Welcome to the wild, wonderful, and sometimes bananas world of Los Angeles real estate. Buying a home here isn't just a transaction—it's a lifestyle upgrade, a boss move, and an adventure all rolled into one. But let's be real: it can feel like a high-stakes game where the rules are written in a language you don't speak. This guide is your secret decoder ring, designed to cut through the noise and show you exactly how to win.

Your LA Home Buying Journey Starts Here

Buying a home in Los Angeles is a completely different beast. The market moves at the speed of a Hollywood car chase, the competition can be fiercer than a casting call, and the rewards are absolutely life-changing. This is a city of sprawling, distinct neighborhoods, each with its own soul. Finding your spot here takes grit, smarts, and a killer game plan.

This isn't your parents' slow-and-steady housing market. Success in LA means being prepared, decisive, and ready to pounce the moment your dream home hits the market. This guide is your launchpad, built to give you the actionable intel and confidence to make smart, fast moves.

Understanding the Current Market

To win the game, you gotta know the playing field. High demand and ridiculously tight inventory define the Los Angeles housing market, creating a competitive pressure cooker for buyers. Getting cozy with the key numbers gives you a realistic baseline for what you're up against.

Before we dive into the nitty-gritty, let's get a snapshot of the current landscape.

Los Angeles Housing Market at a Glance

This table breaks down the essential figures that every potential LA homebuyer needs tattooed on their brain.

| Metric | Value |

|---|---|

| Median Home Sale Price | $1,060,000 |

| Year-Over-Year Price Increase | 27% |

| Median Days on Market | 67 days |

| Time to Sell (Desirable Homes) | As little as 22 days |

These aren't just stats; they're a flashing neon sign. The market's heat and velocity mean that preparation isn't just a good idea—it's everything.

Key Takeaway: The LA market moves fast and doesn't wait for anyone. Having your finances locked and loaded isn't just an advantage—it’s a flat-out necessity for landing your dream home.

Preparing for Your Search

Before you even think about doom-scrolling through listings or hitting up open houses, you need to get your life organized. The road to buying a home in LA starts long before you step foot in a single property. It begins with a crystal-clear understanding of your goals and a tactical plan to get there.

A great way to stay on track is to use a detailed first-time house buying checklist. Think of it as your mission brief, ensuring nothing falls through the cracks from financial prep to closing day.

Here are a few initial steps to get the ball rolling:

- Define Your "Why": What's the real mission here? Slashing your commute? Getting into a killer school district? A complete lifestyle overhaul? Pinpointing your core motivation is the compass that will guide your entire search.

- Set a Realistic Timeline: While some lucky buyers score a home in weeks, others might hunt for months. Set a flexible timeline that accounts for the market's brutal competitiveness and potential plot twists.

- Start the Money Talk: It's time to get brutally honest about your budget and savings strategy. The sooner you start this conversation, the more powerful your position will be when it's time to make an offer. We’ll dive deeper into this next.

Master Your Finances Before the Hunt Begins

Before you find yourself daydreaming about that mid-century modern in the Hills or a perfect little bungalow in Culver City, we need to talk about money. In a market as intense as Los Angeles, sorting out your finances isn't just a preliminary step—it's the entire foundation of your home-buying mission. A strong financial footing is what makes you a real player in a city full of them.

Think of it this way: showing up to an open house without a mortgage pre-approval is like showing up to a marathon in flip-flops. You simply won't be taken seriously. LA sellers often juggle multiple offers, and they'll instantly toss any that aren't backed by solid proof of financing.

Pre-Approval Is Your Golden Ticket

Let’s get one thing straight, because this trips up a lot of first-timers: pre-qualification is not the same as pre-approval. A pre-qualification is a flimsy estimate of what you might be able to borrow. A pre-approval, however, is the real deal—a conditional commitment from a lender for a specific loan amount after they’ve put your finances under a microscope.

To get pre-approved, a lender will go deep on your financial life. They’ll dig into your:

- Credit History: This means pulling your official credit reports and scores.

- Income and Employment: Be ready with pay stubs, W-2s, and tax returns to prove your earning power.

- Assets and Debts: You’ll need to hand over bank statements and document any other loans you're carrying.

Understanding exactly what lenders are looking for is a critical piece of the puzzle. For a deeper dive into the specific criteria they use to evaluate you, this guide on how to qualify for a mortgage is an excellent resource.

Going through this process changes the game. You're no longer a window shopper; you're a powerhouse buyer. With that pre-approval letter in hand, you and your agent know precisely what you can afford, letting you hunt with laser focus and confidence.

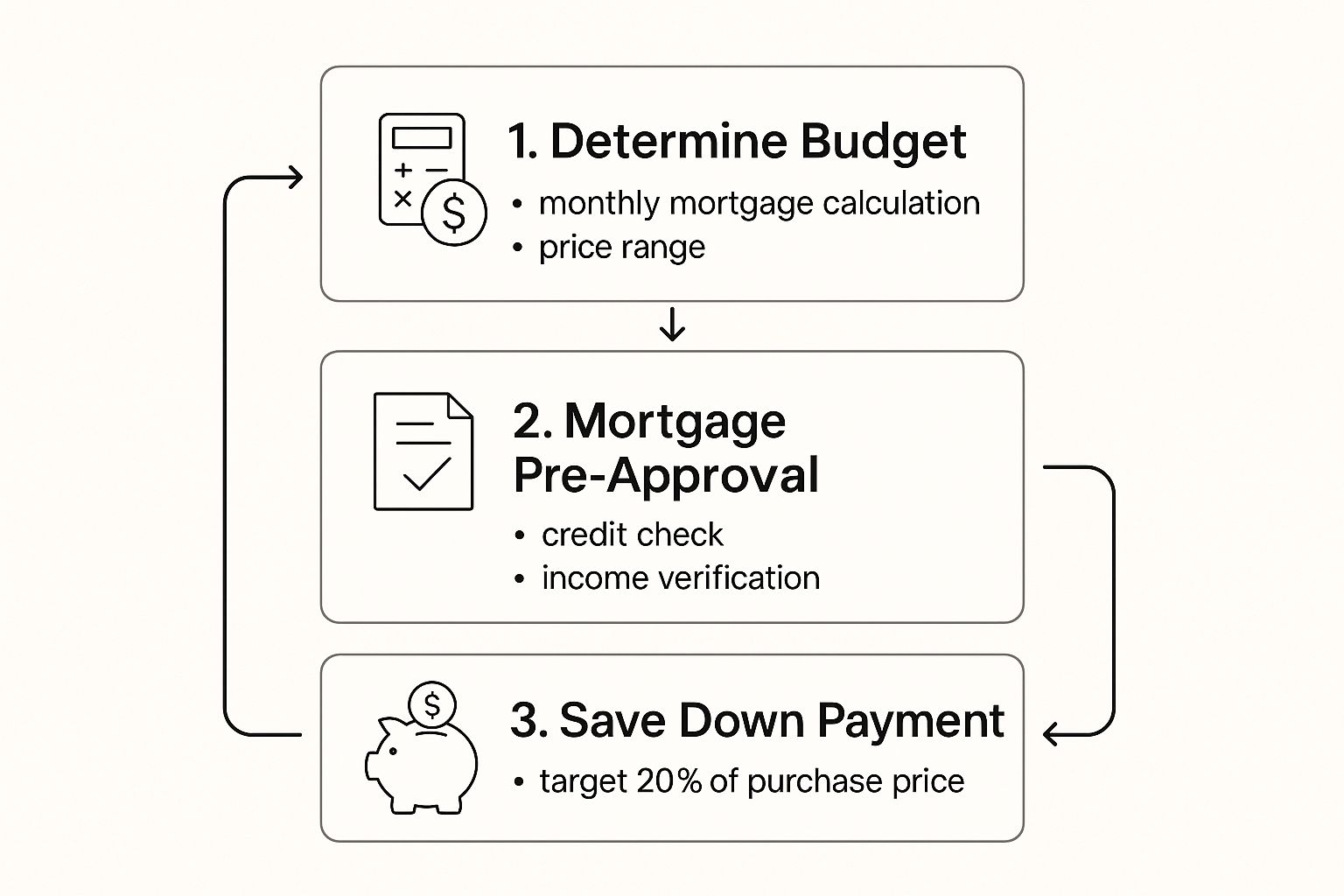

As you can see, figuring out your budget, getting pre-approved, and saving for your down payment are all deeply connected. They work together to build your buying power.

Calculating Your True LA Budget

That pre-approval letter shows you a maximum loan amount, but that doesn't mean you should max it out. A realistic budget for an LA home goes way beyond the sticker price. You have to think about the total cost of ownership, or what we call the "Oh, crap, I have to pay for that too?" fund.

Your monthly housing cost should ideally land somewhere between 28% and 33% of your gross monthly income. This is a benchmark lenders often use, and it’s a solid guideline to keep you from becoming “house poor.”

When you're calculating your monthly payment, you need to include more than just the mortgage itself. Here are the key expenses to factor in:

- Principal and Interest: The core of your mortgage payment.

- Property Taxes: In LA County, expect the tax rate to be around 1.25% of the home’s assessed value each year. Ouch.

- Homeowner's Insurance: Non-negotiable. Costs can jump in areas prone to wildfires or earthquakes.

- HOA Fees: Eyeing a condo or a home in a planned community? These fees can be a significant and recurring monthly hit.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, you'll almost certainly have to pay for PMI.

Just to put it in perspective, a $900,000 home could easily carry over $1,000 a month in property taxes alone. That dramatically changes your total monthly outlay. Seeing how all these costs stack up is just as important as visualizing how a home can be transformed, like we saw with this cozy vintage cottage in Echo Park.

The Down Payment Challenge

Let's be blunt: saving for a down payment in Los Angeles is a Herculean task. While putting 20% down is the gold standard—it helps you avoid PMI and get better loan terms—it’s not a realistic goal for every buyer.

Many successful buyers I've worked with have had to get creative. They’ll pull together a combination of personal savings, financial gifts from family, or look into low-down-payment loan programs like FHA or VA loans if they qualify.

The trick is to start saving early and with a clear strategy. Set a goal, automate your savings, and be aggressive. This financial bootcamp is your first real victory on the path to owning a home in LA.

Finding Your Perfect Los Angeles Neighborhood

Los Angeles isn't one city. It's a massive, sprawling collection of distinct communities stitched together, each with its own vibe, price tag, and way of life. This is where your house hunt gets real—and honestly, it's the fun part. To find a spot that genuinely feels like home when you're buying a house in Los Angeles, you have to look past the Hollywood sign and postcard clichés.

This stage of the journey is all about matching your actual life to a physical location. Are you chasing that creative, walkable energy of Eastside hubs like Silver Lake or Highland Park? Or do you crave the salty air and laid-back feel of Westside spots like Santa Monica or Venice? Maybe the suburban space and relative affordability of "The Valley" is calling your name.

We're going to dig into the real-world factors that actually matter day-to-day. The goal is to find a place that fits you, focusing on amenities and lifestyle. We adhere strictly to Federal Fair Housing guidelines, which means we focus on the property and the community, never on the people who live there. It’s about the place, not the faces.

Look Beyond the Postcard View

First thing's first: you need to start thinking like a local, not a tourist. The iconic image of a neighborhood often has little to do with the reality of living there. You need a practical framework for your research.

Start by getting brutally honest and making a "must-have" versus "nice-to-have" list. Is a short commute an absolute, non-negotiable deal-breaker? Does having direct access to certain parks or hiking trails top your list? Answering these questions will narrow down the map in a huge way.

A great way to approach this is to literally score potential neighborhoods on your key criteria. This turns a vague feeling into a more data-driven decision, helping you compare very different areas objectively.

The Commute Is King

In Los Angeles, your commute can single-handedly define your quality of life. I’m not exaggerating. A 10-mile drive can take 20 minutes or a full hour and a half, depending entirely on the time, direction, and which freeway you're stuck on. Before you even think about falling in love with a house, you have to test-drive the commute.

And I mean actually test-drive it. Drive the route during the exact times you’d be on the road—both in the morning and evening rush hours. Don't just trust the map apps. The soul-crushing reality of LA traffic is something you have to experience firsthand. Also, check out public transit. Being near a Metro line can be a complete game-changer for both your daily stress levels and your wallet.

Pro Tip: Think of your commute as your "second rent." Calculate the cost of gas, car maintenance, and—most importantly—your time. A cheaper house with a miserable, soul-sucking commute might not be a good deal at all in the long run.

Lifestyle and Local Amenities

Once you've wrapped your head around the commute, it's time to explore the neighborhood itself. Your lifestyle should be your main guide here. A neighborhood's character is often defined by its housing stock and local flavor. Exploring the unique architectural styles, like the beautiful Spanish Colonial Revival homes in Bronson Canyon, can give you an immediate feel for an area's history and aesthetic.

Here’s how to do your on-the-ground fieldwork:

- Go on a Weekend Safari: Spend a full Saturday or Sunday in a neighborhood you're considering. Grab coffee at a local spot, walk around, hit up a farmers market, and browse the shops. Get the vibe.

- Do a School District Deep Dive: If schools are a factor, you have to go beyond online ratings. Look into specific programs, check out the campus facilities, and if you can, talk to other parents in the area.

- Check for Future Development: Find out what's planned for the area. Is a cool new park or retail development coming? That could boost property values. Is a massive new apartment complex going up? That could mean years of construction noise and traffic.

- Investigate Noise and Nightlife: Visit at different times. A street that feels peaceful and quiet on a Tuesday morning might transform into a total party zone on a Friday night.

Finding your corner of LA is a process of elimination and discovery. It's about peeling back layers. By focusing on practical things like your commute and aligning your search with your real lifestyle needs, you stop just looking for a house and start finding a place where you'll actually belong.

Assembling Your Crew and Crafting a Winning Offer

You absolutely cannot conquer the Los Angeles real estate market alone. This isn't a solo mission; it's more like a heist movie, and you need a skilled crew with specialized talents. Your most important recruit? Your real estate agent.

Let me be clear: this is not the time to hire your cousin who got their license last month. You need a seasoned pro who has been through the trenches.

Finding the right agent is one of the most critical decisions you'll make. Look for someone who is not just familiar with LA, but is a true specialist in the exact neighborhoods you’re targeting. They should live and breathe the local market, knowing which listings are overpriced, which are hidden gems, and what it really takes to win a bidding war in that specific zip code.

Choosing Your Agent

A great LA agent does more than just unlock doors. They are your strategist, negotiator, and local guru all rolled into one. They must have a proven track record of getting offers accepted in the competitive, multiple-offer bloodbaths that are incredibly common here.

When you're interviewing potential agents, don't be shy. Ask them pointed questions:

- How many deals have you closed in my target neighborhoods this year?

- What’s your specific strategy for making my offer stand out when there are ten others on the table?

- Can you connect me with the trusted lenders, inspectors, and contractors you work with regularly?

Their answers will tell you everything you need to know about their experience and whether their style meshes with yours. This is a partnership, and you need to trust their judgment implicitly when the pressure is on.

The Art of the Winning Offer

Once you and your agent find "the one"—that perfect house that checks all the boxes—it’s time to move with speed and precision. Crafting a compelling offer is an art form in LA, a delicate balance of being aggressive enough to win but smart enough not to overpay wildly.

Your offer is more than just a price. It's a package designed to convince the seller you are the most reliable, serious, and hassle-free buyer they'll meet.

A winning offer in a hot market isn't always about the highest price. It's often the cleanest offer—one with fewer contingencies and strong financial backing that signals a smooth, fast closing.

Here’s what goes into an offer that actually gets noticed:

The Price Strategy: Of course, your agent will pull "comps" (comparable recent sales) to help you figure out a fair price. But in a competitive scenario, you often have to go above asking. This is where your agent’s real-time, on-the-ground market knowledge is invaluable to help you decide just how high to go.

Contingencies: These are your safety nets—conditions like the inspection or appraisal that must be met for the sale to proceed. The fewer contingencies you have, the more attractive your offer looks to a seller. Removing them is risky, and it's a strategic decision you absolutely must make with your agent's guidance.

A Personal Touch: Should you write a "love letter" to the seller? In some cases, absolutely. If you learn the sellers raised their family in the home, a heartfelt letter about your own dreams for the property can create an emotional connection that sets you apart from a faceless investor. It doesn't always work, but when it does, it can be the tiebreaker.

Show Me the Money: Your offer must be backed up by your pre-approval letter and proof of funds for your down payment. This shows you're not just ready and willing, but financially able to close the deal without a hitch.

Making an offer on a home in Los Angeles is a high-stakes moment. It demands a clear strategy, a deep trust in your agent, and the courage to act decisively. With the right team and a thoughtfully crafted offer, you put yourself in the best possible position to get those keys in your hand.

Navigating Escrow, Inspections, and Closing

Your offer was accepted. Pop the champagne—you’ve cleared one of the biggest hurdles in buying a home in Los Angeles! But don't get too comfortable. You've just entered escrow, the final, high-stakes sprint to the finish line.

Think of escrow as a neutral holding zone. A third-party company holds all the money and documents, making sure everything is handled correctly until you and the seller have both fulfilled your sides of the deal. This is where the contract becomes reality, and it demands your full attention.

So, what exactly happens between "offer accepted" and getting those keys in your hand? Let’s break it down.

The Home Inspection: Your Most Powerful Tool

Right after opening escrow, the first and most critical step is scheduling the home inspection. I’m going to say this as clearly as I can: do not skip this. Ever. A professional inspection is your single best defense against discovering costly, gut-wrenching problems after you've moved in.

Your agent will connect you with a licensed inspector who will spend a few hours combing through the property, from the foundation to the roof. You need to be there. Walking through the house with the inspector is invaluable—it turns a long, dry report into a real-world understanding of the home you're about to buy. You can see the issues for yourself and ask questions on the spot.

Key Insight: No home is perfect, not even brand-new construction. The inspection isn't about finding a flawless property; it's about understanding the true condition of the one you've chosen so you can move forward with your eyes wide open.

Once you get the detailed report, you and your agent have some decisions to make. This report is your leverage. Depending on what it uncovers, you can:

- Ask the seller to make specific repairs before the closing date.

- Request a credit from the seller to offset the cost of repairs you'll handle later.

- Decide the problems are too big and walk away from the deal (this is why an inspection contingency in your offer is so important).

This negotiation is a delicate dance. A great agent will help you focus on the big-ticket items—foundation, roof, plumbing, electrical—not the small cosmetic stuff. Serious issues can pop up in any kind of home, from a modern build to a classic like this updated Craftsman bungalow in Silver Lake.

Appraisal, Title, and the Paperwork Mountain

While you’re focused on inspections, other critical pieces are moving in the background. Your lender will order an appraisal to make sure the house is actually worth the price you've agreed to pay. This is non-negotiable for the bank; they won’t lend more than the property's appraised value.

This step can be a nail-biter, especially in a hot market like LA's. We've seen unbelievable growth here. The median home price in LA County skyrocketed from roughly $625,000 in May 2020 to $925,000 by May 2025. That’s a nearly 48% jump in just five years. If the appraisal comes in low, you’ll need to either renegotiate with the seller or find the cash to bridge the gap.

At the same time, the escrow company is running a title report. This is a deep dive into the property's history to ensure the seller has the legal right to sell it and that there are no hidden claims or liens against it. You need a "clean" title to take ownership without any drama down the road.

Finally, you’ll face the paperwork mountain. Get ready to review and sign a stack of documents, from loan disclosures to closing statements. It can feel like a marathon, but don't rush through it. Your agent and escrow officer are there to explain every page. Read everything, and don't hesitate to ask questions until you're completely clear.

Once every contingency is removed, the appraisal is solid, the title is clean, and the final loan documents are signed, you're ready to close. The lender wires the funds, the county records the deed, and then you get the phone call you’ve been waiting for: the keys are officially yours.

Answering Your Toughest LA Home-Buying Questions

Even with a solid plan, buying a home in Los Angeles is a journey filled with questions. It’s a complex, high-stakes process, and feeling uncertain is completely normal. We’ve heard every question in the book from aspiring LA homeowners, so we’ve gathered the most common ones here to give you direct, no-fluff answers.

This isn’t just about knowing the facts; it's about building the confidence you need to make smart, decisive moves in a competitive market. Let's tackle some of the biggest questions that pop up time and time again.

How Much Do I Really Need for a Down Payment?

The age-old “20% down” rule is still held up as the gold standard, and for good reason. It helps you dodge Private Mortgage Insurance (PMI), often lands you a better interest rate, and gives you a nice chunk of equity right from day one. On a million-dollar house, that’s a cool $200,000.

But let’s get real—that’s a massive pile of cash. In a market as expensive as LA, insisting on 20% can feel like an impossible hurdle. The good news? Many successful buyers don't hit that mark. It is absolutely possible to buy a home with less.

Here are a few paths people take:

- FHA Loans: These government-backed loans are a huge help for first-time homebuyers, allowing for down payments as low as 3.5%.

- Conventional Loans: Don't assume you need 20% for a conventional loan. Some programs allow for just 3% or 5% down, though you'll typically need a stronger credit profile to qualify.

- VA Loans: For eligible veterans and active-duty service members, VA loans are a total game-changer, often requiring 0% down.

The Bottom Line: While aiming for 20% is a fantastic goal, it’s not a deal-breaker. The most important first step is talking to a savvy mortgage lender to explore all the low-down-payment options out there. Don't count yourself out just because you don't have six figures liquid in the bank.

How Long Does It Actually Take to Buy a Home in LA?

This is the ultimate "how long is a piece of string?" question. The truth is, the timeline for buying a home in Los Angeles can vary dramatically. From the day you begin your serious search to the day you’re holding the keys, the whole process could take a few months or even stretch over a year.

It really breaks down into two main phases:

- The Search: This is the wild card. Some buyers get incredibly lucky and find "the one" on their first weekend out. More commonly, buyers search for 6-12 months, especially if they have a very specific wish list or are trying to break into a hot neighborhood like Silver Lake or Mar Vista.

- Escrow: Once your offer is accepted, things get more predictable. The escrow period, where all the inspections, appraisals, and loan finalizations happen, typically lasts between 30 and 45 days.

Patience is your superpower here. The LA market can be a grind, and getting outbid is practically a rite of passage. Don't let it discourage you. Every offer you write—even the ones that don't get accepted—makes you a smarter, more strategic buyer for the next one.

What Are Closing Costs, and How Much Should I Budget for Them?

Your down payment isn't the last check you'll write before getting the keys. Closing costs are all the fees required to finalize the real estate transaction and your mortgage loan. They are a totally separate expense and can be a nasty surprise for buyers who aren't prepared.

In Los Angeles, a good rule of thumb is to budget for closing costs between 2% and 4% of the home's purchase price. For a $900,000 home, that means setting aside anywhere from $18,000 to $36,000.

So, what are you actually paying for? It’s a whole slew of services, including:

- Lender Fees: Charges for originating, underwriting, and processing your loan.

- Title and Escrow Fees: Paying the neutral third parties who handle the title search, title insurance, and the transfer of funds.

- Appraisal and Inspection Fees: The cost of hiring professionals to assess the home's market value and physical condition.

- Prepaid Expenses: You'll often prepay for items like your first year of homeowner's insurance and a few months of property taxes.

Your lender will give you a detailed breakdown of these costs before you close. The key is to budget for them separately from your down payment so you're not scrambling for cash at the finish line.

What Does the Future of the LA Market Look Like?

While no one has a crystal ball, we can look at expert analysis to get a sense of where things are headed. Peeking into the future, most analysts see continued—though more moderate—growth for the Los Angeles real estate market.

A forward-looking view of the Los Angeles real estate market, based on expert forecasts for home prices, sales volume, and mortgage rates.

Projected LA Housing Market Trends

| Metric | 2025 Projection | 2026 Projection |

|---|---|---|

| Median Home Price | Approx. +3% | Approx. +4% |

| Existing Home Sales | Approx. +6% | Continued Growth |

| Mortgage Rates | Modest Decline | Stabilizing |

Data compiled from forecasts by the National Association of Realtors and other industry analysts. You can explore more forward-looking Los Angeles real estate market predictions to get a deeper dive.

This steady outlook suggests that waiting on the sidelines for a major price crash might not be a winning strategy. The market isn't expected to fall off a cliff, but rather to continue its steady climb.

Your LA real estate journey is a major life milestone, and you shouldn't go it alone. The experts at ACME Real Estate have the local knowledge and proven track record to guide you through every step, from crafting a winning offer to navigating the complexities of escrow. Ready to make your move? Contact us today at https://www.acme-re.com and let's find your place in Los Angeles.