typical bill is put together, showing you exactly where the money flows.

As you can see, that base tax is just the starting point. It’s the local assessments that make every bill as unique as the property it’s tied to.

The Foundation: The 1% Rule

The single most important number to tattoo on your brain is 1%. California law mandates this general levy, and it applies to the net taxable value of every single property in Los Angeles County. It’s clean, simple math. If your home has a taxable value of $1,000,000, your base tax is a flat $10,000 for the year. Easy, right?

But as you’ve no doubt noticed when cracking open that envelope, the final number is always higher. This is where those local “add-ons” crash the party.

To keep everything straight, the county assigns every property a unique Assessor’s Identification Number (AIN). This multi-part number pinpoints your exact parcel on the county map, ensuring the right taxes hit the right property. You can find more gory details on the county’s annual tax calculation process if you’re a glutton for punishment.

Beyond the Base Rate: Voter-Approved Add-Ons

So, what are these extras that pump up your bill? They generally fall into two buckets:

- Voter-Approved Debt: These are bonds that local residents—your neighbors, and maybe even you—voted to approve. They’re used to fund huge, long-term projects like building new schools, upgrading hospitals, or constructing new transit lines. Think of it as paying back a tiny slice of a loan your community took out to make the area better for everyone.

- Direct Assessments: These are more targeted charges funding services that directly benefit your property or immediate neighborhood. We’re talking about stuff like street lighting, local park maintenance, or a special fire protection district.

Here’s the key takeaway: Your total property tax rate isn’t one number. It’s the 1% base levy plus the sum of all voter-approved debt and direct assessments for your specific spot on the map.

This is exactly why your neighbor across the street, who might be zoned for a different school district, could pay a slightly different amount—even if your homes have the exact same assessed value.

To really see how this plays out, let’s look at a sample bill.

Sample Breakdown of a Los Angeles Property Tax Bill

This table shows a hypothetical calculation for a home with a $1,000,000 assessed value. It illustrates how the base tax gets layered with common local assessments to arrive at the final number you’re stuck with.

| Tax Component | Calculation Basis | Estimated Amount | What It Funds |

|---|---|---|---|

| General Levy (Prop 13) | 1% of Assessed Value | $10,000 | County/City General Funds, Schools, Special Districts |

| LAUSD School Bond | Rate per $100k of value | $214 | School construction and modernization projects |

| Metro Transit Bond | Rate per $100k of value | $98 | Public transportation infrastructure expansion |

| LA County Flood Control | Direct Assessment Fee | $75 | Storm drain maintenance and flood prevention |

| Local Park District | Direct Assessment Fee | $45 | Maintenance and services for nearby parks |

| Total Estimated Tax Bill | Sum of all components | $10,432 | Combined Annual Property Tax |

As you can see, those “small” add-ons pack a real punch. Every property’s combination of these extra fees will be unique.

What Is a Mello-Roos Tax?

You’ll almost certainly hear the term Mello-Roos thrown around, usually with a hint of terror. A Mello-Roos is just a specific type of financing used to pay for shiny new infrastructure in developing areas. If you buy a home in a newer community, there’s a solid chance you’ll see a Mello-Roos tax on your bill.

This special tax is what pays for things like:

- New streets and sidewalks

- Water and sewer systems

- Community schools and public parks

- Local police and fire stations

While it definitely adds to your annual bill, it’s also the reason you have sparkling new facilities right outside your door. The good news is these taxes aren’t forever; they are designed to expire after a set number of years. It’s always smart to ask if a property is in a Mello-Roos district before you buy to avoid any nasty surprises down the road.

Understanding the Power of Proposition 13

If you own a home in California, or even just dream of it, there’s a name you absolutely need to know: Proposition 13. This isn’t just another piece of tax code. Passed by voters way back in 1978, this law is the single biggest factor shaping property taxes in Los Angeles and the entire state.

Frankly, it dictates the entire game. For any homeowner, understanding Prop 13 is non-negotiable. It’s the reason your tax bill doesn’t spiral into oblivion every time the market goes on one of its wild, unhinged runs.

The Prop 13 Price Lock Analogy

The easiest way to get your head around Prop 13 is to think of it as a ‘price lock’ on your property’s value for tax purposes. The moment you buy a home, the county assessor establishes its initial assessed value based on your purchase price. That number becomes your baseline.

From that day forward, Prop 13 puts a hard ceiling on how much that assessed value can climb each year. It doesn’t matter how bonkers the LA real estate market gets or how much your home’s market value skyrockets. Your assessed value for tax purposes can only increase by a maximum of 2% annually.

This creates a massive, tangible benefit for long-term homeowners, effectively shielding them from being taxed right out of their own homes.

How This Plays Out in the Real World

Let’s walk through a classic Los Angeles scenario. Imagine you bought a house in Silver Lake back in 1995 for $200,000. Thanks to Prop 13, your assessed value has only inched up by that tiny annual percentage for decades.

Now, fast forward to today. A new neighbor buys the identical house right next door for $1.5 million. Even though the homes are exactly the same, their property tax bill will be calculated based on that fresh $1.5 million price tag. Yours, however, is still anchored to a number much, much closer to your original purchase price.

This is exactly why you see such dramatic differences in the property taxes paid by neighbors living on the same street. It all comes down to when they bought their home.

Proposition 13 is the fundamental reason California property taxes are based on acquisition value, not current market value. This creates predictability and stability for homeowners, which was the law’s original intent.

The system has its critics, for sure, but for the individual homeowner, it provides a powerful layer of financial armor against the market’s unpredictable mood swings.

When the Price Lock Gets Reset

So, does this magical price lock last forever? Not quite. There are two main events that trigger a “reassessment,” which is a fancy way of saying your property’s value gets reset to the current market rate for tax purposes.

This reset is a critical concept for anyone buying, selling, or inheriting property in Los Angeles.

The Two Triggers for Reassessment

- A Change in Ownership: This is the big one. When a property is sold, it gets reassessed at its new sale price. The new owner starts with a completely fresh baseline, and their Prop 13 clock begins ticking from that new, and usually much higher, value.

- Significant New Construction: If you take on a major renovation or add a brand-new structure (like an ADU), the value of that new construction is added to your existing assessed value. Your original assessment remains protected by the 2% cap, but the new portion gets valued at its current market cost.

Understanding these triggers is absolutely vital for financial planning. A reassessment can dramatically increase the tax burden on a home, especially one that’s been in the same family for a long time. Given the relentless rise in property values across LA, the impact can be staggering. The California State Board of Equalization notes that this system has successfully kept the statewide average effective rate near the 1% target, despite huge local variations in home prices.

The Property Assessment Process Explained

Your journey with Los Angeles property taxes begins with a single, powerful office: the County Assessor. This office holds the monumental task of figuring out the value of every single piece of land and building in LA County. This whole process, known as property assessment, is the engine that actually funds our public services.

Think of the annual assessment roll as a massive, constantly updated inventory of all taxable property. It’s a complete ledger tracking the value of everything, from beachfront mansions in Malibu to industrial warehouses in the Valley. This isn’t just some abstract accounting exercise; it’s the foundation for billions in revenue that pays for schools, police, fire departments, and local infrastructure.

The Annual Assessment Roll

Every year, the Assessor’s Office compiles this complete list, which reflects all the changes from the year before. This includes properties that were sold, new construction projects, and the standard 2% inflation adjustment that Prop 13 allows. The sheer scale of this job is staggering.

This ever-growing valuation has a direct line to the county’s financial health. For example, back in 2019, property assessments in Los Angeles County hit a record-breaking $1.6 trillion. This marked the ninth straight year of growth, fueled by a hot housing market and a ton of new construction. That increase alone added about $1 billion to county coffers, providing critical funds for everything from healthcare to transportation.

How Your Property Gets Its Value

So, how does the Assessor actually land on a value for your home? When you first buy a property, its assessed value is typically locked in at your purchase price. From that point on, it’s protected by the Prop 13 cap, but that initial number is everything.

Assessors have a few tools in their belt to determine this value. They analyze recent sales of similar properties in your neighborhood and calculate the cost to replace the structure. To get a better handle on the foundation of your tax bill, you can explore in more detail how property value is determined by various factors. For a deeper dive into establishing your home’s market worth, check out our guide on how to determine home value.

Your property’s assessed value is the single most important number on your tax bill. It’s the figure that the 1% general levy and other special taxes are applied to. A mistake here will ripple through your entire calculation.

This is precisely why you need to pay very close attention to the mail you get from the Assessor’s Office.

Don’t Ignore the Notice of Assessed Value

Sometime in late June or early July, a crucial piece of mail will land in your mailbox: the Notice of Assessed Value. So many homeowners just glance at it and toss it aside, assuming it’s just more government paperwork. This is a huge mistake.

This notice is not your tax bill. Think of it as a preview—your first and best chance to see the value the county has assigned to your property for the upcoming tax year. It tells you exactly what the Assessor thinks your home is worth for tax purposes.

Carefully check these key details on your notice:

- The Assessed Value: Does this number look right? Does it reflect what you paid plus any allowable increases?

- Homeowners’ Exemption: Is your exemption actually listed? If not, you’re leaving automatic savings on the table.

- Property Description: Did they get the basic facts right? Double-check for any obvious mistakes in square footage or other features.

If you spot an error or just flat-out disagree with their number, this notice is your starting gun. It’s your official heads-up to prepare an appeal before the final tax bill is calculated and mailed out in October. Ignoring it means you’re accepting the Assessor’s valuation, for better or for worse.

Actionable Strategies to Lower Your Property Tax Bill

Watching your property tax bill climb can feel like you’re just a spectator in a game you can’t win. But what if you could step onto the field and play a little offense? You absolutely can. There are concrete, actionable steps you can take to challenge your assessment and potentially lower what you owe on your property taxes in Los Angeles.

This isn’t about finding some secret loophole; it’s about understanding the system and using the tools available to every single homeowner. We’ll walk through the most effective strategies, from claiming simple exemptions to formally appealing your property’s assessed value. This is your playbook for making sure you only pay your fair share.

Start with the Low-Hanging Fruit: Exemptions

Before you gear up for a full-blown appeal, make sure you aren’t leaving free money on the table. The county offers several property tax exemptions that can chip away at your bill every year. The best part? For most, you only need to apply once.

The most common and valuable one is the Homeowners’ Exemption. If you own and live in your property as your main residence, you qualify. This one simple filing shaves $7,000 off your property’s assessed value, which automatically saves you about $70 on your tax bill each year. It might not sound life-changing, but it’s a permanent reduction you get for a one-time application. Why wouldn’t you?

Beyond that, other significant exemptions are available for specific groups:

- Disabled Veterans’ Exemption: This provides a much larger reduction in assessed value for veterans with a service-connected disability. The exemption amount changes, so check with the Assessor’s office for the current figures.

- Senior Citizen and Disabled Person Deferral: This program doesn’t eliminate your tax, but it allows eligible seniors and disabled individuals to postpone payment of their property taxes.

Claiming these is usually just a matter of filling out a form. Check your Notice of Assessed Value to confirm your Homeowners’ Exemption is active. If not, get that application in immediately.

Appealing Your Assessed Value

So you’ve claimed your exemptions, but you still have a gut feeling the Assessor got your home’s value wrong. Maybe the market dipped after you bought it, or you’ve found damage you didn’t know about. In these cases, it’s time to file a formal appeal.

This process involves filing an Application for Changed Assessment with the Assessment Appeals Board. Think of it as officially raising your hand and saying, “I disagree with this number, and here’s my proof.” You have a limited window to do this, typically from July 2 to November 30.

An appeal is your right as a property owner. You aren’t just fighting the county; you are presenting evidence to an impartial board to ensure your property is valued fairly and accurately based on market conditions.

The goal is to prove that your property’s market value on January 1st was lower than the assessed value on your notice. A successful appeal can save you thousands, not just for one year, but for years to come, since the new, lower value becomes your new baseline under Prop 13.

Building a Bulletproof Case for Your Appeal

Winning an appeal comes down to one thing: evidence. You can’t just show up and say you feel your taxes are too high. You need to build a compelling case with cold, hard facts. It’s also worth noting that a holistic approach to your property finances is key; for instance, many investors explore strategies for short term rental tax deductions to reduce their overall tax burden.

Here’s what you’ll need to gather:

- Comparable Sales Data (“Comps”): This is your most powerful weapon. Find at least three comparable homes in your immediate neighborhood that sold for less than your assessed value in the months leading up to January 1. “Comparable” means similar in size, age, condition, and location.

- Photos and Documentation: Did your home suffer damage from a fire or flood? Document everything with photos, repair estimates, and insurance reports. State law actually allows for a temporary reduction in assessed value after a disaster.

- A Professional Appraisal: While not always required, getting an independent appraisal can lend significant weight to your case. It shows you’ve invested in a professional, third-party opinion.

Putting this evidence together is a core part of any smart property transaction, which is why a solid real estate due diligence checklist is so critical for buyers and owners alike. You’ll present this information to the Assessment Appeals Board, which will then make a final determination on your property’s value.

How to Navigate Deadlines and Avoid Penalties

When it comes to Los Angeles property taxes, procrastination is your absolute worst enemy. Missing a deadline isn’t a simple oversight; it’s an immediate and painful 10% penalty on your installment. Staying on top of the calendar is everything.

Think of it as a predictable rhythm you can set your watch to. The county treasurer and tax collector sends out the annual secured property tax bills every October. The moment that bill leaves their office, the clock starts ticking on your first payment.

The Key Dates You Must Know

Forgetting these dates is like showing up to the airport a day after your flight—an expensive and completely avoidable mistake. To make them stick, here’s a little mnemonic I tell my clients: “No Doy, Feo Abril.” It’s a silly but effective way to remember November/December for the first payment and February/April for the second.

- October 1: Annual tax bills start making their way to your mailbox.

- November 1: The first installment is now officially due. You have a grace period until December 10th.

- December 10: After 5:00 PM Pacific Time, if your payment hasn’t been made, it’s delinquent. That 10% penalty hits instantly.

- February 1: The second installment is officially due. Your grace period runs until April 10th.

- April 10: After 5:00 PM Pacific Time, the second installment becomes delinquent. This one gets the 10% penalty plus an additional administrative fee.

The rule is simple: pay your first installment by December 10th and your second by April 10th. Treat these dates as non-negotiable to keep your money in your wallet, not the county’s coffers. For those who want to dig deeper into the data behind real estate, exploring real estate data analytics can offer valuable insights into market trends and property values, which is especially useful when planning for these large expenses.

Demystifying Supplemental and Escaped Tax Bills

Just when you think you’ve mastered the schedule, a surprise bill might land in your mailbox. Don’t panic. These are usually supplemental or escaped tax bills, and they pop up when your property’s assessed value changes.

A supplemental tax bill is triggered whenever a property sells or new construction is completed. It’s a one-time bill that covers the tax on the difference between the old assessed value and the new, higher one for the rest of the fiscal year.

An escaped tax bill, on the other hand, is a bill from the past. It’s issued to collect taxes that were accidentally under-billed in a previous year, maybe due to an assessor’s error or unreported construction. While they’re never fun to get, these bills just ensure everyone pays their fair share based on the property’s actual value over time.

Your Los Angeles Property Tax Questions Answered

Even after you think you’ve got a handle on the system, property taxes in Los Angeles can throw you a curveball. Let’s tackle some of the most common questions that pop up for homeowners, getting you the clear, straightforward answers you need.

Why Do My Taxes Seem Higher Than My Neighbors?

This is the classic Los Angeles property tax puzzle, and the answer almost always comes down to one thing: Proposition 13. Your tax bill is anchored to the value of your home when you bought it, not what it’s worth today.

It creates some wild disparities. A neighbor who bought their house for $250,000 back in 1998 might have an assessed value that’s crept up to just under $400,000 today. But if you bought the identical house next door last year for $1.5 million, your tax bill will be nearly four times higher.

It has nothing to do with fairness and everything to do with their purchase date versus yours.

Do Property Taxes Differ By Neighborhood?

Yes, absolutely—but probably not how you’re thinking. The base 1% tax rate is the same for everyone across the county. The difference comes from what’s layered on top.

Every property sits in a specific “tax rate area” or TRA. Each TRA has its own unique cocktail of voter-approved bonds for schools, parks, libraries, and other local projects.

So while a Beverly Hills home has a higher bill than one in Llano mostly because of sky-high property values, two homes with the exact same assessed value in different parts of LA can still have different tax bills. One neighborhood might be paying for a school bond that the other isn’t.

It’s not just about the city name on your address; it’s about the specific combination of local taxes layered on top of the county-wide levy. This is why you see variations even between adjacent neighborhoods.

What Happens if a Wildfire Damages My Property?

When a disaster like a wildfire strikes, the state has a system to provide some financial relief. California law allows the county assessor to temporarily lower your property’s assessed value if it suffers significant damage—usually $10,000 or more.

The assessor’s office will estimate the percentage of value your property lost and apply that reduction to your current assessment. This is a critical lifeline that ensures you aren’t paying taxes on the full value of a home that’s been damaged or even destroyed while you’re focused on rebuilding.

In the wake of a major fire, the Governor might also issue an executive order allowing homeowners in affected zip codes to delay their tax payments without facing penalties.

Navigating the complexities of the LA real estate market, from property taxes to finding the perfect home, requires a partner with deep local knowledge. ACME Real Estate is your dedicated guide, providing data-driven insights and personalized service to help you make informed decisions. Let us help you turn your property dreams into reality. Explore what Los Angeles has to offer with ACME Real Estate today.