Let’s cut to the chase: is earnest money required? While no federal law forces your hand, in the real-world thunderdome of real estate, the answer is a deafening yes. Trying to buy a house without it is like showing up to a high-stakes poker game with an IOU—you won’t even get a seat at the table.

Your Ticket to Being Taken Seriously

Think of the earnest money deposit as your financial handshake. It’s the definitive signal to a seller that you’re a serious buyer with skin in the game, not just a casual window shopper. This is the move that transforms your offer from a simple piece of paper into a credible, forceful commitment that demands attention.

This “good faith” deposit is a fundamental part of the homebuying process. It’s the money you put down to show you mean business, and according to the National Association of REALTORS®, it’s a deposit made by a buyer to demonstrate serious intent to purchase a property. It’s paid after your offer is accepted and held safely by a neutral third party (like an escrow company) until the deal closes.

An offer without earnest money is just a conversation. An offer with it is a commitment that forces everyone to take you seriously.

Imagine you’re the seller. The moment you accept an offer, you pull your home off the market. You cancel open houses, stop all advertising, and tell other interested parties that the home is spoken for. Your earnest money deposit is their insurance policy—the assurance that you won’t suddenly get cold feet and leave them high and dry, forced to relist and start the entire process from scratch.

Separating Window Shoppers from Serious Buyers

This deposit is a powerful filter. In any competitive market, it instantly separates the motivated, prepared buyers from those just kicking the tires. It’s a non-negotiable part of crafting a winning offer, especially in a fast-moving market like Los Angeles.

Your earnest money deposit effectively proves three critical things:

- You are committed: You’re putting your own cash on the line, proving you have every intention of seeing the purchase through to the end.

- You are financially capable: It’s tangible proof that you have the funds ready to begin the home buying journey.

- You respect the seller’s time: You acknowledge that taking their property off the market is a significant decision that deserves a financial guarantee.

What Earnest Money Is and Why Sellers Demand It

So, what’s the big deal with earnest money? Imagine you’re selling a prized vintage car. One person says they’ll buy it, but another person walks up and slaps a cash deposit right on the hood. Who are you going to take more seriously?

That’s earnest money in a nutshell.

It’s your “good faith” deposit that tells the seller—and the rest of the world—that you’re not just kicking tires. This isn’t a casual “maybe.” It’s a real, financial commitment to see your offer through to the end.

The Seller’s Side of the Story

To really get why earnest money is so critical, you have to put yourself in the seller’s shoes for a minute. The second they accept your offer, their entire world shifts. They have to pull their home off the market immediately, which means no more showings and turning away any other buyers who might be circling.

All their marketing grinds to a halt. The “For Sale” sign gets an “In Escrow” or “Pending” rider slapped on it. For the seller, this is a massive leap of faith. They are placing a bet, both financially and emotionally, on you and your promise to close the deal.

Your earnest money deposit is what gives them the confidence to take that leap. It’s their insurance policy—a guarantee that you won’t get cold feet over something small or just change your mind, forcing them to start the entire, expensive process of selling all over again.

Earnest money is a powerful filter. It separates the serious contenders from the window shoppers. For a seller, it’s the first and most important line of defense against flaky buyers and offers that go nowhere.

This idea of putting down a deposit to show you mean business is nothing new. The concept actually goes back centuries, with roots in ancient Roman and Greek deals where a payment symbolized a solemn promise. In real estate today, it does the exact same job: it proves your commitment and gives the seller the security they need to move forward with you.

Why It’s More Than Just Money

Think of the earnest money deposit as having a specific job to do. It’s not just sitting in an account somewhere; it’s actively working to hold your deal together. In competitive markets, especially when navigating the complexities of buying a home in Los Angeles, an offer that comes in without a solid deposit is often dead on arrival.

A strong deposit immediately tells the seller that you have:

- Serious Intent: You’re not playing games. You have actual skin in the game.

- Financial Readiness: It proves you have the liquid cash needed to get the purchase process started.

- Respect for the Process: You understand the seller is taking a risk by choosing your offer, and you’re willing to provide a safety net.

Without that deposit, your offer just doesn’t have the teeth it needs to compete. It’s the key that unlocks the door to serious negotiations and, ultimately, to getting you into your new home.

How Much Earnest Money Makes Your Offer Stand Out

So, you get it. An earnest money deposit is a non-negotiable part of any serious offer. The real question is: how much is enough to get the seller’s attention? Think of it less like a fixed fee and more like a strategic bid in a high-stakes auction. The right amount signals strength and can make all the difference.

The general rule of thumb is to put down 1% to 3% of the home’s purchase price. On a $500,000 house, that’s a deposit between $5,000 and $15,000. But this isn’t a one-size-fits-all formula. It’s a starting point you need to adjust based on the battlefield you’re on.

Adjusting Your Deposit for Market Conditions

The temperature of your local real estate market is the single biggest factor here. In a sleepy buyer’s market where homes linger for weeks, a 1% deposit might be perfectly fine. The seller is just happy to see a real offer come through.

But in a red-hot seller’s market, like many areas in Los Angeles, 1% won’t even get you a callback. When a dozen other buyers are fighting for the same property, a higher deposit becomes your power move. It screams, “I am serious, I am capable, and I am here to win.”

In hyper-competitive markets, a larger earnest money deposit isn’t just about showing good faith—it’s a weapon. A higher amount can make a seller choose your offer over another, even if the purchase prices are identical.

For instance, in major real estate hubs like Los Angeles, a 3% deposit is standard practice. If you offer less, a savvy listing agent will immediately question the strength of your offer. An offer of 1% on a hot property in Santa Monica or Silver Lake will likely be laughed out of the room. Don’t be that person.

Beyond just earnest money, understanding how to calculate your down payment is another crucial financial step. The two work together to show a seller you have your finances in order.

High-Value Properties Demand More Skin in the Game

The property’s price tag also plays a huge role. For a lower-priced starter home, a 1-2% deposit is pretty standard. When you get into the luxury market, however, sellers expect more. A lot more.

Putting down just 1% on a multi-million dollar home can look weak, as if you’re stretching your finances to the absolute limit. For these high-stakes deals, a deposit closer to 3% or even higher is often what it takes to show you have the financial stability to actually close.

This is especially true for buyers who are buying a new home before selling their old one. In that scenario, a beefy deposit proves you have the liquidity to manage both transactions without a hitch.

How to Protect Your Deposit with Contract Contingencies

Putting thousands of dollars on the line is a big deal. The good news is your earnest money deposit isn’t just floating out there, vulnerable to a seller’s whims. Your purchase contract should be armed with powerful “escape hatches” called contingencies.

Think of them as your financial safety net—legal, pre-approved reasons to walk away from a deal with your deposit safely back in your wallet. These clauses are your best friends in a real estate transaction. They turn a rigid agreement into a more flexible one, acknowledging that you need time to do your homework. Skipping them is like skydiving without a backup parachute. It’s a risk you just don’t want to take.

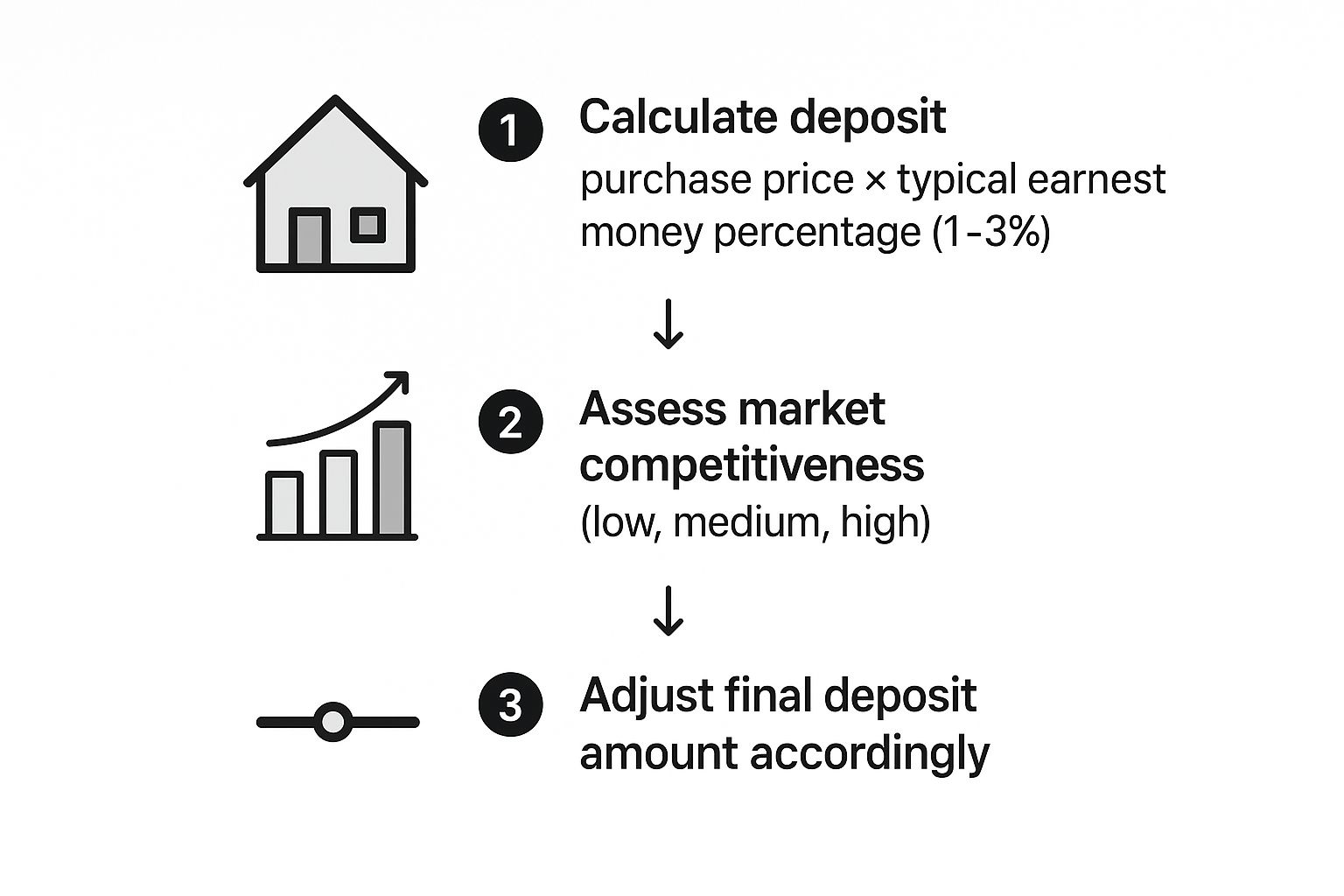

This process flow shows how to strategically figure out your initial deposit, balancing what’s standard with what the market demands.

The key takeaway is that your earnest money amount shouldn’t be a random guess; it’s a calculated decision based on the home’s price and how much competition you’re up against.

The Big Three Contingencies Every Buyer Needs

While you can write a contingency for almost anything, there are three that are absolutely essential for protecting your earnest money. Let’s break down the legal jargon into what it actually means for you.

1. The Inspection Contingency

This is arguably the most important “get out of jail free” card for a buyer. It gives you a set amount of time, usually 7-17 days depending on your contract, to have the property professionally inspected from top to bottom.

- Real-World Scenario: Your inspector discovers the foundation has major cracks that will cost a whopping $30,000 to fix. With an inspection contingency, you aren’t trapped. You can go back to the seller and try to negotiate for repairs or a price cut. If they won’t budge, you can walk away from the deal and get your full deposit back.

2. The Appraisal Contingency

When you get a mortgage, your lender will hire a professional appraiser to figure out the home’s fair market value. This contingency is your shield if that value comes in lower than your offer price.

- Real-World Scenario: You agree to buy a home for $850,000, but the bank’s official appraisal comes in at only $820,000. The lender will only loan you money based on that lower value. The appraisal contingency lets you renegotiate the price with the seller or cancel the contract and get your deposit back if you can’t cover that $30,000 gap.

3. The Financing Contingency

This one protects you if, for some unforeseen reason, your home loan falls through. Even with a pre-approval, life happens.

A financing contingency is your ultimate backstop. It ensures that if your lender unexpectedly denies your loan, you won’t be penalized by losing your earnest money for something totally outside of your control.

- Real-World Scenario: You were pre-approved for your loan, but days before closing, you get laid off from your job. Your lender immediately pulls your financing, making it impossible to buy the home. Because you have a financing contingency, you can legally terminate the contract, and your earnest money is returned. Without it, you would almost certainly lose your entire deposit to the seller.

When You Can Kiss Your Earnest Money Goodbye

Alright, time for some real talk. While your contract contingencies are your financial bodyguards, they can’t protect you from yourself. There are absolutely ways to lose your earnest money, and it almost always happens when a buyer gets careless or simply drops the ball.

Think of your purchase agreement as the rulebook for a very expensive game. As long as you play by the rules—specifically, the timelines and conditions spelled out in your contingencies—your deposit is safe. The moment you break those rules, you risk forfeiting your cash to the seller.

The Biggest Pitfalls That Put Your Deposit at Risk

Losing your deposit is a painful lesson, but it’s an avoidable one. Most buyers who forfeit their earnest money do so for a handful of predictable reasons. They get swept up in the emotion of the deal and make a critical error that costs them thousands.

Here are the classic “what not to do” scenarios that can make your earnest money vanish:

- Waiving Contingencies Like a High Roller: In a hot market, you might feel pressure to waive your inspection or appraisal contingency to make your offer look stronger. This is a high-stakes gamble. If you waive your inspection contingency and later find a deal-breaking issue with the foundation, that’s your problem now. The seller keeps your deposit.

- Getting a Case of Cold Feet: Buyer’s remorse is real, but it’s not a valid reason to break a contract. If you wake up one day and just decide you don’t like the house anymore for a reason not covered by a contingency, you can’t just walk away. The seller is entitled to keep your deposit as compensation for taking their home off the market.

- Ignoring the Ticking Clock: Your contract is filled with deadlines. You have a specific window to get inspections done, secure your final loan approval, and review documents. If you blow past these deadlines without getting a written extension from the seller, you are in breach of contract. The seller can cancel the deal and claim your deposit.

The purchase agreement is a legally binding document, not a casual suggestion. Once your protective contingency periods have expired, your earnest money becomes “hard,” meaning it’s fully committed to the seller if you fail to close the deal for any unprotected reason.

Ultimately, your agent is your guide through this minefield. Their job is to keep you on track and make sure you understand exactly when your deposit goes from being protected to being at risk. Treat your contract deadlines with the seriousness they deserve, and you’ll avoid kissing your money goodbye.

Common Questions About Earnest Money

When you’re in the middle of a real estate deal, a million questions can start racing through your mind. Let’s tackle the most common ones about earnest money so you can move forward feeling confident, not confused.

Does Earnest Money Go Towards My Down Payment?

Yes, it absolutely does. The best way to think about your earnest money is as a down payment on your down payment. It’s not some extra fee tacked on top of the sale; it’s a portion of the cash you were already planning to bring to closing.

Once the deal successfully closes, that deposit, which has been sitting safely in an escrow account, gets credited right back to you. In almost every case, it’s applied directly to your down payment or used to chip away at your closing costs. Either way, it reduces the final wire transfer you’ll need to send on closing day.

Who Holds the Earnest Money Deposit?

This is a big one: your earnest money should never, ever go directly to the seller. If a seller asks for this, it’s a massive red flag. To keep everyone protected, the funds are always held by a neutral third party in what’s called a trust or “escrow” account.

This job is usually handled by one of these professionals:

- The title company managing the sale

- A dedicated escrow agent or company

- In some cases, a real estate brokerage (depending on state laws)

This arrangement guarantees the money is secure and is only released according to the precise terms everyone agreed to in the purchase contract.

Think of the escrow holder as the impartial referee. They don’t play for either team; their only job is to enforce the rules of the game (your contract) and make sure the money goes to the rightful party once the match is over.

Can I Pay Earnest Money with a Personal Check?

You might be able to, but I wouldn’t bet on it. For a smaller deposit in a sleepy market, a personal check could work. But in competitive situations—which is most of the market these days—sellers want guaranteed funds, and a personal check simply isn’t that. It could bounce, and no seller is willing to take their property off the market for that kind of risk.

More often than not, they’ll require a cashier’s check from your bank or, most commonly, a wire transfer. A wire is the gold standard—it’s fast, secure, and provides immediate proof of payment. Always ask about the seller’s preferred method before you write the offer. For new buyers, getting these details right is crucial, and you can find more tips in our first-time homebuyers guide for Los Angeles real estate.

Can I Negotiate the Earnest Money Amount?

Of course. Just like nearly every other term in a real estate contract, the earnest money amount is negotiable. The real question is how much leverage you actually have.

If you’re in a slow buyer’s market where homes are sitting for a while, you have more power to propose a lower deposit. But if you’re in a hot seller’s market with multiple offers flying around, a weak deposit can get your otherwise strong offer tossed aside without a second thought. Your agent is your best guide here—they know what’s considered a compelling but fair amount for your specific neighborhood.

Your Los Angeles real estate journey deserves a team that knows the city inside and out. At ACME Real Estate, we combine local expertise with a commitment to getting you the best possible outcome. Ready to make your move? Visit us at https://www.acme-re.com to get started.