When it comes to negotiating a home price, most people think it’s all about the final haggle. Wrong. The real work—the stuff that gives you an ironclad advantage—happens long before you ever make an offer.

This isn’t about some secret handshake or slick one-liner. It’s about showing up as a serious, undeniable buyer with your financing locked down, knowing the property’s true market value better than anyone, and having a killer agent in your corner. Get this foundation right, and you walk into the negotiation with the kind of swagger that closes deals.

Build Your Negotiation Power Play

Walking into a negotiation unprepared is like showing up to a heavyweight fight in flip-flops. You aren’t just buying a house; you’re making one of the biggest financial moves of your life. Winning the deal doesn’t start when you submit an offer—it starts with the homework you do weeks, or even months, beforehand.

Success in real estate negotiation is built on a foundation of power. That power comes from three places: cold, hard cash (or a loan that’s good as gold), killer intel, and an expert team. Let’s break down how to build your arsenal.

Get Financially Bulletproof

Before you even start lusting after listings, you need to get a full, underwritten pre-approval letter from a reputable lender. Let me be crystal clear: a simple pre-qualification is a participation trophy. It’s barely a first step.

A real pre-approval means a lender has already put your income, assets, and credit under a microscope. To a seller, you’re not a risk; you’re a “sure thing.”

Think of it this way: a pre-approval letter is your golden ticket. It tells the seller you aren’t just a dreamer; you’re a qualified buyer with the financial muscle to close the deal. That alone can put your offer at the top of the pile, especially when things get competitive.

Master the Market Data

Never, ever take the list price at face value. It’s a starting point, a suggestion, an opening bid. Your agent’s job is to pull the “comps”—the comparable sales data showing what similar homes in that exact neighborhood have actually sold for in the last few months.

When you’re digging into the comps, you need to look for a few key signals:

- Sale-to-List Price Ratio: Are homes selling for over, under, or right at the asking price? This is the clearest indicator of how hot (or cold) the local market is.

- Days on Market (DOM): A house that’s been sitting for 60+ days is a different ballgame. The seller is likely getting antsy and might be far more open to a lower offer.

- Price Reductions: A history of price drops is a huge flashing sign. It screams that the seller started too high and is now chasing the market down, which means they are motivated to make a deal.

Understanding the bigger market trends is also crucial. Despite higher mortgage rates, home prices are still on an upward trajectory. Forecasts from sources like Wells Fargo and the S&P Case-Shiller Index are pointing to price hikes between 4.4% and 5.2% in the near future. Knowing this helps you frame an offer that’s both aggressive and realistic. For a deeper dive, check out this housing price forecast analysis.

Assemble Your A-Team

An elite real estate agent is your most valuable weapon. Don’t just sign up with the first agent you meet at an open house. You need a shark—a proven negotiator who lives and breathes the local market.

A great agent brings insights you simply can’t find online and has the street smarts to navigate you through tense counteroffers. Their expertise can easily be the difference between overpaying by thousands and securing a fantastic deal.

And as you get ready for the intricate dance of negotiation, it helps to see the whole picture. The journey doesn’t end at the closing table. Getting a handle on everything that comes next can give you even more confidence. This helpful new homeowner checklist is a great resource for seeing what’s on the horizon.

Read the Seller and the Market

Every negotiation is a two-way street. If you really want to know how to negotiate home price, you have to become a bit of a real estate detective. This means digging into both the seller’s motivations and the pulse of the current market. This intel is what separates a blind guess from a strategic, compelling offer.

Of course, all your research needs to be done ethically and in line with Federal Fair Housing guidelines. The goal is to uncover the why behind the sale without ever being invasive. You are evaluating the property and the transaction, not the people.

Is the seller relocating for a new job with a non-negotiable start date? Are they downsizing and happy to wait for the perfect price? Or are they up against a financial deadline? Knowing their timeline and motivation gives you incredible insight.

Become a Real Estate Detective

Your agent is your biggest ally here. They can often get a feel for the situation just by talking to the seller’s agent. A few smart questions can reveal a lot:

- “Why are your clients moving?” It’s a simple, direct question that can sometimes get a surprisingly honest answer.

- “Do the sellers already have a new home under contract?” If they do, they’re on the clock. The fear of carrying two mortgages can make them much more flexible on price.

- “What’s most important to the sellers—price, closing date, or a clean offer?” This question helps you understand their priorities and structure your offer accordingly.

You can also look for public clues. Check the property’s sales history. If it was bought just a year or two ago, that could signal an unexpected life event is forcing the sale. To really read the situation, it also helps to understand what adds real value to a home. Researching factors that boost home value can sharpen your eye for a property’s true potential and strengthen your negotiation position.

Decode the Market Signals

Beyond the seller’s personal story, the market itself tells you what’s possible. You have to look past the list price and dive into the hard data.

A key indicator is the “days on market” (DOM). A property that’s been sitting for 90 days and has already had two price cuts tells a very different story than one that just hit the market last week.

The table below breaks down how to translate common market indicators into real negotiation leverage.

Decoding Market Signals for Negotiation Leverage

This table will help you spot opportunities in the market data and use them to build a stronger offer.

| Market Signal | What It Means | Your Negotiation Angle |

|---|---|---|

| High Days on Market (DOM) | The property has been listed for a long time without selling, suggesting low demand. | You have more room to make a lower offer. The seller is likely feeling pressure and may be more willing to negotiate. |

| Multiple Price Reductions | The seller started with an unrealistic price and is now chasing the market down. | This is a clear sign of seller motivation. Your offer, even if below the new list price, might be seen as a welcome solution. |

| Low Inventory (Seller’s Market) | Few homes are available, so buyers are competing for limited options. | Your leverage is weaker on price. Focus on other terms, like a flexible closing date or a clean, no-contingency offer. |

| High Inventory (Buyer’s Market) | Many homes are for sale, giving buyers more choices and power. | This is your time to be more aggressive with your offer price. Sellers know they have competition. |

Understanding these signals means you can craft an offer based on reality, not just wishful thinking.

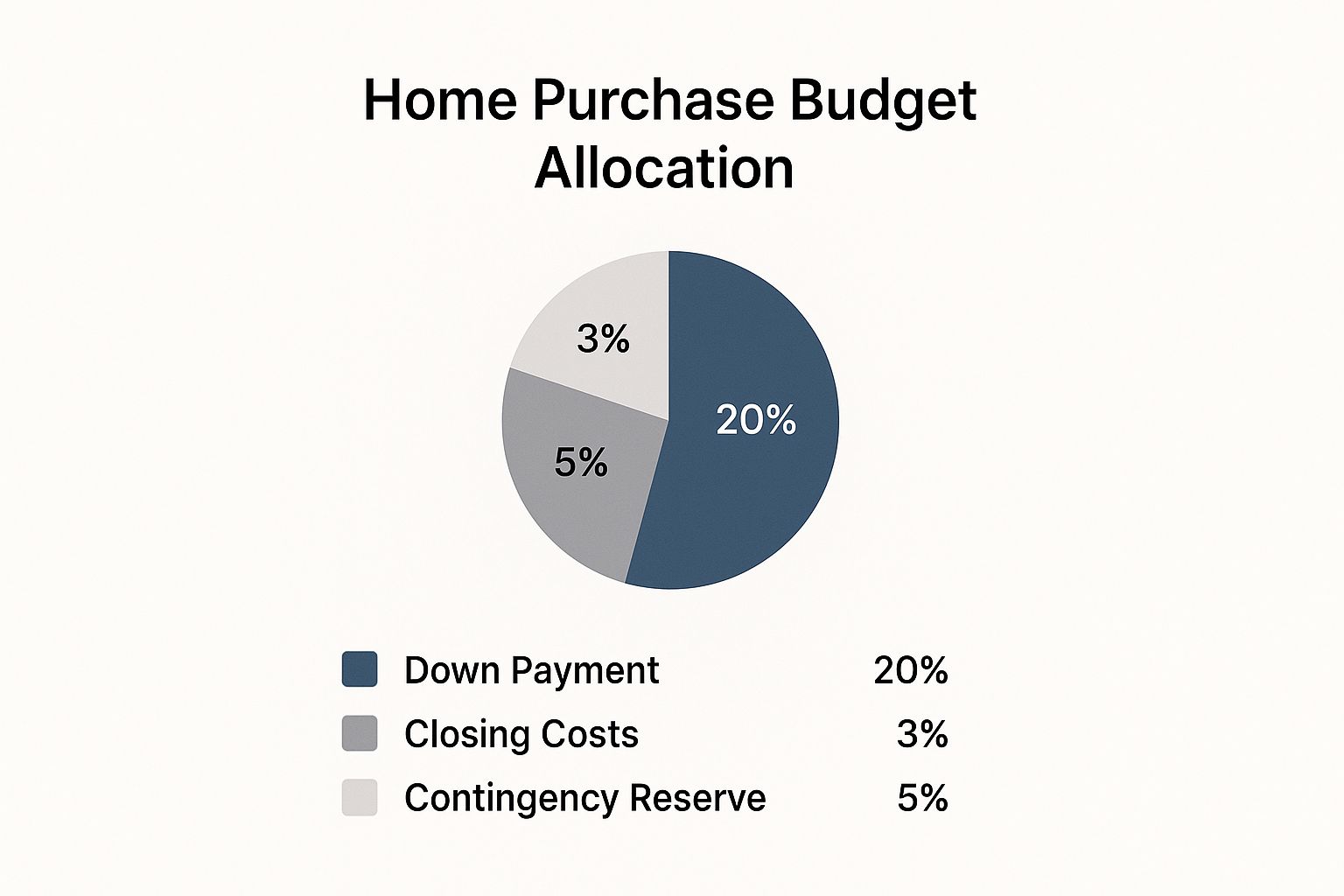

The budget breakdown above is also critical. Your negotiation power is about more than just the final price. Having solid reserves for closing costs and other contingencies shows you’re a serious, well-prepared buyer, which sellers love.

The broader market climate is also in flux. Right now, the national housing supply is around 3.5 months. While that’s higher than in recent years, it’s still historically tight. It’s a complex dynamic—buyers have more options, but sellers still hold some cards.

However, some regional markets are definitely cooling off. Zillow’s Market Heat Index, for instance, shows 25 major metro areas shifting toward buyers, particularly in the Southeast and Southwest.

A home’s story is written in its data. A high DOM, multiple price cuts, and a motivated seller are the ingredients for a successful negotiation. Combine that with your market knowledge, and you’re no longer guessing—you’re strategizing.

Don’t forget to zoom in on hyperlocal trends, too. National data can miss the nuances of a specific city or neighborhood. Our deep dive into Los Angeles real estate market trends is a perfect example of how local knowledge gives you an edge.

By connecting these dots—the seller’s personal needs and the market’s hard reality—you can build an offer that’s both compelling and incredibly smart.

Craft an Offer They Can’t Ignore

This is it—the moment of truth. Your first offer isn’t just a number; it’s your opening move in a high-stakes chess match. I’ve seen countless buyers sabotage themselves right out of the gate.

A thoughtless lowball offer can instantly offend the seller and kill the conversation before it even starts. On the other hand, blindly offering the full asking price could mean leaving thousands of dollars on the table.

The goal is to present an offer that’s taken seriously the second it lands. This requires a delicate balance: being aggressive enough to get a good deal but credible enough that they actually respond. It’s an art form, really, and it’s anchored by the solid research you’ve already done.

The Anatomy of a Winning Offer

A powerful offer is a full package. While the price gets all the attention, the other components are your secret weapons. A seller’s decision often comes down to which offer represents the path of least resistance.

Your offer needs to be clean, clear, and compelling. It will always include:

- Offer Price: The amount you’re willing to pay for the house.

- Earnest Money Deposit: This is your skin in the game—a good-faith deposit that shows you’re serious. A stronger deposit can make your offer much more attractive. We break this down completely in our guide on if earnest money is required.

- Contingencies: These are the conditions that must be met for the sale to go through, like the home inspection, appraisal, and your financing approval.

- Closing Date: Your proposed timeline to finalize everything.

Think of these elements as levers. You can adjust each one to make your offer more appealing, even if your price isn’t the absolute highest on the table.

Contingencies as Strategic Bargaining Chips

Contingencies are there to protect you, but for the seller, they represent uncertainty. The fewer “what ifs” you present, the stronger your offer becomes. This is a crucial piece of the puzzle when you’re learning how to negotiate the home price.

Let’s imagine a seller with two offers. One is for $505,000 but comes loaded with financing, appraisal, and inspection contingencies. The other is for $500,000, but it’s an all-cash offer with no need for financing or appraisal approval. I can tell you from experience, many sellers would jump at the lower, more certain offer just to avoid the risk of the deal falling through weeks down the line.

A clean offer with fewer strings attached can often beat a higher offer that’s loaded with conditions. A seller’s biggest fear is the deal collapsing, forcing them to put the house back on the market and start all over.

This dynamic is especially true when the market feels a bit shaky. Any hint of economic uncertainty can make sellers nervous and prioritize a sure thing over a few extra dollars.

The Personal Touch That Seals the Deal

In a world of sterile contracts and formal transactions, a genuine human connection can be your ultimate trump card. I’ve seen a well-written personal letter to the seller completely transform an offer from a simple number into a compelling story.

This isn’t about begging or oversharing. It’s about respectfully explaining why you love their home. Mention a specific feature you admire—the big backyard where you can already picture your dog playing, or the cozy reading nook that seems perfect for your book collection. It shows you appreciate the care and love they’ve poured into the property.

Keep the letter brief, positive, and focused on the home itself. It’s critical to adhere to Federal Fair Housing guidelines by avoiding personal details like your race, religion, or familial status. The whole point is to build rapport and make your offer memorable, not to create any basis for discrimination.

When a seller is staring at multiple similar offers, that personal touch can be the one thing that tips the scales in your favor and lands you your dream home.

So You Got a Counteroffer. Now What?

First off, take a breath. A counteroffer is a great thing. It means you’re in the game. The seller isn’t offended, they’re not shutting you down—they’re talking to you. This is where the real negotiation begins.

Getting a counter is an invitation to dance, and how you respond separates the buyers who get a good deal from the ones who get a great one. This is where a cool head and a sharp strategy can save you thousands.

Read Between the Lines: Deconstruct Their Counter

Before you even think about throwing another number back at them, you have to break down what they sent you. Their response is packed with intel about what they truly care about. You just have to know how to spot it.

- All About the Benjamins: If they only changed the price and left all your other terms alone, you know their focus is purely on the final number. This is a straightforward haggle.

- It’s the Little Things: Did they agree to your price but push back the closing date? Or maybe they crossed out your request for the patio furniture? This is a huge tell. Their priority might be a convenient timeline or avoiding hassle, not just squeezing every last dollar out.

- A Little of This, A Little of That: Most often, you’ll see a counter that adjusts the price and a few other terms. This is a clear sign they’re looking for a compromise on all fronts.

Once you understand their motivation, you have leverage. If you know they need a quick close, you can use that. Offer them a faster closing in exchange for a better price. If they seem allergic to the idea of doing repairs, you can offer to handle it all yourself for a credit. It’s a strategic give-and-take.

How to Craft a Winning Response

Your next move shouldn’t be just splitting the difference. That’s what amateurs do. A smart counteroffer addresses their needs while getting you closer to your goal.

A counteroffer isn’t a math problem where you just meet in the middle. It’s about finding the concessions that cost you the least but mean the most to the seller. Sometimes, the most valuable chip you have isn’t money at all.

Let’s play this out. They countered your $550,000 offer with $570,000. The obvious, but lazy, move is to offer $560,000.

Instead, what if you offered $558,000 but gave them a free rent-back for two weeks after closing? That flexibility might be worth far more to them than the extra $2,000, especially if they’re trying to time their own home purchase. You save money, and they get a major headache solved. That’s how deals get done.

The Inspection Report: Your Ultimate Leverage

After your offer is accepted, the home inspection is the most powerful negotiating tool you have. The report will almost always uncover issues, from minor annoyances to major red flags. This gives you a perfectly valid reason to reopen negotiations.

You generally have three ways to play this:

- Request Repairs: You can ask the seller to fix specific items before closing. This can work, especially with flippers or builders who have crews on standby. The downside? You have zero control over the quality of the work. You might get the cheapest fix possible, not the right one.

- Request a Price Reduction: You can ask for a straight reduction of the sale price to account for the needed repairs. This lowers your mortgage, but it doesn’t put cash in your pocket for the fixes you’ll have to make the day you move in.

- Request a Seller Credit: This is almost always the strongest move. You ask the seller for a credit toward your closing costs. This means you need less cash to close, leaving that money in your bank account to hire your own contractors. You control the repairs and the quality.

The key here is to be reasonable. Don’t sweat the small stuff or try to nitpick cosmetic flaws. Focus on the big-ticket items—the roof, the HVAC, electrical problems, or foundation issues. Back up your request with actual quotes from licensed professionals. It shows you’re serious and makes your request almost impossible to ignore.

Avoid These Costly Negotiation Mistakes

Knowing how to negotiate on a house is as much about dodging pitfalls as it is about making smart moves. I’ve seen it happen time and again: one wrong step can cost a buyer thousands of dollars, or even worse, the house they really wanted.

Let’s walk through the classic blunders that trip up even savvy buyers so you can sidestep them completely.

Letting Your Feelings Sabotage Your Strategy

The single biggest mistake I see is buyers falling head over heels for a property—and letting everyone know it. The second you let your emotions drive the bus, you’ve handed all your leverage to the seller.

It’s easy to get attached, I get it. But emotional decisions almost always lead to overpaying. When sellers or their agents sense your desperation, they know they don’t have to budge on price. You have to stay cool and treat it like the massive business transaction it is.

Another rookie move is revealing your financial hand too early. Never, ever tell the seller’s agent, “My absolute max is $750,000, but I’d like to offer $725,000.” You’ve just told them they can likely push you for an extra $25,000, and believe me, they will. Keep your financial ceiling confidential.

Pro Tip: Your initial offer sets the entire tone for the negotiation. A lowball offer that isn’t backed by solid market data or legitimate property condition issues will just get you dismissed as an unserious buyer. Your offer needs to be aggressive but always justifiable.

Winning the War, Not Every Little Battle

Don’t get bogged down in small-scale conflicts. I’ve seen deals get heated over whether the seller leaves behind the patio furniture or a set of drapes. This is a classic distraction.

Remember what you’re here for: to negotiate the price of a major asset, not to furnish your home for free. Focus on the big-ticket items that truly impact the property’s value and your long-term finances.

A critical mistake is not digging deep enough during your due diligence period. A thorough home inspection is absolutely non-negotiable before you finalize any offer. This is your chance to uncover the hidden issues that can give you real bargaining power.

For example, understanding the warning signs and strategies for addressing potential mold growth can help you identify a costly future problem and turn it into a powerful negotiation point.

If you can avoid these common negotiation traps, you’ll keep a level head, stick to your game plan, and close a deal you’re genuinely proud of.

Home Negotiation Questions Answered

You’ve done the legwork and you’re ready to make your move. But even the most prepared buyers have those nagging little questions that can stir up last-minute doubt.

Let’s cut through the noise and tackle the most common things that come up, so you can walk into your negotiation with total confidence.

Should I Make a Lowball Offer?

It’s tempting, I get it. But throwing out a “lowball” offer without any justification is a classic rookie mistake. An offer that’s 15-20% below asking price with no data to back it up—like major repair needs or awful comps—just signals you aren’t serious. Honestly, it’s more likely to tick off the seller and get your offer tossed than it is to start a real conversation.

Now, a low offer isn’t the same as a lowball offer if you have the evidence to support it. If a house has been languishing on the market for 90+ days and comparable homes have sold for significantly less, your lower price isn’t an insult; it’s just a reflection of reality.

The key is to justify your number with cold, hard facts. That’s how you turn a potential insult into a smart, strategic opening.

Is Asking for Seller Credits Better Than a Price Reduction?

For most buyers, my answer is a resounding yes. A seller credit directly cuts down the cash you have to bring to the closing table, which is often the biggest hurdle.

Let’s look at the math. A $10,000 price reduction on a 30-year mortgage at 6.5% interest might only drop your monthly payment by about $63. Sure, that adds up over three decades, but it does nothing for the immediate, and often crushing, costs of moving in.

A $10,000 seller credit, on the other hand, means $10,000 less cash you have to scrape together on closing day. That’s real money in your pocket, ready for new furniture, paint, or hiring contractors you trust—not the cheapest ones the seller could find.

What if the House Appraises for Less Than My Offer?

This is what we call an “appraisal gap,” and it can feel like a major roadblock. When a home appraises for less than your agreed-upon price, the lender will only finance the lower, appraised value. It’s a moment of truth, but you have options:

- You can cover the difference: If you have the cash reserves, you can pay the difference out of pocket to close the deal.

- The seller can lower the price: You go back to the seller and renegotiate the price down to what the appraiser said it’s worth.

- You can meet in the middle: A common solution where you and the seller agree to split the difference.

- You can walk away: If your contract has an appraisal contingency (and it should!), you can cancel the deal and get your earnest money back.

This is where your agent’s guidance is absolutely critical. In a hot market, some savvy buyers will even write an “appraisal gap coverage” clause into their offer, promising to cover a certain amount if the appraisal comes in low. This can make an offer incredibly attractive to a seller who’s nervous about the valuation.

Ready to put these strategies to work and find your place in Los Angeles? The expert negotiators at ACME Real Estate are here to guide you through every twist and turn, making sure you secure the best possible deal. Let’s make your real estate goals a reality. Visit us at https://www.acme-re.com to get started.