Trying to make sense of the Los Angeles real estate market can feel like trying to nail jello to a wall. One headline screams “Buyer’s Market!” while another declares it’s a “Seller’s Paradise!” The truth? It’s something uniquely LA—a high-stakes, high-cost world that’s finally showing signs of finding its balance.

So let’s cut through the noise. Forget the clickbait headlines and look at the real numbers, the vital signs that tell us what’s actually happening on the ground.

Los Angeles Real Estate Market at a Glance

Before we dive deep, here’s a quick snapshot of the key metrics driving the LA market right now. This table gives you a clear, no-nonsense look at the numbers that matter most, whether you’re thinking of buying, selling, or just keeping an eye on your investment.

| Metric | Current Figure | What This Means for You |

|---|---|---|

| Median Sale Price | $1,060,000 | Competition is still fierce, and affordability is the name of the game. |

| Listing vs. Sale Price | Sells for ~3% below list price | Buyers are finding a little more room to negotiate. The days of waiving everything are fading. |

| Time on Market | Average 67 days | Well-priced, desirable homes move fast (around 22 days), but others are sitting longer. |

This isn’t just a spreadsheet of data; it’s a story. A story about a massive city where nearly 4 million people live, but only about 35% own their homes. That fundamental tension keeps demand incredibly strong, even when the broader economy gets shaky.

Reading Between the Lines: What the Vitals Really Mean

The data tells a fascinating story. On one hand, you have a median sale price that has shot up an incredible 27% year-over-year, now sitting at a formidable $1,060,000. That number alone shows the sheer force of demand in this city.

But then you see the other side of the coin. Homes are now selling for, on average, about 3% below their asking price. That might not sound like much, but in a market like LA, it’s a significant signal. It tells us that buyers are regaining a bit of leverage and are no longer willing to pay any price just to get a deal done.

The most desirable homes? They’re still getting snapped up in as little as 22 days. But the average property is now sitting on the market for around 67 days. This growing gap tells you everything you need to know: quality and pricing are more important than ever.

It’s this combination of intense demand and newfound buyer caution that defines the current market. A median price tag over $1 million proves the game is still high-stakes, but that small discount from list price is a clear sign that the frenzy is over. Buyers finally have some breathing room.

While we’re zeroed in on Los Angeles, it’s smart to keep an eye on the bigger picture. Understanding the emerging trends in real estate investment on a national level gives you the context for why our local market is behaving the way it is.

Getting a handle on these core numbers is the first real step to crafting a winning strategy in one of the most talked-about, competitive, and rewarding real estate arenas in the world.

What’s Really Driving the LA Market

The raw numbers—median price, sales volume, days on market—give us a snapshot, but they don’t tell the real story. To truly understand the Los Angeles real estate market, you have to look under the hood at the powerful forces pushing and pulling on prices, demand, and inventory. It’s a complex mix of economics, demographics, and that uniquely LA ambition.

Think of the LA market as a high-performance car. The sale price is just the number on the speedometer. What’s really making it go? It’s the engine (the economy), the fuel (jobs), and the road conditions (interest rates).

Let’s pop the hood and see what’s actually making this thing move.

The Engine: Job Growth and Economic Diversity

Los Angeles isn’t a one-trick pony; it’s a sprawling economic machine. We have entertainment, tech in “Silicon Beach,” aerospace, healthcare, and massive international trade. This diverse job market is the primary driver of housing demand, period. When studios are green-lighting projects and tech startups are hiring, people with good jobs move here, ready to put down roots.

This economic horsepower creates a constant stream of new residents with solid incomes, all competing for a finite number of homes. And this isn’t just about celebrities buying mansions in the Hills. It’s about a huge, well-educated workforce looking for everything from Downtown lofts to suburban homes in the Valley.

The fundamental truth of the LA market is this: as long as our diverse job market is humming, housing demand will stay exceptionally strong. This creates a high floor for property values, making the market surprisingly resilient even when the national economy stumbles.

The Squeeze: The Chronic Inventory Shortage

If you want to know the one thing that defines the LA real estate market, it’s this: a chronic lack of homes for sale. I’m not talking about a temporary dip in listings. This is a deep, structural problem that’s been building for decades. The demand for housing has consistently, and dramatically, outpaced new construction, creating a perpetual seller’s market.

This imbalance is supercharged by the “lock-in effect.” A mind-boggling 81% of California homeowners are sitting on mortgage rates below 5%. With current rates much higher, these owners are financially chained to their homes. Selling would mean trading a comfortable monthly payment for a painfully larger one. This keeps a massive number of potential homes off the market.

This dynamic creates a few critical outcomes for anyone trying to buy or sell:

- Intense Competition: Fewer homes for sale means more buyers fighting over every decent property that hits the market.

- Upward Price Pressure: It’s basic economics. When supply is low and demand is high, prices are constantly being pushed upward.

- Strategy is Everything: For buyers, showing up with a pre-approval and a sharp, decisive strategy isn’t just a good idea—it’s the only way to play the game.

This inventory crunch is the key to understanding why prices stay so high, even when interest rates climb. For a deeper look at how these market mechanics are changing the game, our guide on how buying and selling recently changed breaks it all down.

The Wildcard: Interest Rates and Affordability

If inventory is the constant pressure cooker, interest rates are the variable that can either hit the accelerator or slam on the brakes. When rates were at historic lows, it fueled a buying frenzy. Now that rates are higher, the sheer cost of borrowing has pushed many potential buyers to the sidelines.

The impact is massive. To afford a mid-tier California home in June 2025, a household needed an income of roughly $237,000. That’s more than double the state’s median household income. This affordability gap is a major headwind, cooling the market’s temperature and giving buyers a little more breathing room than they had during the peak madness.

To see how these forces play out on a national scale, understanding the fundamentals of Investing in Rental Property provides crucial context. These factors—jobs, inventory, and rates—don’t exist in a vacuum. They are the interconnected gears that dictate where the Los Angeles real estate market is heading next.

The Long View on LA Home Values

Is all this market noise a temporary blip, or is it part of a much bigger story? To really get what’s happening with Los Angeles real estate trends, you have to zoom out. Way out. Looking at monthly or even yearly data gives you a snapshot, but the real wisdom comes from understanding the long-term journey of property values across LA County.

Think of it like tracking a stock. Watching the daily ticks can drive you absolutely crazy with the constant ups and downs. But when you pull up the 10-year chart, the true growth pattern snaps into focus. The LA real estate market plays by a similar rulebook, rewarding those who can see the forest for the trees.

This isn’t some dry history lesson. By looking at the historical cycles—the spectacular peaks, the nerve-wracking valleys, and the plateaus in between—we gain critical context. It helps you separate the short-term market anxiety from the powerful, deep-rooted fundamentals that have made LA real estate a global benchmark for decades.

Decoding the Cycles of Boom and Bust

The LA housing market has always moved in cycles, a lot like the tides. You see periods of rapid, almost frantic appreciation, which are always followed by necessary periods of cooling off and finding a new floor. We saw it in the late ‘80s, again in the mid-2000s, and most recently with the post-pandemic surge. Each of these cycles was fueled by a different cocktail of economic factors, from interest rate policies to major shifts in local industry.

Understanding these patterns is your best defense against making purely emotional decisions. When everyone else is panicking during a downturn, a long-term perspective shows you that these dips have historically been incredible buying opportunities. On the flip side, when the market feels euphoric and it seems like the party will never end, history is there to remind you that it always does.

Here’s what these cycles have shown us, time and time again:

- Resilience is in its DNA: After every single downturn, the LA market has not only recovered but has always gone on to smash previous records.

- Economic Drivers are Key: The market’s health is directly wired into the broader economic vitality of Southern California. When jobs are created and innovation thrives, housing follows.

- Scarcity is the Constant: The fundamental imbalance of ridiculously high demand and chronically low supply has been the bedrock of value growth for more than 50 years.

This historical resilience is exactly why savvy investors and long-term homeowners bet on Los Angeles. They aren’t just buying a piece of property; they’re buying into a market with a proven track record of bouncing back stronger.

The most powerful tool for navigating the Los Angeles real estate market isn’t a crystal ball—it’s a history book. Understanding the market’s DNA of resilience and growth allows you to build a strategy that weathers any storm.

The Unwavering Climb of LA Property Values

To put this long-term growth into perspective, let’s look at a key indicator: the All-Transactions House Price Index for Los Angeles County. This isn’t just one home’s Zestimate; it’s a broad, official measure of the entire market’s price movement over time. Back in 1975, this index was sitting at a mere 16.91. As of early 2024, it rocketed to a record-breaking 398.42.

This staggering climb perfectly illustrates the incredible, long-term appreciation of LA property, driven by relentless demand and a simple lack of land. You can dig into the specifics of this long-term data and see how this index tracks regional trends.

This steady, upward march isn’t an accident. It’s the direct result of decades of economic expansion, population growth, and the simple geographic fact that they aren’t making any more land in Los Angeles. While the journey has certainly had its bumps, the overall direction has been consistently up, cementing LA’s status as one of the most durable and valuable real estate markets on the planet.

A Deep Dive Into LA’s Micro-Markets

Los Angeles isn’t just one real estate market. It’s a sprawling, electric mosaic of dozens of micro-markets, each with its own vibe, price tag, and personality. To really get a handle on Los Angeles real estate market trends, you have to ditch the 30,000-foot view and get your boots on the ground.

Here, we’re putting key areas under the microscope. This isn’t about steering you toward a specific zip code—that would go against fair housing principles. Instead, the goal is to arm you with the data-driven intelligence on what makes different parts of LA tick so you can spot opportunities that align with your goals.

We’ll look at the unique dynamics of diverse locales, from the sun-drenched coastal enclaves and creative Eastside hubs to the sprawling, ever-changing San Fernando Valley. This deep dive helps you understand the trade-offs and see where you might find value that lines up with your goals.

The Westside Story: Luxury and Lifestyle

When people fantasize about LA real estate, their minds usually drift to the iconic neighborhoods of the Westside. We’re talking about places like Beverly Hills, Santa Monica, and Pacific Palisades. These areas are defined by their proximity to the coast, world-class amenities, and, of course, luxury price points.

The market here operates on a different plane. While broader Los Angeles real estate market trends like interest rates have an impact, the high-end market is often more insulated. Buyers in this segment are typically less sensitive to mortgage fluctuations. It’s a market driven more by wealth preservation and lifestyle choices than by traditional affordability metrics.

- Market Temperature: Consistently warm to hot. Even when the broader market cools, demand for well-priced, prime properties stays incredibly strong. Inventory is perpetually tight.

- Key Characteristics: High price per square foot, a strong international buyer presence, and a laser focus on privacy, views, and architectural significance. These are legacy markets where values have shown remarkable long-term resilience.

- Actionable Insight: Competition is fierce. Success here often comes down to having a connected agent who can get you into off-market or “pocket” listings before they ever hit the MLS.

The Eastside Vibe: Creative Energy Meets Appreciation

Head east of Hollywood, and you’ll find a completely different world. Neighborhoods like Silver Lake, Echo Park, and Highland Park have exploded into epicenters of creative culture, drawing artists, musicians, and young professionals in droves. This cultural boom has directly fueled a real estate boom.

The trend here is all about rapid appreciation driven by fierce demand for a specific lifestyle. Buyers are chasing walkability, unique architecture (think hillside bungalows and mid-century gems), and a vibrant community feel with independent coffee shops, boutiques, and art galleries on every corner.

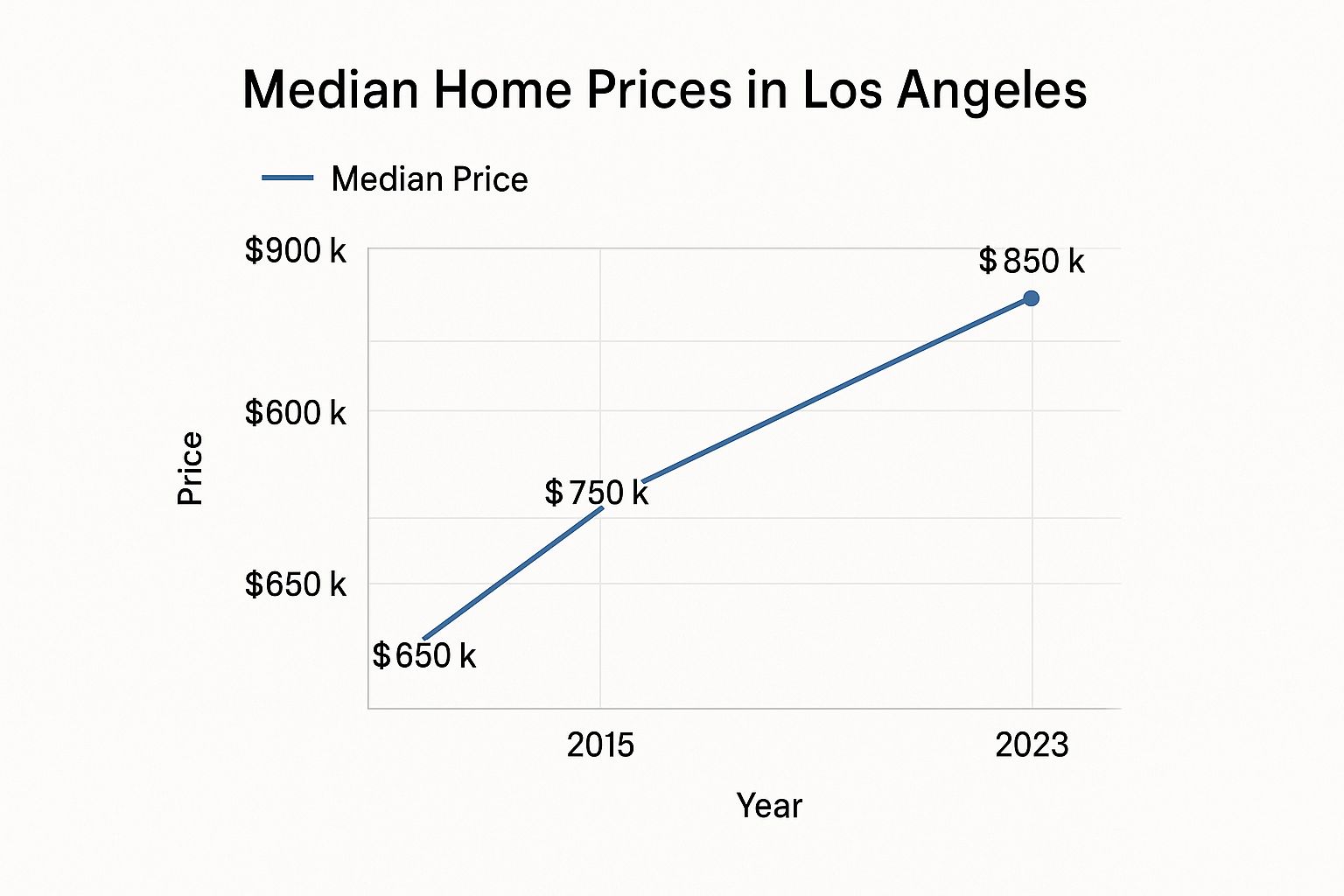

This chart shows just how steadily median home values have climbed across Los Angeles over the past several years. It’s a testament to the market’s long-term strength.

The infographic clearly shows a consistent upward trend, proving the market’s resilience despite any short-term bumps in the road.

The Eastside is a case study in how cultural capital can translate directly into real estate capital. The demand isn’t just for a house; it’s for a place within a thriving, dynamic community. This has led to some of the city’s most significant property value growth over the last decade.

The Valley: The Changing Face of Suburban LA

For decades, “The Valley” was shorthand for classic American suburbia. Not anymore. Today, the San Fernando Valley—home to neighborhoods like Sherman Oaks, Encino, and Studio City—is in the middle of a major renaissance. It’s no longer just a more affordable alternative to the city proper; it’s a destination in its own right.

The market here offers a much wider range of housing, from post-war single-family homes to modern condos and sprawling estates south of the boulevard. The value proposition is crystal clear: you get more space for your money, access to excellent public schools in certain areas, and increasingly sophisticated dining and shopping. As affordability continues to challenge the rest of LA, the Valley’s appeal has only intensified, driving strong and steady price growth.

To give you a clearer picture of how these areas stack up, here’s a quick snapshot of their market characteristics.

LA Neighborhood Market Snapshot

| Area Profile | Median Price Range | Market Temperature | Key Characteristics |

|---|---|---|---|

| The Westside | $2.5M – $20M+ | Hot | Luxury estates, ocean views, strong international demand, high price-per-square-foot. |

| The Eastside | $900K – $2.5M | Very Hot | Trendy, walkable, creative hubs, rapid appreciation, architectural gems. |

| The Valley | $850K – $3M+ | Warm to Hot | More space for money, family-oriented options, strong schools, evolving amenities. |

This table is just a starting point, but it shows how different the opportunities and entry points can be from one part of the city to the next.

Exploring which locations might be the right fit for your lifestyle is a big decision. For a more detailed breakdown, our guide to the best neighborhoods to live in LA offers even deeper insights into what makes each community unique.

Understanding these neighborhood-specific dynamics is the key to navigating the Los Angeles market effectively. Each area tells a different story, offering unique opportunities and challenges for buyers, sellers, and investors alike.

Forecasting the Future of the LA Market

After sifting through past cycles and the current market chaos, it’s time to look ahead. Forget the crystal ball—let’s examine what the real expert forecasts and leading economic indicators are telling us. Where are the Los Angeles real estate market trends actually heading?

Predicting LA’s next move is a high-stakes game. Will the market continue its gravity-defying climb, settle into a much-needed period of stability, or finally face a real correction? It’s time to unpack the evidence-based outlook so you can plan your next move with confidence, not just crossed fingers.

This isn’t about guesswork. It’s about piecing together credible data to paint a realistic picture of what’s coming for home prices, sales activity, and those all-important mortgage rates.

The Million-Dollar Question: Correction or Stabilization?

Let’s get straight to the question on everyone’s mind: are prices going to crash? The short answer from most analysts is a resounding no. A full-blown crash, the kind we saw in 2008, seems highly unlikely. Why? Because LA’s chronic low housing supply and relentless buyer demand aren’t going anywhere.

But that doesn’t mean it’s all smooth sailing. The more probable scenario is a period of modest correction or stabilization. Think of it less like a dramatic implosion and more like the market finally taking a deep breath after a years-long sprint. Prices might dip slightly or just flatten out for a while, giving the market a chance to find a healthier, more sustainable balance.

This recalibration is being forced by the affordability crisis. When the income needed to buy a median-priced home is more than double what the median household actually earns, something has to give. That pressure forces the market to adjust, creating a new equilibrium where buyers can realistically get back in the game.

The forecast for Los Angeles isn’t a story of collapse, but one of correction and gradual recovery. Expect a market that favors strategy over desperation, where well-priced homes sell and overpriced ones linger.

What the Forecasts Predict for 2025-2026

Diving into specific numbers, a consensus is forming around a market that bends but doesn’t break. For instance, most industry forecasts see a measured increase in home sales on the horizon. Projections from the National Association of Realtors and other key analyses suggest existing home sales could rise by 6% in 2025 and a more substantial 11% in 2026. This points to a slow but steady return of buyer confidence. You can explore the full Los Angeles market forecast to get deeper into these numbers.

This expected rebound in sales is tied directly to mortgage rates. Forecasters see rates hovering around 6.4% in the back half of 2025 before—hopefully—dipping to 6.1% in 2026. This gradual drop in borrowing costs could be the exact trigger needed to unlock all that pent-up demand.

Here’s a quick breakdown of what these expert forecasts suggest for the LA market:

- New Home Sales: Builders seem confident, with sales expected to climb by 10% in 2025 and another 5% in 2026.

- Median Home Prices: Projections show modest bumps of 3% in 2025 and 4% in 2026, signaling stability, not another price explosion.

The main takeaway here is that the market is expected to hold steady, sidestepping a crash while offering a slight improvement in affordability.

The Wildcard Factors to Watch

Of course, no forecast is foolproof, especially in a beast as complex as Los Angeles. A few wildcard factors could easily push the market in a different direction.

State and local economic health is everything. If LA’s key industries—tech, entertainment, trade—take a serious hit, it could slam the brakes on housing demand harder than anyone expects. On the flip side, an unexpected economic boom could reignite rapid price growth.

The “lock-in effect” will also continue to be a huge player. As long as most homeowners are sitting comfortably on their sub-4% mortgage rates, inventory is going to stay tight. Any major shift in that dynamic—whether from new government incentives or a big change in homeowner psychology—could dramatically alter the supply side of the equation.

Ultimately, the future of Los Angeles real estate market trends points toward a more balanced, less frantic environment. The market is shifting from one driven by pure momentum to one grounded in economic reality. That means strategic, well-informed decisions will matter more than ever.

Your Playbook for Buying and Selling in LA

All this data is just noise without a game plan. It’s one thing to understand the Los Angeles real estate trends, but it’s another thing entirely to use that knowledge to win. This is where we turn the forecasts and figures into a real, tactical playbook for anyone trying to buy or sell in LA’s famously cutthroat market.

Let’s be clear: this isn’t the market of two years ago. The old “offer anything and waive everything” playbook is collecting dust on a shelf. To succeed today, you need a sharp, nuanced strategy that respects the market’s new reality.

For LA Buyers: Crafting an Offer That Wins

In a market that’s finally finding its footing but still starved for good homes, your offer needs to be both aggressive and smart. You can’t just throw money at the problem and expect to win anymore. It’s all about looking like a rock-solid buyer without giving up all your power.

Here’s how you get your offer to the top of the stack right now:

- A Solid Pre-Approval is Your Ticket to the Game: A pre-qualification letter is nice, but it’s not enough. A full, underwritten pre-approval from a lender with a great reputation shows you’re not just window shopping—you’re a serious contender ready to close. Honestly, it’s the bare minimum.

- Get Strategic with Contingencies: Waiving all your contingencies is a massive risk and far less common now. But you can still show you’re serious by tightening them up. Offer a shorter inspection period, say 7 days instead of the standard 17. It shows you mean business without exposing yourself to insane risk.

- The Personal Touch Still Works Wonders: Never, ever underestimate the power of a well-written letter to the seller. Tell them what you love about their home and why you can see your life unfolding there. Sometimes, that human connection is the tiebreaker when offers are close.

The whole process can feel overwhelming, I get it. Our detailed guide on buying a home in Los Angeles breaks it all down, step-by-step, to get you from searching to sold.

For LA Sellers: Pricing for Maximum Impact

Sellers, listen to me on this: your pricing strategy is everything. Overprice your home by even a small amount, and you risk it sitting there, going stale while you field nothing but lowball offers. The real key is to price it competitively right out of the gate to spark immediate interest and create a genuine sense of urgency.

The goal isn’t just to get one offer. The goal is to get multiple offers. Pricing your home right at or even slightly below its true market value is the single most effective way to ignite a bidding war that pushes the final price well above what you asked for.

For anyone focused on maximizing profit, especially investors or flippers, you have to nail your numbers. If you’re looking at a property as an investment or planning a renovation, using a real estate flip profit estimator is a no-brainer for understanding your potential return on investment.

Whether you’re buying your dream home or selling a major asset, today’s market rewards those who are prepared, strategic, and ready to move decisively. This playbook gives you the tools to be one of them.

Your Burning LA Real Estate Questions, Answered

Alright, you’ve crunched the numbers, you’ve seen the forecasts, and you’ve got a game plan. But there are probably still a few big questions swirling around in your head. Let’s get right to it.

This isn’t about fluffy, generic advice. It’s about giving you clear, battle-tested answers to guide your next move in the beautiful, chaotic world of Los Angeles real estate.

Is Now a Good Time to Buy a House in Los Angeles?

I get this question constantly, and honestly, the answer has more to do with your personal situation than trying to nail the market’s timing perfectly. Let’s be real: waiting around for some dramatic price crash in LA is almost always a losing bet. The market’s history and the sheer lack of homes for sale just don’t support that fantasy.

Yes, today’s prices and interest rates are a serious hurdle, no one’s denying that. But you have to remember that LA has a rock-solid, decades-long track record of powerful appreciation. The real question isn’t “when?” but “are you ready?” If your income is stable, your credit is solid, and you see yourself staying put for at least five to seven years, then buying now could absolutely be your ticket to building serious long-term wealth.

Which LA Neighborhoods Have the Best Investment Potential?

To be crystal clear and stay on the right side of Federal Fair Housing laws, I’ll never steer a client toward one specific neighborhood over another. Instead, my job is to give you the framework to spot the high-potential areas for yourself, just like the pros do. The savviest investors don’t follow hype; they follow the data.

Here’s what you should be hunting for:

- New Infrastructure Projects: Is the city pouring money into new Metro lines, parks, or public upgrades? That kind of investment is almost always a signal that property values are about to get a lift.

- High Rental Demand: Look for areas with rock-bottom vacancy rates and consistently strong rents. It’s a dead giveaway that you’re looking at a desirable, stable community where people want to live.

- Favorable Price-to-Rent Ratios: This metric is your secret weapon. It helps you figure out if it’s smarter to buy or rent in a given area, and it can point you toward pockets of the city that might be undervalued.

Use this data-first mindset to find the neighborhoods that tick your boxes, not someone else’s.

What Down Payment Is Realistic for Los Angeles?

Can we please put the 20% down payment myth to rest? It’s simply not the reality for most people buying in a market as expensive as LA. Of course, a bigger down payment means a smaller monthly mortgage, but it is far from the only path to owning a home here.

The idea that you need over $200,000 in cash for a down payment is one of the biggest misconceptions holding buyers back. You have options.

Plenty of successful buyers are using modern loan programs built for today’s world. FHA loans, for instance, can get you in the door with as little as 3.5% down. For veterans and service members, VA loans are an absolute game-changer, offering an incredible 0% down payment. Even some conventional loans are available with much less than 20% down.

The key is to talk to a great lender who can walk you through all the programs available. You need a complete, realistic picture of your upfront costs—including closing costs—not an outdated myth.

Making a smart move in Los Angeles requires a partner who knows every street, every strategy, and every pitfall. ACME Real Estate brings together deep local expertise with hard data to help you win. Whether you’re buying your first home, selling an investment, or building a portfolio, your LA real estate journey starts with a real conversation. See what’s possible at https://www.acme-re.com.