Forget what you’ve seen on TV. Flipping houses isn’t about dramatic reveals; it’s a cold, hard business built on a simple formula: buy an undervalued property, renovate it with surgical precision, and sell it for a profit. This is your no-BS guide to the mindset you absolutely must have to win in this game.

Your Blueprint For a Profitable House Flip

Let’s cut right to the chase. Flipping houses isn’t a hobby or a get-rich-quick scheme. It’s a high-stakes venture that demands sharp business chops, an unemotional view of the investment, and a bulletproof plan.

Think of every project as a startup and yourself as the CEO. Your mission is to execute a clear business model, not build your dream home.

This means mastering the numbers is completely non-negotiable. Profit is made when you buy, not when you sell. If you don’t live and breathe concepts like After Repair Value (ARV), renovation costs, and holding costs, you’re not investing—you’re gambling.

The Flipping Mindset

To make real money flipping houses, you have to think like an entrepreneur, not a homeowner. This is a critical mental shift. You must prioritize ROI over your personal taste, every single time. Your job is to create a product that appeals to the widest possible audience in a specific neighborhood, always adhering to Fair Housing guidelines by marketing the property’s features, not making assumptions about who the buyer will be.

This mindset forces you to stay laser-focused on a few key areas:

- Market Analysis: You need to know your target neighborhood inside and out. What are buyers actually looking for? What’s the absolute ceiling for home prices? This isn’t about stereotypes; it’s about data-driven decisions on what features sell.

- Budget Discipline: Sticking to a meticulously planned budget is everything. Every single dollar you spend must directly contribute to the final sale price.

- Speed and Efficiency: Time is money, literally. The longer you hold a property, the more your profits get eaten away by taxes, insurance, and loan interest.

The core of a profitable flip is dead simple: Control your costs, know your market, and get out fast. Every decision you make, from the property you buy to the paint color you choose, must be filtered through the lens of profitability.

To keep these core principles front and center, I think of every project in terms of four essential pillars. Getting any one of these wrong can sink the entire flip.

The Four Pillars of a Successful Flip

| Pillar | What It Means | Why It’s Critical |

|---|---|---|

| The Right Property | Finding an undervalued home in a desirable location where your renovations can add significant value. | You make your money on the purchase. Overpaying upfront is a mistake you can’t fix with fancy finishes. |

| Accurate Numbers | A rock-solid budget for the purchase, renovation, holding, and selling costs, plus a realistic After Repair Value (ARV). | Without accurate numbers, you’re flying blind. This is what separates professional investors from amateurs. |

| Smart Renovation | Focusing renovations on high-ROI updates (kitchens, baths, curb appeal) that appeal to local buyers, not your personal style. | Over-improving for the neighborhood or choosing niche designs shrinks your buyer pool and kills your profit margin. |

| Efficient Execution | Managing the project on time and on budget, then staging and marketing the property effectively to sell quickly. | Delays and budget overruns are profit killers. A fast sale minimizes holding costs and maximizes your return. |

These pillars aren’t just guidelines; they are the fundamental structure of a successful business model in the flipping world.

Is House Flipping Still Worth It?

Even with the market shifts we’ve seen, house flipping is still a powerful wealth-building tool. The market has definitely cooled from its frenzied peaks, but that just means the opportunities are there for savvy, professional investors.

Recent data shows that flips account for about 7-9% of all U.S. home sales. While the insane ROI has settled from nearly 49% to a more sustainable 25-30%, the average gross profit per flip is still strong, often landing between $40,000 and $75,000.

This data tells us the game has changed, but it’s far from over. Success now demands more skill, better analysis, and a smarter strategy. It is one of several powerful approaches to building wealth, and you can learn more by exploring the best real estate investment strategies available today.

The days of throwing money at any property and expecting a massive return are gone. We’re now in an era where calculated, professional flippers thrive.

Finding the Deal and Funding the Dream

You can have the most brilliant renovation plan in the world, but it means absolutely nothing if you overpay for the property. This is the cold, hard truth of flipping: a killer renovation can’t fix a bad purchase.

Your profit is locked in the moment you sign on the dotted line. Mastering the art of the hunt isn’t just a skill—it’s the skill that makes or breaks you in this business.

Forget mindlessly scrolling the MLS. Sure, a deal can pop up there occasionally, but the real gems—the properties with enough meat on the bone for a profitable flip—are almost always found off-market. This is where you outwork the competition.

Hunting for Deals Beyond the Obvious

To find properties that haven’t been picked over by every other investor, you have to get a little creative and a little gritty. It means hitting the pavement and digging for opportunities that aren’t being served up on a silver platter.

These are the channels that consistently produce winners for my team:

- Local Auctions: This is ground zero for distressed properties. Foreclosure auctions and estate sales can be goldmines, but you have to show up prepared. That means having your financing secured and your maximum bid calculated before you walk in the door. No exceptions.

- Driving for Dollars: It sounds old-school because it is, but it works. Get in your car and drive through the neighborhoods you’re targeting. Look for signs of neglect: overgrown lawns, boarded-up windows, or stacks of unopened mail. These are visual cues of a potentially motivated seller.

- Direct-to-Seller Marketing: This is a more advanced strategy, but it can yield incredible results. Targeted mail campaigns to absentee owners or the owners of inherited properties can open doors to deals with zero competition. It’s a numbers game, but the payoff can be huge.

Once you’ve got a potential property in your sights, zoom out and look at the neighborhood. You’re not just buying a house; you’re buying into a hyper-local market. A rising tide lifts all boats, so buying in an area with upward momentum is key. Look for new coffee shops, renovated parks, and other homes being fixed up. These are all signs of a neighborhood on the upswing.

Never fall in love with the house; fall in love with the deal. The numbers must work, period. If the math is wrong, you walk away, no matter how much potential you think the property has.

Getting the Money to Make Money

With a promising property identified, the next question is always the same: how are you going to pay for it? The world of investment financing is a completely different beast than the traditional mortgage process. Here, speed and flexibility are the name of the game.

Traditional banks are usually too slow for the fast-paced world of flipping. By the time they approve your conventional loan, a cash buyer or an investor with private funding has already scooped up the deal. That’s why most professional flippers turn to alternative sources.

Hard Money Lenders

Think of hard money lenders as the special forces of real estate financing. They are private lenders who focus on the asset—the property itself—more than your personal credit score.

- Pros: They are incredibly fast, often able to fund a deal in a matter of days, not weeks. They get the flipping model and will often finance both the purchase and a portion of the renovation costs.

- Cons: This speed comes at a price. Expect higher interest rates, often in the 8-15% range, plus origination points. These loans are also short-term, typically for 12-24 months, because they’re designed to get you in and out of a project quickly.

Private Money Lenders

This is just what it sounds like: financing from individuals in your network—friends, family, or other investors. It’s built entirely on relationships and trust.

You bring them a solid, well-researched deal, and they provide the capital in exchange for a fixed return on their investment. It can be a massive win-win, but make sure you have everything documented by a real estate attorney. It keeps things professional and protects everyone involved.

No matter which path you choose, running the numbers with absolute precision is non-negotiable. To truly know if a deal makes sense, you have to account for every single cost—from closing fees to carrying costs to the final coat of paint.

For a detailed breakdown of all the variables, our real estate investment calculator is an invaluable tool for making sure your projections are rock-solid before you commit a single dollar.

Renovating for Profit Not Perfection

This is where the real work begins—and where your flip’s profitability is truly decided. The renovation is the engine that turns a tired property into a hot commodity. But let’s be crystal clear: your personal taste doesn’t matter here. Not one bit.

You’re not building your dream home. You’re executing a calculated, market-driven renovation designed to do one thing: make money. Every decision, from the cabinet hardware to the front door color, must answer a single question: “Will this appeal to the broadest pool of buyers in this neighborhood and increase the home’s final sale price?”

This is the core discipline of flipping houses. You have to renovate with your head, not your heart.

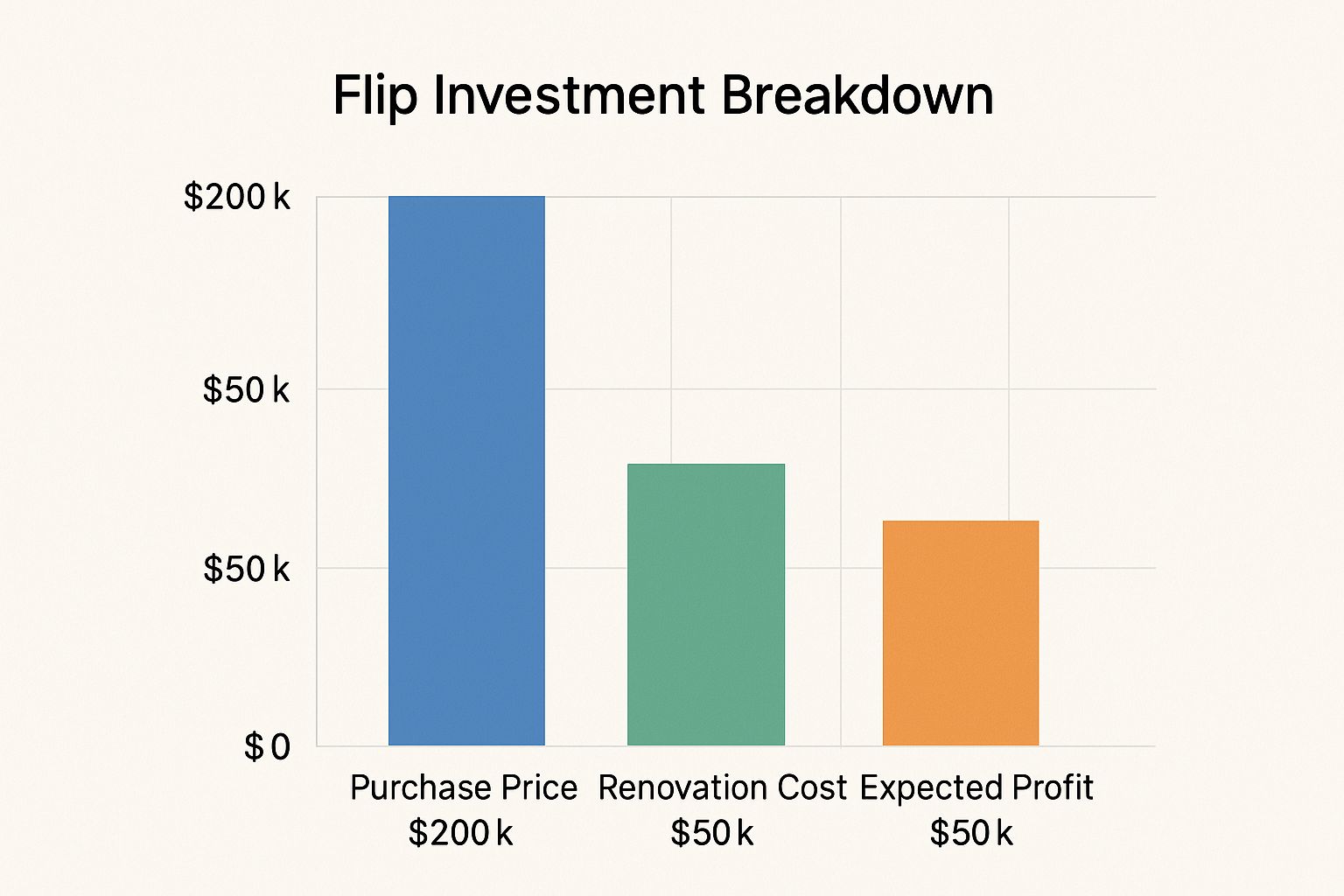

As you can see, the rehab budget is a massive piece of the pie. Mess this up, and your profit margin evaporates.

The Scope of Work Blueprint

Before anyone even thinks about picking up a hammer, you need a rock-solid scope of work (SOW). Think of this document as the constitution for your project. It details every single task, every material, and every finish. A vague SOW is just begging for budget overruns and timeline disasters.

Painful specificity is your best friend. Don’t just write “update kitchen.” That’s useless. Instead, your SOW should look something like this:

- Cabinets: Shaker-style, color: “Chantilly Lace,” model #XYZ from ABC Supply.

- Countertops: Quartz, “Calacatta Laza,” 3cm thickness with an eased edge.

- Backsplash: 3×6 white subway tile, laid in a herringbone pattern with “Oyster Gray” grout.

- Flooring: Luxury Vinyl Plank, 7-inch width, “Coastal Oak” from Brand ABC.

This level of detail leaves zero room for interpretation. Your contractor knows exactly what’s expected, and you ensure the vision stays on track and, more importantly, on budget.

High-ROI Upgrades vs. Money Pits

Not all renovations are created equal. Some are proven money-makers. Others are just expensive hobbies that will sink your project. Your job is to focus ruthlessly on the upgrades that deliver a return.

We’ve all seen flips where the investor clearly fell in love with a trendy, expensive finish that no buyer in that price point cared about. Don’t be that person. Stick to the classics that move the needle.

| Project | Average Cost | Typical ROI (%) | Why It Works |

|---|---|---|---|

| Kitchen Remodel (Minor) | $15,000 – $25,000 | 75-100% | The heart of the home. Fresh cabinets, neutral countertops, and new appliances are the biggest selling points. |

| Bathroom Update | $8,000 – $15,000 | 65-80% | Buyers want clean, modern, spa-like spaces. New vanities, fixtures, and tile make a huge impact. |

| Curb Appeal Boost | $3,000 – $7,000 | 100%+ | First impressions are everything. New paint, a modern front door, and landscaping create instant “wow.” |

| New Flooring & Paint | $5,000 – $12,000 | 70-90% | Creates a clean, move-in-ready feel. Consistent flooring makes spaces feel larger and more cohesive. |

| High-End Pool | $50,000+ | 20-40% | A classic money pit. Narrows the buyer pool and rarely recoups its cost unless it’s a luxury market standard. |

| Finished Basement | $30,000 – $60,000 | 50-70% | Adds square footage but is valued less than above-grade space. Can be a good move, but the ROI isn’t guaranteed. |

The takeaway is simple: focus on the visual impact zones—kitchens, baths, and curb appeal. These are the areas that sell houses.

Vetting Contractors and Navigating Permits

Your general contractor is the most critical member of your team during the rehab. A great one is a partner who saves you money and delivers a beautiful product on time. A bad one can single-handedly bankrupt you.

Vet them like your entire investment depends on it… because it does.

- Check licenses and insurance. This is non-negotiable.

- Call at least three recent references. Ask the tough questions: Were they on time? On budget? How did they handle problems?

- Visit a current job site. See their work and organization firsthand. Is it clean and professional, or a chaotic mess?

Once you’ve found your contractor, get the permit process started immediately. Permit delays are one of the most common reasons flips go off schedule. Don’t even think about cutting corners here. Unpermitted work is a massive red flag for buyers and their lenders, and it can kill your deal at the closing table.

Location Dictates Renovation Costs

Always remember that your renovation strategy has to be tailored to the local market. What works in a lower-cost area of Ohio won’t fly in a high-end California suburb. Costs for labor and materials vary wildly across the country, and this directly impacts your bottom line.

For example, a state like Alabama often has some of the lowest average renovation costs in the nation, which can make it easier to turn a profit on lower-priced homes. Contrast that with a market like San Jose, California, where sky-high home values demand high-end finishes and command a much larger renovation budget. Your numbers must reflect your specific location.

By focusing on a smart, market-driven renovation, you’re not just fixing up a house—you’re manufacturing equity. You’re setting the stage for a smooth, profitable sale.

Staging Marketing and Selling for Top Dollar

The dust has settled, the last contractor has packed up, and the smell of fresh paint hangs in the air. You’ve done the grueling work of transforming a neglected property into a polished gem. Now it’s time for the final, most crucial phase: getting paid.

This isn’t just about listing a house; it’s about manufacturing buyer obsession. You need to create an emotional gut punch the second someone walks through the door or sees the first photo online. This is where you cash in on all your hard work and smart decisions.

The Non-Negotiable Power of Professional Staging

An empty house is just a box of rooms. It feels cold, sterile, and smaller than it actually is. Buyers struggle to visualize their lives there. This is why professional staging isn’t a luxury; it’s a mission-critical investment that separates the pros from the amateurs.

Staging does more than just fill a space with furniture. It tells a story. It helps buyers forge an immediate emotional connection, turning a property viewing into a mental move-in day.

Staged homes sell, on average, for 8-10% more and spend significantly less time on the market. Don’t skip this step to save a few bucks. The ROI is massive.

A professional stager understands scale, flow, and how to highlight the home’s best features while downplaying any awkward layouts. They use a neutral, aspirational style designed to appeal to the widest possible audience, ensuring your personal taste never gets in the way of a sale.

Crafting a Magnetic Listing That Sells

In today’s market, your online listing is the new curb appeal. Most buyers will decide whether or not to even visit your property based solely on the first few photos they see. This is your one shot to make a powerful first impression, so don’t mess it up with amateur smartphone pictures.

- Invest in Professional Photography: This is absolutely essential. A pro photographer knows how to use lighting, angles, and composition to make every room look its absolute best. It’s the single most important marketing expense you’ll have.

- Write Compelling Copy: Don’t just list features (“3 bed, 2 bath”). Tell a story. Describe the experience of living in the home. Talk about the morning light flooding the kitchen or the backyard being perfect for weekend barbecues. Paint a picture with your words.

Your listing should be a magnet for your ideal buyer, drawing them in and making them feel like they have to see the home in person.

Finding the Pricing Sweet Spot

Pricing your flip is both an art and a science. Price it too high, and it will sit on the market, accumulating holding costs and becoming stale. Price it too low, and you leave a pile of your hard-earned cash on the table.

The goal is to find that strategic sweet spot that generates immediate buzz and encourages multiple offers. This is where a sharp real estate agent who knows the local market is invaluable. They can pull hyper-local comps—recent sales of similar, renovated homes—to pinpoint a price that creates urgency.

Slightly underpricing the home is a common and effective strategy to spark a bidding war. Attracting more buyers often results in the final sale price being driven well above what you might have listed it for initially. It’s a bold move, but it can pay off handsomely when executed correctly.

Dominating the Negotiation and Closing

Once the offers start rolling in, your work isn’t over. This final sprint to the closing table requires a steady hand and sharp negotiation skills. You’ll need to handle offer contingencies, navigate the home inspection report, and address any appraisal issues that might arise.

The inspection is often a second round of negotiations. Buyers may come back with a list of requested repairs. Be prepared to address legitimate issues while pushing back on minor, cosmetic requests. Having a great contractor on your team can help you quickly get quotes for any necessary repairs, giving you leverage in the conversation.

Understanding the nuances of these discussions is key, and it’s a good idea to explore our guide on how to negotiate home price to arm yourself with effective tactics. By staying organized, responsive, and firm, you can confidently guide the deal to a successful close, finally turning all your effort into tangible profit.

Building Your House Flipping Power Team

Let’s get one thing straight: house flipping is not a solo sport. Trying to go it alone is the fastest way to get chewed up and spit out by this business. Your real secret weapon—the asset that will protect your capital and your sanity—is a hand-picked crew of professionals. This is your power team.

A great team is your insurance policy against the chaos that every single flip inevitably throws at you. These are the people in the trenches with you, and building these relationships is just as important as finding the right property. A bad hire can sink a project, but the right team makes success almost inevitable.

Your Core Four Professionals

While your network will grow over time, every flipper needs to lock down four key players from day one. These aren’t just contacts; they are strategic partners who will make or break your deals.

- The Hustler Real Estate Agent: You don’t want an agent who just forwards MLS listings. You need a shark—an investor-savvy agent who lives and breathes the local market. They should be bringing you off-market deals, have a deep understanding of After Repair Value (ARV), and know exactly what renovations local buyers will pay a premium for.

- The Rock-Solid General Contractor: This is arguably the most important relationship you will build. A trustworthy General Contractor (GC) who delivers on time and on budget is worth their weight in gold. A bad one can single-handedly destroy your profit margin and timeline. No excuses.

- The Detail-Oriented Real Estate Attorney: Don’t skimp here. A sharp attorney who specializes in real estate transactions is your shield. They review contracts, navigate title issues, and ensure your closings are airtight, protecting you from legal landmines that could derail the entire project.

- The Agile Lender: Whether it’s a hard money or private lender, you need a financing partner who understands the speed of the flipping game. They must be responsive, transparent with their terms, and capable of closing a deal in days, not weeks.

How to Vet Your Team and Spot Red Flags

Finding these people isn’t about a quick Google search. It’s a rigorous vetting process. Think of it like a job interview where your entire investment is on the line—because it is.

When interviewing a potential team member, especially a contractor, dig deep. Ask for at least three recent references from other investors, not just homeowners. Call every single one and ask the tough questions: Did they stick to the budget? How did they handle unexpected problems? Were they a good communicator?

A major red flag is anyone who resists putting things in writing. Vague quotes, handshake deals, and a lack of a detailed contract are signs of an amateur. Pros document everything.

Pay close attention to how they communicate. Are they responsive? Do they answer questions directly? A professional who is hard to get a hold of during the vetting process will be impossible to reach when a real problem arises on the job site.

Nurturing Your Professional Network

Once you’ve assembled your A-team, treat them like gold. Building lasting relationships is the key to long-term success in flipping houses. This isn’t transactional; it’s relational.

Your network is a two-way street. Pay your contractors and lenders on time, every time. Be clear and organized with your communication. When you bring a clean, well-analyzed deal to the table, it makes everyone’s job easier and more profitable.

Ultimately, a strong team creates a deal-making machine. Your agent finds the gem, your lender funds it quickly, your contractor transforms it efficiently, and your attorney closes it cleanly. This synergy is how you flip houses successfully, project after project.

Answering the Tough Questions on Flipping Houses

Jumping into house flipping brings up a storm of questions. It’s a high-stakes world, and feeling a little unsure is completely normal. I’ve heard just about every question in the book from new investors over the years, so I’ve put the big ones right here.

This is your no-fluff guide, designed to give you clear, honest answers. From figuring out how much cash you really need to understanding the rules of the road, think of this as your final check-in before you start hunting for that first deal.

How Much Money Do You Really Need to Start?

There’s no single magic number, and it’s definitely a lot more than just the purchase price of the house. You need a solid cash reserve to cover a few critical areas. First up is your down payment, which for an investment property is almost always going to be 20-25%.

Then, you need the entire renovation budget sitting in the bank before you even think about starting demo. On top of that, you need enough cash on hand to cover 6-12 months of holding costs—we’re talking mortgage payments, insurance, utilities, and property taxes. While some flippers use hard money loans to bring less cash to the table, those come with brutal interest rates.

A safe starting point is having access to at least $50,000-$100,000 in liquid cash, but this can swing wildly depending on your local market.

What’s the 70% Rule All About?

The 70% Rule is a quick, back-of-the-napkin formula that savvy investors use to see if a deal has potential. It’s your first line of defense against overpaying and helps you protect your profit margin from the get-go.

The rule is simple: you should never pay more than 70% of the home’s After Repair Value (ARV), minus the estimated cost of repairs. That leftover 30% is your safety net. It’s built to absorb your holding costs, closing costs, realtor commissions, and—most importantly—your profit.

Let’s run the numbers:

Say you find a house with a potential ARV of $400,000 that needs $60,000 in work.

- Step 1: Calculate 70% of the ARV:

$400,000 * 0.70 = $280,000- Step 2: Subtract your reno budget:

$280,000 - $60,000 = $220,000According to the rule, $220,000 is the absolute most you should offer on that property. Pay a dollar more, and you’re eating into your own profit.

What’s the Biggest Mistake New Flippers Make?

The single most devastating mistake rookies make is completely blowing their renovation budget and timeline. It happens over and over. They cook up an optimistic budget that conveniently ignores the nasty surprises hiding behind the drywall—rotted subfloors, ancient wiring, or a plumbing nightmare waiting to happen.

To avoid this, you must build a contingency fund into every single project. A 15-20% buffer on your total renovation cost isn’t just a good idea; it’s the professional standard.

A close second? Getting emotionally attached to a house and over-improving it. Putting in finishes that the local comps just don’t support will absolutely torch your return on investment.

Can I Really Flip a House with Zero Experience?

Yes, but you have to be smart and check your ego at the door. Trying to tackle a full gut job on your first go is a masterclass in how to lose your shirt. For a true beginner, the best path forward is to partner with someone who has been around the block—a seasoned contractor or an experienced investor who can show you the ropes.

If you’re dead set on flying solo, you have to start small.

- Go for a cosmetic flip: Find a solid house that just needs paint, new floors, and minor updates.

- Dodge the big stuff: Stay far away from projects that involve moving walls, pulling permits, or messing with plumbing and electrical systems.

- Become a student of the game: Network with local real estate pros, go to meetups, and soak up every bit of information you can.

Think of your first deal as your real-world tuition. The goal isn’t to hit a grand slam on profit; it’s to learn the entire process from start to finish while keeping your risk as low as possible. Don’t be afraid to pay for good advice to avoid making a six-figure mistake.

At ACME Real Estate, we believe that a successful real estate journey is built on a foundation of knowledge and expert guidance. Whether you’re a first-time flipper or a seasoned investor looking for your next project in Los Angeles, our team has the local expertise and industry connections to help you succeed. Explore your next opportunity with us at https://www.acme-re.com.